Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

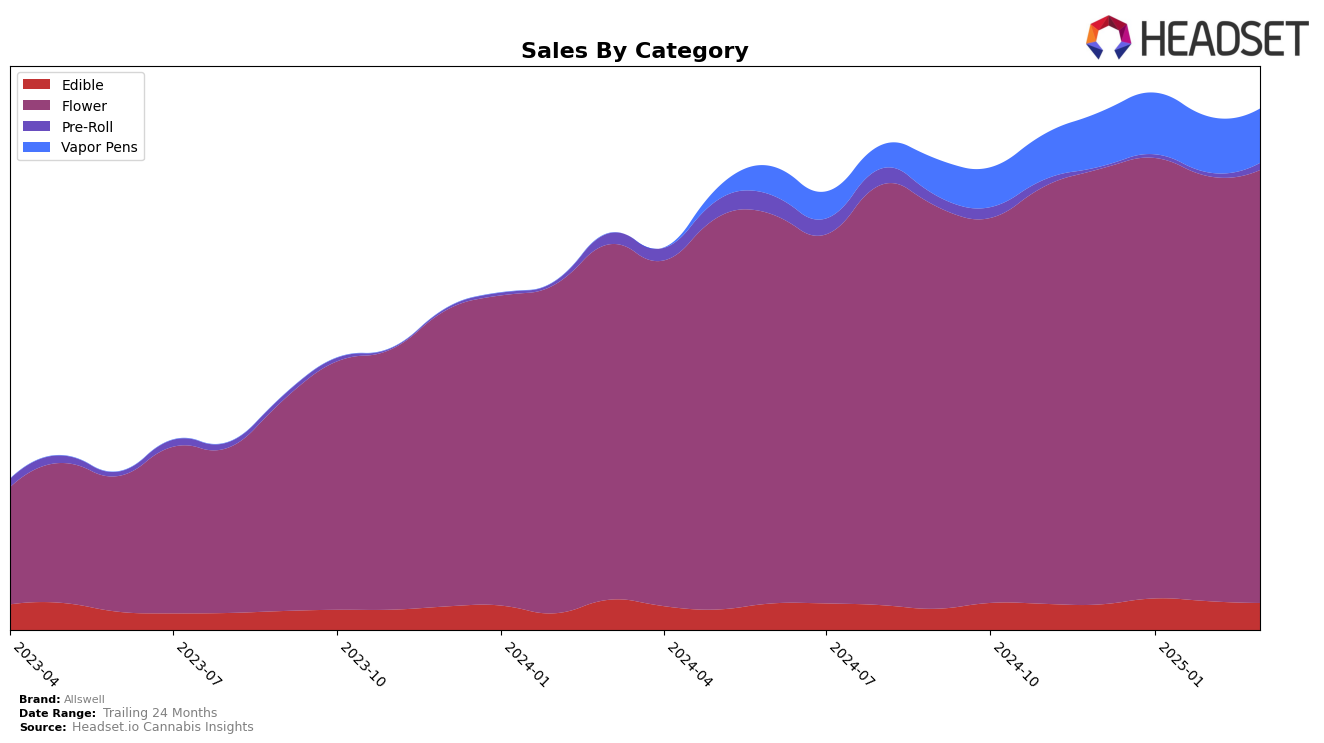

In the state of California, Allswell has shown varied performance across different product categories. Notably, in the Flower category, Allswell maintained a strong presence, ranking consistently within the top 7 over the past four months, peaking at 5th place in January and February 2025. This indicates a robust demand for their Flower products, despite a slight dip in March 2025. In contrast, the Edible category saw Allswell barely holding onto a spot within the top 30, with rankings fluctuating from 28th to 30th place. This suggests that while there is a presence in the Edible market, competition is fierce, and Allswell's position is precarious.

Meanwhile, the Vapor Pens category presents a different narrative for Allswell in California. The brand's ranking varied more significantly, starting at 54th in December 2024 and improving to 45th in January 2025, before slipping back to 50th by March 2025. This fluctuation indicates a volatile performance, possibly reflecting shifting consumer preferences or competitive pressures. The data suggests that while Allswell has a foothold in the Vapor Pens market, there is considerable room for growth and improvement to secure a more stable and higher-ranking position in this category.

Competitive Landscape

In the competitive landscape of the California flower category, Allswell has experienced notable shifts in its rank and sales performance over the past few months. Starting from December 2024, Allswell was ranked 6th, showing a promising rise to 5th in January and February 2025, before slipping back to 7th in March 2025. This fluctuation indicates a dynamic market environment where competitors like Blem and CAM have also been active. Blem, for instance, showed a similar pattern of rank fluctuation, moving from 4th to 7th and back to 5th, while CAM maintained a steady 6th place, suggesting consistent performance. Notably, Pacific Stone has shown a positive trend, improving from 11th to 9th, potentially impacting Allswell's market position. These dynamics highlight the competitive pressures Allswell faces, necessitating strategic adjustments to regain and sustain higher rankings.

Notable Products

In March 2025, the top-performing product for Allswell was Mint Jelly Smalls (3.5g) in the Flower category, securing the number one rank. Sweet Fruit Punch Gummies 10-Pack (100mg) maintained its strong position at rank two, following its performance from February. Funky Donny (3.5g), also in the Flower category, dropped to third place from its consistent first-place ranking in the previous months, with sales reaching 4902 units. Sour Kiwi Strawberry Gummies 10-Pack (100mg) held the fourth position, showing a slight decline from its February rank. Special R*ntz Smalls (3.5g) entered the rankings at fifth place, marking its debut in the top five for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.