Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

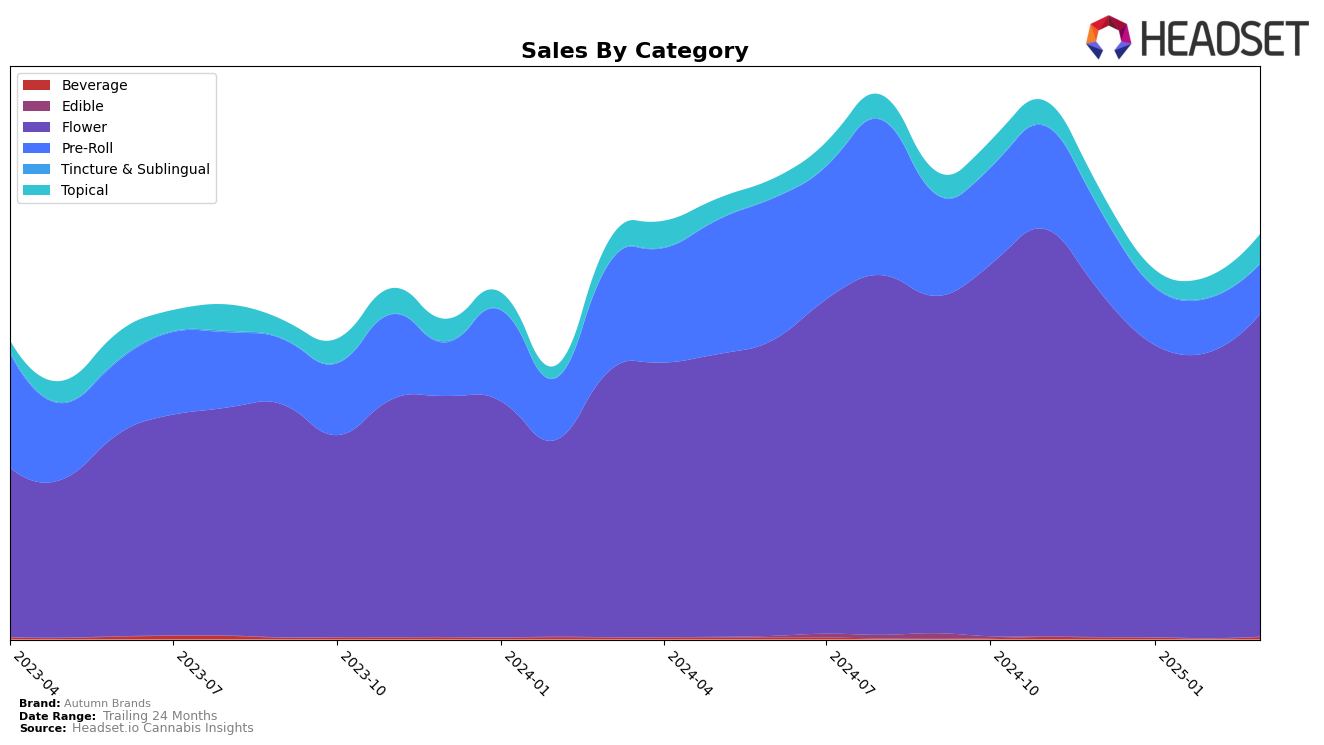

Autumn Brands has shown varied performance across different categories in California. In the Flower category, the brand has been hovering around the 60th to 70th rank, with a notable improvement in March 2025, moving up to the 60th position from 67th in February. This could indicate a positive trend or effective strategy adjustments. However, in the Pre-Roll category, Autumn Brands has not managed to break into the top 30, maintaining a rank in the high 80s and 90s, and even dropping out of the top 100 in March 2025. This suggests challenges in gaining market traction in this segment, which could be an area for potential improvement.

In contrast, the Topical category tells a more promising story for Autumn Brands in California. The brand has maintained a strong presence, consistently ranking within the top 10. In March 2025, they climbed to the 9th position, showcasing a steady increase in sales and market presence. This consistent performance in the Topical category highlights a potential strength or competitive advantage for Autumn Brands. While specific sales figures are not extensively detailed here, the directional movement and rank stability suggest a solid foothold in this segment, possibly driven by consumer loyalty or product differentiation.

Competitive Landscape

In the competitive landscape of the California flower category, Autumn Brands has experienced notable fluctuations in its market position over the past few months. As of March 2025, Autumn Brands improved its rank to 60th, up from 67th in February, indicating a positive trend in sales performance. However, it still trails behind competitors like Cookies, which maintained a higher rank of 50th in March, and Lolo, which, despite a slight decline, remained in the top 52. Meanwhile, Pure Beauty and Lights Out have shown mixed performance, with ranks of 67th and 66th respectively in March, indicating that Autumn Brands is closing the gap with some competitors. The sales figures reflect these rankings, as Autumn Brands' sales have shown a recovery from February to March, though still lagging behind the top players like Lolo. This dynamic environment suggests that while Autumn Brands is making strides, there is still significant room for growth to challenge the leading brands in the California flower market.

Notable Products

In March 2025, Purple Carbonite (3.5g) emerged as the top-performing product for Autumn Brands, climbing to the first rank from fourth in February, with sales reaching 1078. Sticky Pre-Roll (1g) made a strong debut in March, securing the second position, while Hella Fire Pre-Roll (1g) followed closely in third. Coolin' Out Pre-Roll (1g) experienced a drop from second in February to fourth in March. The CBD/THC 1:7 Nourishing Muscle & Joint Salve (50mg CBD, 350mg THC, 2oz) entered the rankings in March at fifth position. This shift in rankings highlights a dynamic change in consumer preferences, particularly with the rise of pre-rolls in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.