Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

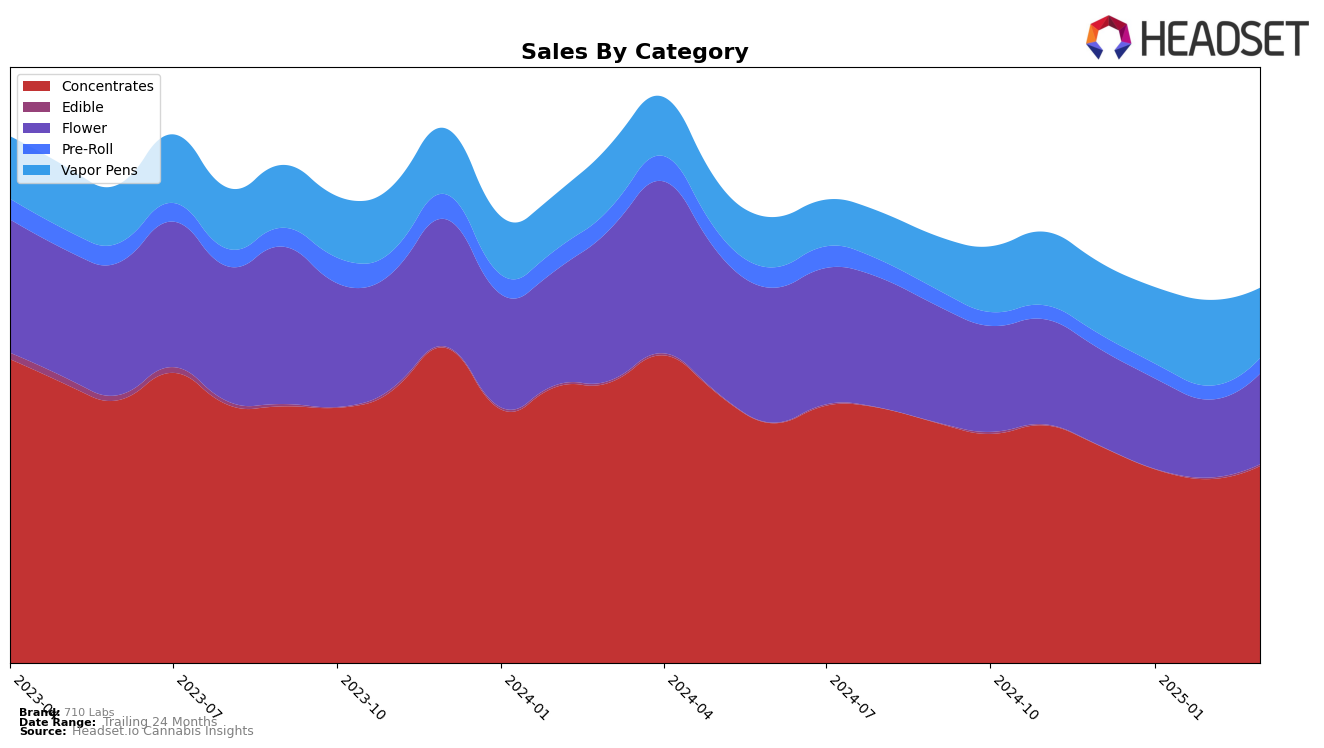

In California, 710 Labs has demonstrated a consistent performance in the Concentrates category, maintaining a steady rank of 4th place from January to March 2025, despite a slight dip in sales between December and February. This stability in ranking suggests a strong market presence and customer loyalty within this category. However, the brand's performance in the Flower category has been more volatile, with rankings fluctuating from 60th to 76th, indicating potential challenges or increased competition. Additionally, the Vapor Pens category has seen a downward trend, with 710 Labs dropping from 45th to 57th place by March, which might be a signal of shifting consumer preferences or increased market competition.

In Colorado, 710 Labs has secured a solid position in the Concentrates category, consistently holding the 4th rank over the months analyzed. This indicates a robust foothold in the market, similar to their performance in California. The Flower category in Colorado presents a more positive trajectory, with the brand climbing from 12th to 6th place by March, suggesting an increasing consumer demand or successful brand strategies. On the other hand, in Michigan, while 710 Labs has shown some variability in the Concentrates category, moving from 7th to 11th and back to 8th, the Vapor Pens category has seen a significant improvement, jumping from 63rd to 40th place in February, before settling at 48th in March. This indicates potential growth opportunities for 710 Labs in the Vapor Pens market in Michigan.

Competitive Landscape

In the competitive landscape of California's concentrates market, 710 Labs has consistently maintained a strong presence, ranking 4th from January to March 2025, after a slight drop from 3rd place in December 2024. This stability in ranking suggests a loyal customer base despite a gradual decline in sales over the same period. The brand faces stiff competition from STIIIZY, which improved its position from 4th in December 2024 to 2nd by March 2025, indicating a significant upward trend in consumer preference. Meanwhile, Punch Extracts / Punch Edibles consistently held the 2nd and 3rd positions, showcasing robust sales performance. CannaBiotix (CBX) and WVY also showed competitive movements, with WVY climbing from 9th to 6th place by March 2025, reflecting a positive sales trajectory. These dynamics highlight the competitive pressure on 710 Labs to innovate and potentially adjust its strategies to regain a higher rank and boost sales in the coming months.

Notable Products

In March 2025, the top-performing product for 710 Labs was SB 36 #1 (Bulk) in the Flower category, which ascended to the first rank with sales reaching 6026 units. Date Night #6 (Bulk) also showed a significant improvement, moving from fifth place in February to second place in March, indicating a strong sales growth. Stay Puft #19 (Bulk) maintained its third position from the previous month, while Garlic Cocktail #7 (Bulk) slipped from the top spot in December 2024 to fourth in March 2025. Ego Death #12 (Bulk) made its entry into the rankings at fifth place, showcasing its popularity despite not being ranked in prior months. Overall, the Flower category saw notable shifts in product rankings, reflecting dynamic consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.