Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

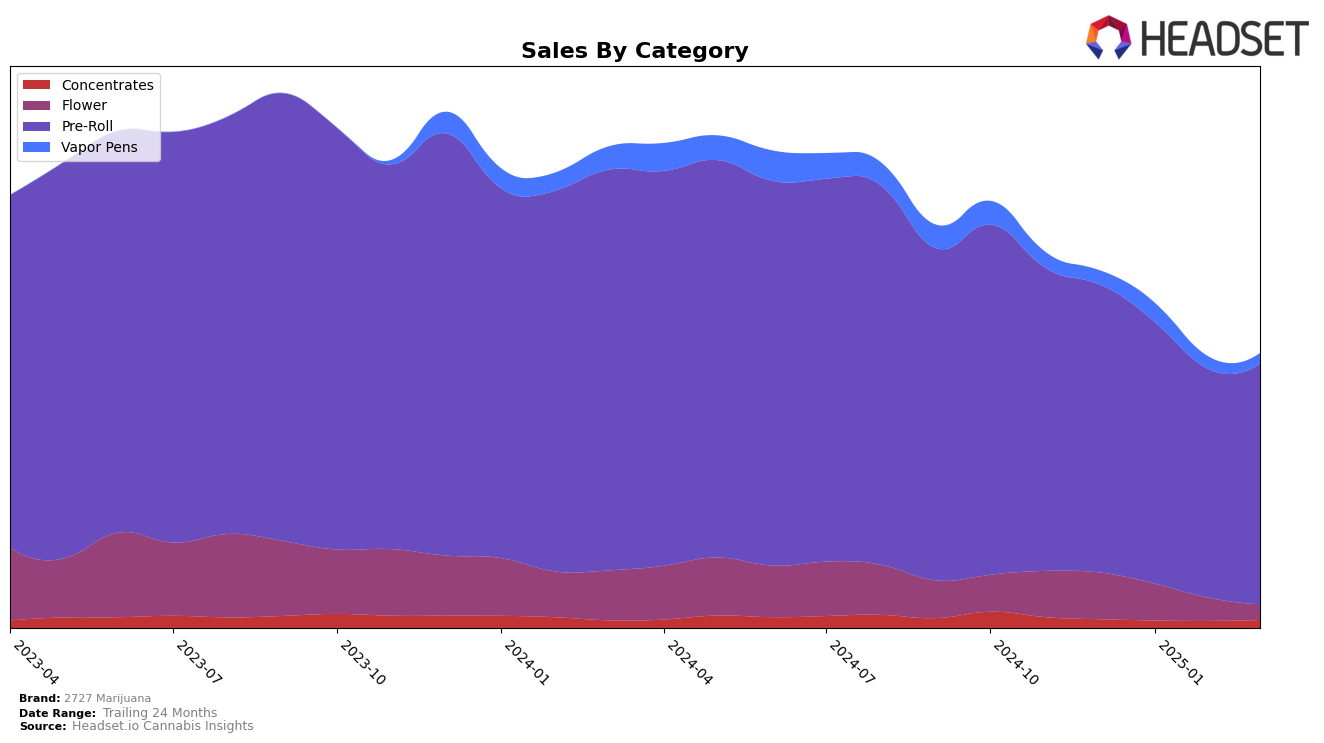

In the state of Washington, 2727 Marijuana has shown varying performance across different product categories. In the Concentrates category, the brand has been climbing the ranks, moving from 91st in December 2024 to 86th by March 2025. This upward trend is noteworthy despite a minor dip in sales, suggesting increased market penetration or consumer preference for their products. However, the Flower category tells a different story, where 2727 Marijuana fell out of the top 30 after January 2025, indicating a potential challenge in maintaining competitiveness or consumer interest in this segment.

The Pre-Roll category is where 2727 Marijuana has consistently excelled, maintaining a strong position at 3rd place from December 2024 through February 2025, before slightly dropping to 4th in March 2025. Despite this minor drop, the brand's sustained high ranking in Pre-Rolls highlights its dominance and popularity in this category. Meanwhile, in the Vapor Pens segment, the brand's absence from the top 30 in December 2024, followed by a rank of 89 in January 2025, points to a significant breakthrough, although the lack of subsequent rankings suggests room for growth. Such dynamics across categories and timeframes reflect the brand's strategic positioning and market challenges within Washington.

Competitive Landscape

In the competitive landscape of the Washington pre-roll category, 2727 Marijuana has demonstrated a consistent performance, maintaining a strong presence among the top brands. Despite a slight dip in rank from third to fourth place in March 2025, 2727 Marijuana's sales figures reflect a robust market position, with sales consistently outperforming competitors like Lifted Cannabis Co and Stingers. However, the brand faces stiff competition from Ooowee, which has maintained a steady second place, and Mama J's, which has shown upward momentum, moving from fourth to third place by March 2025. This competitive pressure highlights the need for 2727 Marijuana to innovate and potentially expand its market strategies to reclaim its previous ranking and continue its sales growth trajectory.

Notable Products

In March 2025, Oreo Cookies Pre-Roll 5-Pack (5g) emerged as the top-performing product for 2727 Marijuana, securing the number one rank with sales reaching 1998 units. Blueberry Infused Pre-Roll (1g) followed closely at the second position, showing a notable improvement from its fourth place in February 2025 with sales of 1364 units. Pineapple Express Infused Pre-Roll (1g) climbed to the third rank, demonstrating a consistent upward trajectory since its entry into the rankings. Super Lemon Haze Infused Pre-Roll (1g) placed fourth, maintaining a stable presence in the top five despite fluctuating ranks in previous months. Tonic Bubble Pre-Roll 5-Pack (5g) rounded out the top five, experiencing a drop from its second place in December 2024, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.