Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

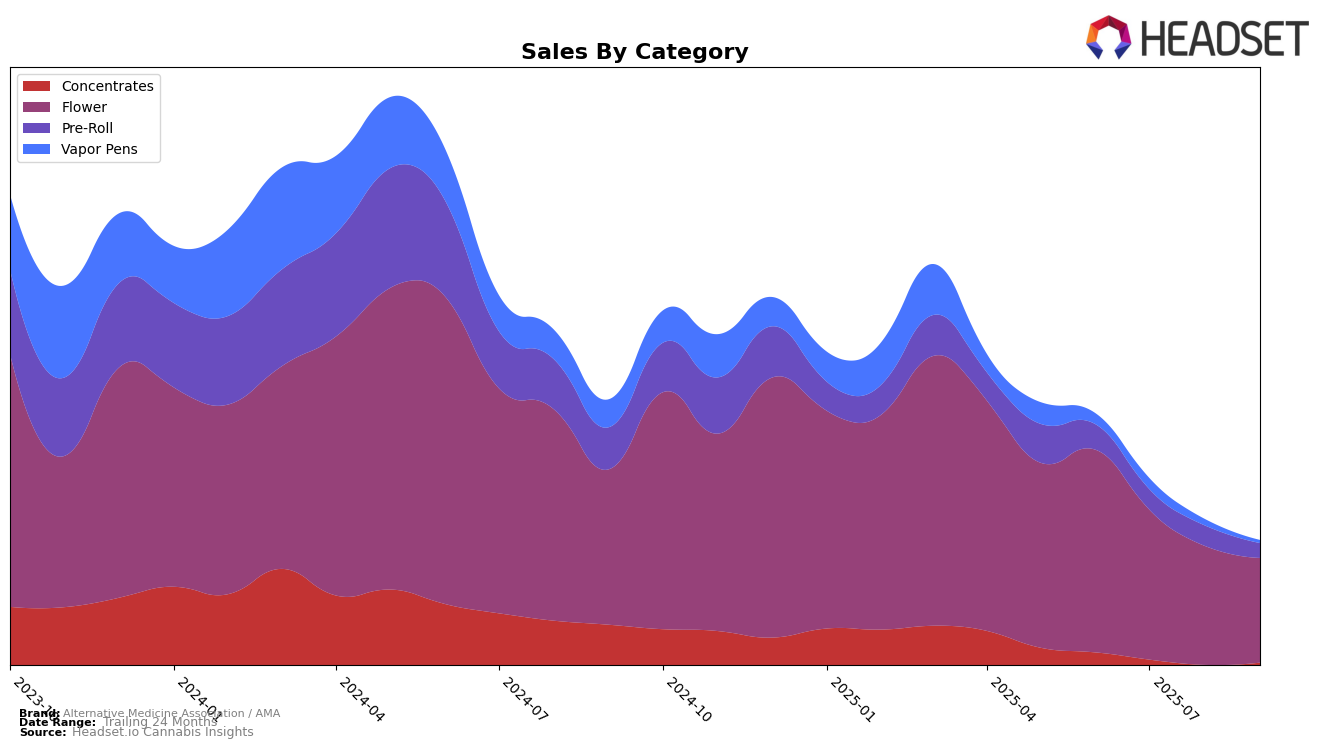

Alternative Medicine Association / AMA has shown varied performance across different product categories in Nevada. In the Concentrates category, the brand has maintained a strong presence, consistently ranking in the top four, with a notable rebound to the second position in September 2025. This suggests a resilient demand for their concentrates despite a dip in sales during the summer months. The Flower category tells a different story, with AMA starting strong in June 2025 at the second position but slipping to fifth position by September. This downward trend in ranking could reflect increasing competition or shifting consumer preferences in the flower market.

In the Pre-Roll category, AMA's performance has been relatively stable, with minor fluctuations in rankings from sixth to eighth place. Despite this stability, the brand's sales figures indicate a gradual decline, which might warrant closer attention to maintain market share. On the other hand, the Vapor Pens category has seen AMA hovering around the lower end of the top 20, with a slight improvement in August before reverting to its previous rank in September. This category's performance highlights potential growth opportunities if the brand can capitalize on consumer trends and preferences effectively. The absence of top 30 rankings in any other states or categories suggests a focused market strategy primarily centered on Nevada, which could either be a strategic choice or a limitation in broader market penetration.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Alternative Medicine Association / AMA has experienced notable fluctuations in its ranking and sales over the past few months. Starting strong in June 2025 with a rank of 2nd, the brand saw a decline to 5th in July and further down to 7th in August, before recovering slightly to 5th in September. This downward trend in rank coincides with a consistent decrease in sales, highlighting potential challenges in maintaining market share. In contrast, Medizin has shown resilience, maintaining a top 3 position throughout the same period, indicating strong brand loyalty or effective market strategies. STIIIZY also demonstrated competitive strength, consistently ranking within the top 4, suggesting a robust presence in the market. Meanwhile, Lavi and Nature's Chemistry have shown varied performances, with Lavi peaking in July and Nature's Chemistry showing a steady climb towards September. These dynamics suggest that while Alternative Medicine Association / AMA remains a key player, it faces significant competition and must adapt to sustain its position in the evolving Nevada flower market.

Notable Products

In September 2025, Scoby in the Flower category emerged as the top-performing product for Alternative Medicine Association / AMA, achieving the number one rank with sales of 3570 units. Scoby Pre-Roll in the Pre-Roll category, which was ranked first in August, slipped to second place with sales amounting to 2892 units. Jealousy Cake Pre-Roll debuted in the rankings at third place, while Dirty Taxi Pre-Roll experienced a drop from its previous consistent first-place position in June and July to fourth place in September. Pixie Dust in the Flower category rounded out the top five, marking its first appearance in the rankings. Overall, the rankings in September displayed a dynamic shift, with notable movements among the top contenders compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.