Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

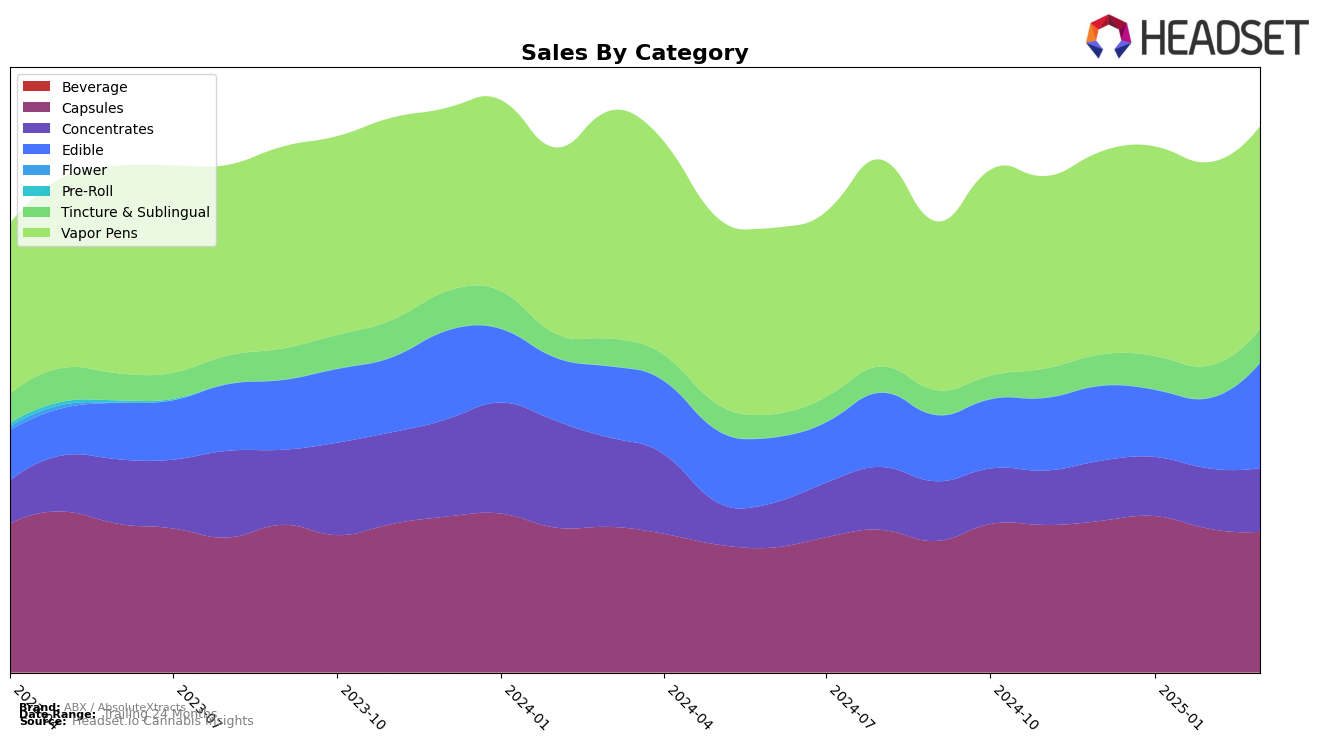

ABX / AbsoluteXtracts has demonstrated a solid presence in the California cannabis market across various product categories. In the capsules category, the brand maintained a consistent performance, holding the third rank from January to March 2025, a slight improvement from the fourth position in December 2024. This stability suggests a strong consumer base and effective product positioning. However, in the concentrates category, ABX / AbsoluteXtracts experienced a decline, moving from ninth to eleventh place by March 2025, which could indicate increasing competition or shifting consumer preferences. Despite this, their sales figures in this category showed a positive trend, with an increase from February to March 2025, highlighting potential resilience in sales despite ranking challenges.

The brand's performance in the edibles category in California is noteworthy, as it climbed from seventeenth in January to twelfth in March 2025, reflecting a significant upward trajectory. This improvement, coupled with a substantial jump in sales from February to March, suggests a successful strategy in capturing consumer interest in edibles. Conversely, in the vapor pens category, the brand saw a slight drop from eighteenth to nineteenth place by March 2025, indicating potential room for growth or strategic adjustments. Meanwhile, in the tincture and sublingual category, ABX / AbsoluteXtracts maintained a stable seventh position throughout the observed period, pointing to a steady demand and consistent market presence.

Competitive Landscape

In the competitive landscape of vapor pens in California, ABX / AbsoluteXtracts has shown a consistent performance, maintaining its rank at 18th position from December 2024 to February 2025 before slightly dropping to 19th in March 2025. This stability in rank is notable given the dynamic shifts among competitors. For instance, Papa's Herb improved its position from 19th in December 2024 to 17th in February 2025, before settling at 18th in March 2025, indicating a competitive edge in sales growth. Meanwhile, Clsics demonstrated volatility, moving from 20th to 17th, then back to 19th, and again to 17th, reflecting fluctuating sales performance. Kurvana and Sauce Essentials have not broken into the top 20 consistently, with Kurvana only reaching 20th in March 2025. Despite these shifts, ABX / AbsoluteXtracts' steady sales figures suggest a loyal customer base, though the slight dip in rank indicates potential areas for strategic improvement to fend off rising competitors.

Notable Products

In March 2025, ABX / AbsoluteXtracts saw Tangie Terp Chew 20-Pack (100mg) rise to the top position in the Edible category, marking a significant improvement from its fifth place in February. The Sleepytime- THC/CBN 2:1 Elderberry Gummies 20-Pack, despite being dethroned, maintained a strong presence at second place, with sales reaching 6,946 units. Forbidden Fruit Terp Chews 20-Pack held steady at third place, showing consistent performance. Maui Wowie Terp Chews 20-Pack entered the rankings in fourth place, demonstrating a positive trend. Strawberry Haze Terp Chews, which was second in February, slipped to fifth, indicating a slight decline in its popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.