Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

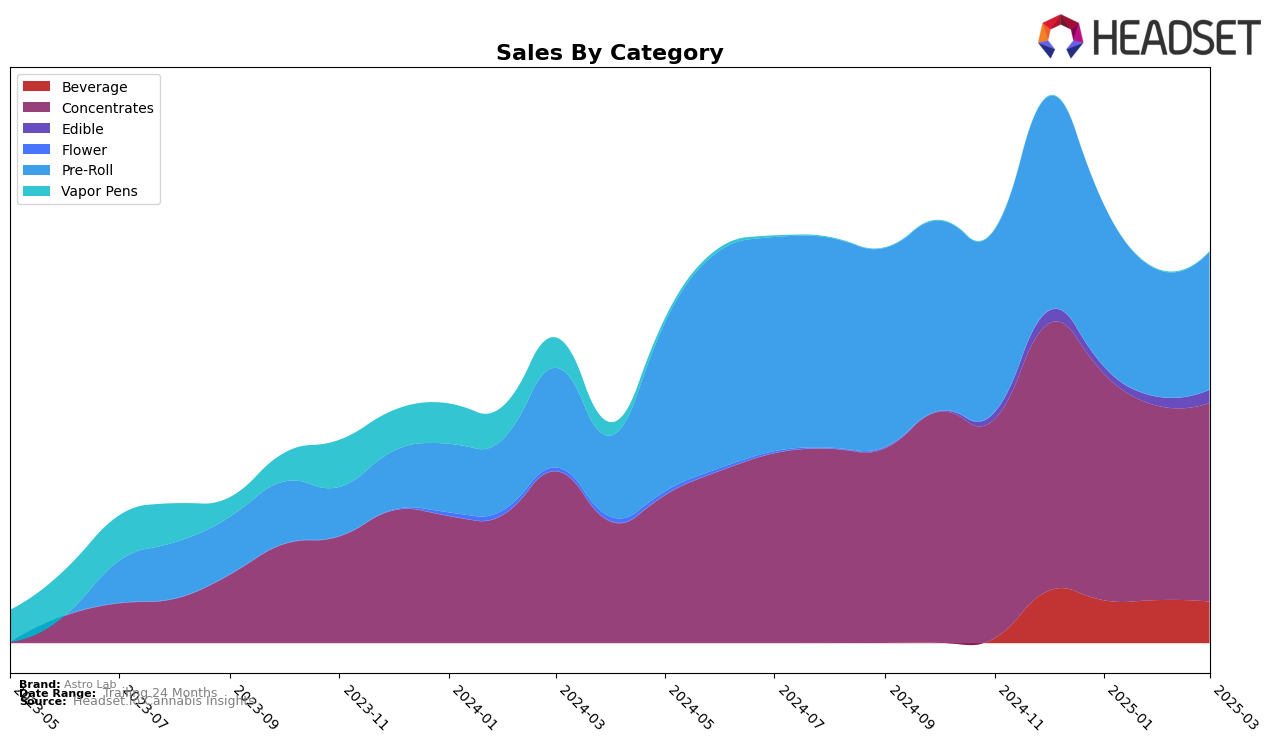

Astro Lab's performance in the Alberta market shows interesting trends across various categories. In the Beverage category, Astro Lab consistently held the 15th position from January to March 2025, having not been in the top 30 in December 2024. This indicates a positive movement as they entered and maintained their position within the top 30. In the Concentrates category, Astro Lab fluctuated between the 3rd and 4th ranks, demonstrating a strong presence despite a slight dip in sales from December 2024 to March 2025. However, in the Pre-Roll category, the brand's ranking fell from 26th in December 2024 to 37th by March 2025, indicating challenges in maintaining their market share.

In Ontario, Astro Lab's performance in the Beverage category improved as they climbed from the 16th position in December 2024 to 13th by February and March 2025. This upward trend suggests a growing popularity in this category. Meanwhile, in the Concentrates category, the brand's ranking showed slight fluctuations, moving from 16th to 15th over the same period. Despite these minor shifts, the brand managed to stay within the top 15, indicating a relatively stable performance. The absence of Astro Lab from the top 30 in the Edible category in January 2025 in Alberta suggests some volatility, though they regained their presence by March. These movements highlight the brand's strengths and areas for potential improvement across different provinces and product categories.

Competitive Landscape

In the Alberta concentrates market, Astro Lab has demonstrated a consistent performance, maintaining a competitive position among top brands. Despite a slight dip in rank from 3rd in December 2024 to 4th in January 2025, Astro Lab rebounded to 3rd place in February, before settling again at 4th in March. This fluctuation in rank is mirrored by a general downward trend in sales from December to February, with a slight recovery in March. Notably, Dab Bods consistently held the 2nd position, indicating a strong foothold in the market. Meanwhile, Nugz showed a notable rise in March, climbing from 6th to 3rd place, potentially challenging Astro Lab's position. The competitive landscape suggests that while Astro Lab remains a key player, it faces pressure from both established brands like Vortex Cannabis Inc. and emerging contenders such as Roilty Concentrates, which have shown variable ranks but stable sales figures.

Notable Products

In March 2025, Astro Lab's top-performing product was the Interstellar Rocket Lime Live Rosin Soda in the Beverage category, which ascended to the top rank from consistently holding the second position in previous months, achieving sales of 4,816 units. The Interstellar Live Rosin Cream Soda, also in the Beverage category, dropped to the second position after holding the top rank for the past three months. The Pineapple Orange Peel Live Rosin Infused Pre-Roll 3-Pack maintained its steady third-place ranking across all months. Galactic Sour Live Rosin Star Soft Chew, an Edible, improved its rank to fourth in March from fifth in December and February, showing a positive trend. Gummy Old School Hash in the Concentrates category remained in the fifth position, indicating stable performance despite fluctuating sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.