Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

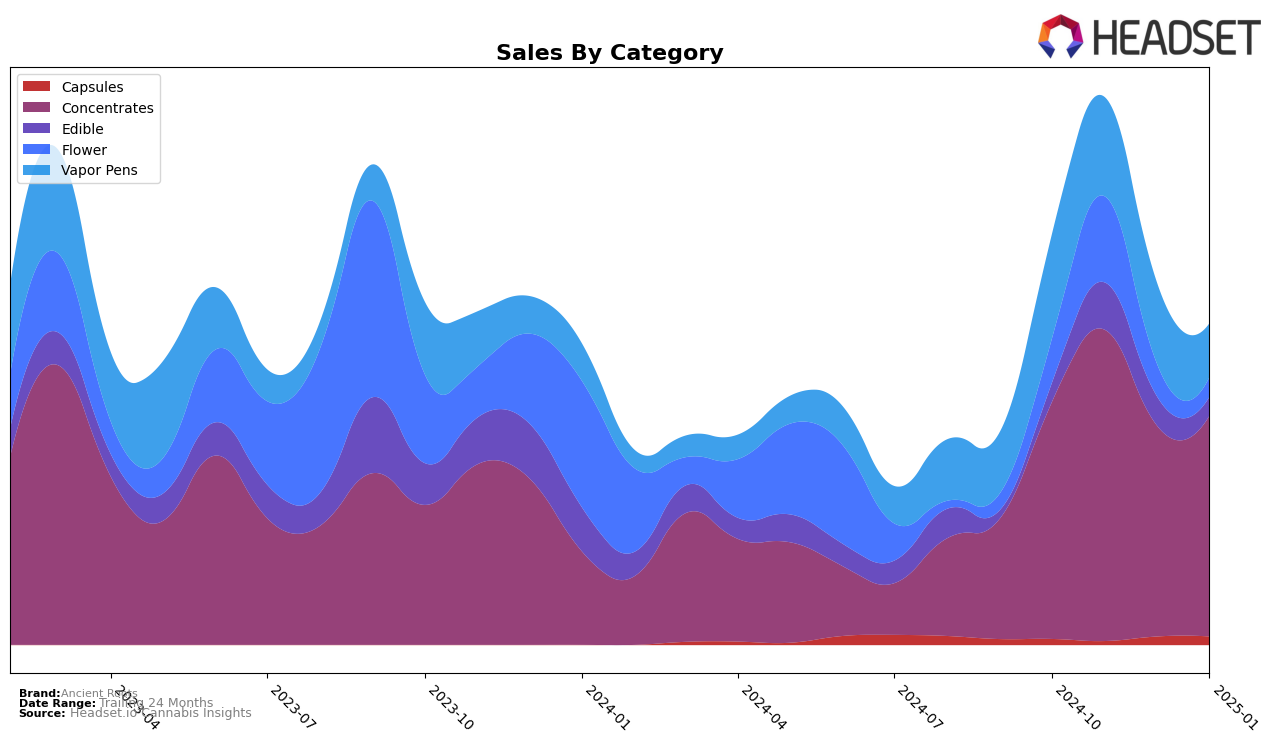

Ancient Roots has shown varied performance across different product categories in Ohio. In the Concentrates category, the brand has maintained a relatively stable presence, showing a modest improvement in ranking from 14th in October 2024 to 12th by January 2025. This suggests a consistent demand for their concentrates despite a slight dip in sales during December 2024. However, in the Edible category, Ancient Roots did not make it into the top 30 rankings for most months, only appearing at 55th in November 2024. This indicates a potential area for growth or a need for strategic adjustments in this segment.

In terms of Flower products, Ancient Roots made noticeable progress, climbing from 53rd in October 2024 to 45th in November 2024, though they did not sustain this momentum into subsequent months. This upward trend in November suggests a brief period of increased consumer interest or successful marketing efforts. Conversely, their Vapor Pens category has seen a consistent decline in rankings, dropping from 55th in October 2024 to 65th in January 2025, accompanied by a steady decrease in sales. This downward trend highlights a challenge in maintaining market share in the competitive vapor pen market. Overall, while Ancient Roots has shown some strengths in specific categories, there are clear opportunities for improvement and growth.

Competitive Landscape

In the Ohio concentrates market, Ancient Roots has experienced fluctuating rankings, with its position shifting from 14th in October 2024 to 12th by January 2025. This movement reflects a competitive landscape where brands like Moxie and Buckeye Relief have shown significant rank improvements, notably with Buckeye Relief climbing from 15th in October to 11th in January. Despite these challenges, Ancient Roots has managed to maintain a relatively stable sales performance, unlike Moxie, which saw a dramatic sales drop from November to January. Meanwhile, Farmaceutical Rx (Frx) has been gaining ground, entering the top 20 in November and rising to 10th by January, indicating increasing competition. These dynamics suggest that while Ancient Roots is holding its ground, the brand must strategize to counter the upward momentum of its competitors to enhance its market position.

Notable Products

In January 2025, Mystic Spirits Hash Coin (1g) from Ancient Roots maintained its top position in the Concentrates category, mirroring its rank from October 2024, with notable sales of 139 units. Lemon Kush #2 (2.83g) continued to perform strongly in the Flower category, holding the second rank, consistent with its previous standings in October and December 2024. Cap Junk Live Rosin Badder (1g) emerged as a new entrant in the rankings, securing the third position in Concentrates with 128 units sold. Lemon Kush #5 Live Rosin Badder (1g) and Straw Picanna Live Rosin Badder (1g) both shared the fourth rank in January 2025, with the latter dropping from its third-place position in December 2024. Overall, the rankings highlight consistent demand for Ancient Roots' Concentrates, alongside a stable performance from their Flower product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.