Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

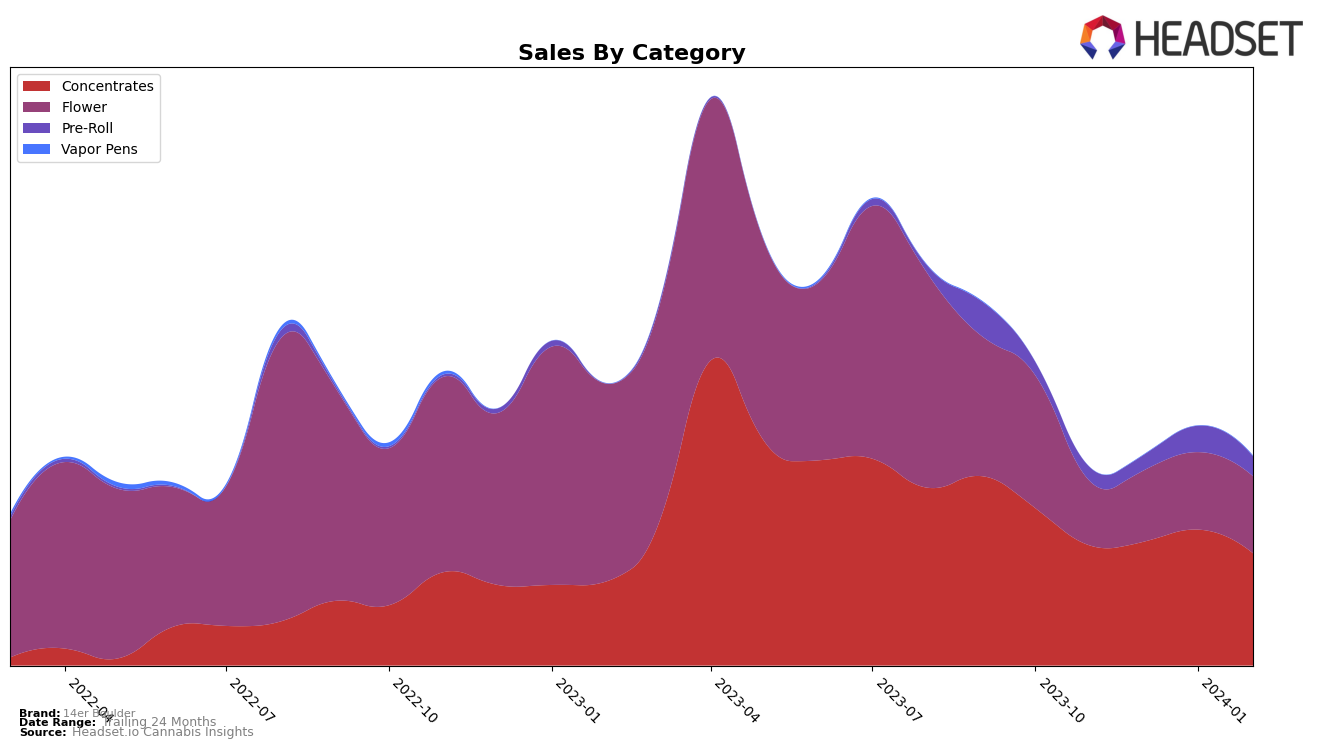

In the competitive cannabis market of Colorado, 14er Boulder has shown notable performance across several categories, albeit with varying degrees of success. The brand's concentrates category has seen a consistent rise in rankings from November 2023 to February 2024, moving from 27th to 20th position. This upward trajectory indicates a growing consumer preference for 14er Boulder's concentrates, backed by an increase in sales from $84,299 in November 2023 to $78,907 in February 2024, despite a slight dip in the latter month. On the other hand, their venture into the vapor pens category in February 2024 at the 100th rank, with sales amounting to $443, suggests a challenging entrance into this market segment. The brand's ability to climb the ranks in concentrates, however, showcases its potential to improve its standing in other categories with targeted strategies.

Flower and pre-roll categories tell a story of gradual improvement and resilience for 14er Boulder within the Colorado market. The flower category witnessed a significant jump from the 71st position in November 2023 to the 52nd by February 2024, accompanied by a steady increase in sales, indicating a solidifying market presence. Similarly, the pre-roll category saw an improvement from 61st to 52nd position during the same period, with a notable peak in January 2024 at the 46th rank. This peak is particularly impressive, considering the sales more than doubled from $9,631 in November 2023 to $18,454 in January 2024, before slightly decreasing to $13,826 in February 2024. These movements across categories highlight 14er Boulder's dynamic market strategy and ability to capture consumer interest in a highly competitive landscape, although the absence from the top 20 in any category suggests there is room for growth and an opportunity to capture a larger market share with continued effort and innovation.

Competitive Landscape

In the competitive landscape of the concentrates category in Colorado, 14er Boulder has shown a notable upward trajectory in its rank from November 2023 to February 2024, moving from not being in the top 20 to securing the 20th position by February. This improvement in rank is indicative of a positive trend in sales and market penetration, despite still trailing behind competitors such as Harmony Extracts, which experienced a slight decline but maintained a presence in the top 20 throughout the same period. Another competitor, Olio, saw a more significant drop in rank and sales, moving out of the top 20 by February 2024. Meanwhile, Nuhi managed to improve its standing slightly, indicating a competitive but fluctuating market. 14er Boulder's gradual climb in the rankings, despite lower sales figures compared to these competitors, suggests a growing consumer interest and potential for further market share gains. The brand's trajectory contrasts with that of Edun, which also did not rank in the top 20 initially but showed less improvement over time. This analysis underscores the dynamic nature of the concentrates market in Colorado, with 14er Boulder's recent performance hinting at a promising direction amidst fierce competition.

Notable Products

In February 2024, 14er Boulder's top-performing product was Hybrid Live Rosin (1g) from the Concentrates category, maintaining its number one rank with sales of 2356 units. Following closely, Mac And Cheese Pre-Roll (1g) in the Pre-Roll category rose to the second position, showing a notable increase in rank from the third position in January. The third spot was taken by Blackberry Banana Kush (3.5g) from the Flower category, which also held the third rank in December, indicating consistent consumer preference. Dreadneck (3.5g), another product from the Flower category, entered the rankings directly in the fourth position, showcasing a new preference among consumers. Lastly, Papaya Cake (3.5g), consistently ranked fifth across several months, demonstrates steady demand within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.