Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

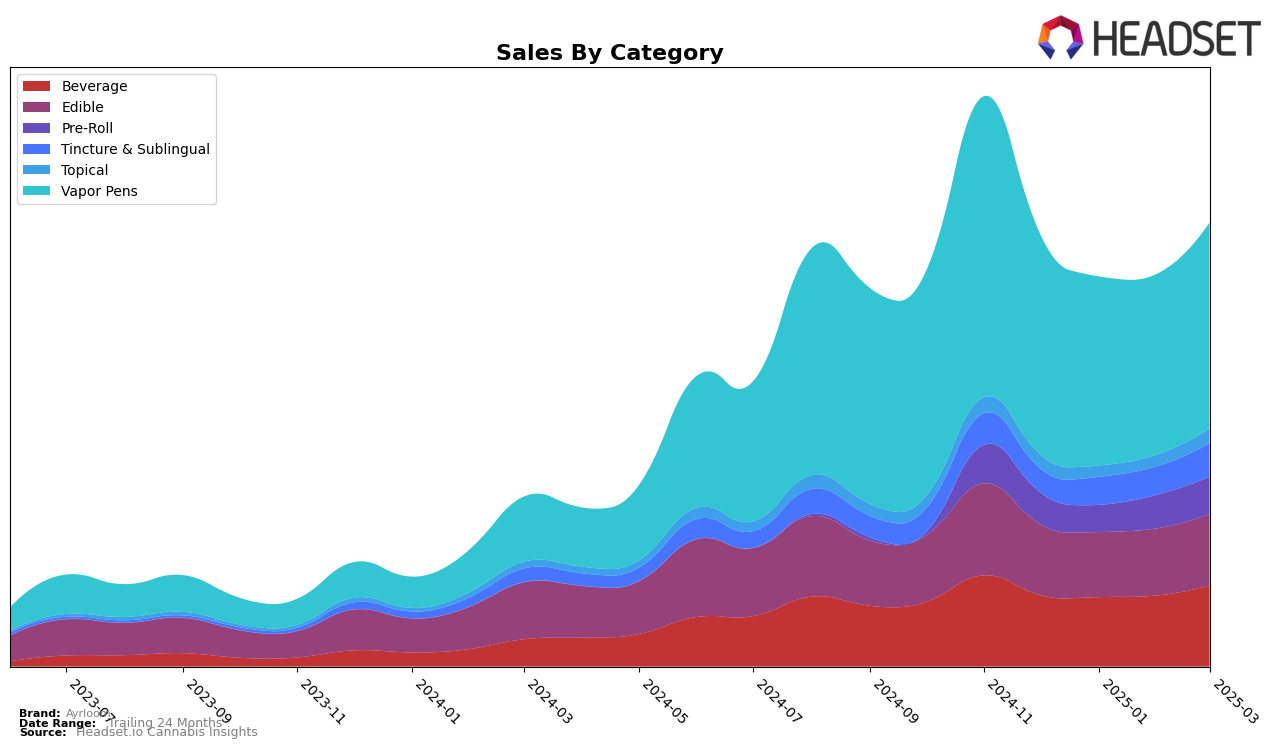

Ayrloom has maintained a strong presence in the New York cannabis market, particularly in the Beverage and Tincture & Sublingual categories, where it consistently held the top rank from December 2024 through March 2025. This consistent performance highlights Ayrloom's dominance and consumer preference in these categories. Notably, the Beverage category saw a substantial increase in sales by March 2025, indicating robust growth and possibly reflecting a successful marketing strategy or product innovation. However, in the Vapor Pens category, Ayrloom slipped from the first position in December 2024 to second in January 2025, where it remained through March. This shift might suggest competitive pressures or changes in consumer preferences that Ayrloom needs to address to regain the top spot.

In other categories, Ayrloom's performance in New York has been mixed. The Edible category saw Ayrloom holding steady at fifth place in most months, except for a slight dip to sixth in January 2025. This stability indicates a consistent demand, although there might be room for growth if the brand seeks to climb the rankings. Pre-Rolls showed some fluctuation, moving from tenth in December 2024 to eighth in February 2025, before settling at ninth in March. This variability suggests a competitive landscape, where Ayrloom might need to innovate or differentiate its offerings to capture a larger market share. In the Topical category, Ayrloom maintained its top position throughout, but the sales figures suggest a more modest market size compared to other categories.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Ayrloom has experienced notable shifts in its market position over the past few months. Initially ranked first in December 2024, Ayrloom saw a slight decline to the second position from January to March 2025. This change in rank is primarily influenced by the rise of Jaunty, which ascended to the top spot in January and maintained its lead through March, showcasing a strong upward sales trajectory. Despite this, Ayrloom's sales rebounded in March, indicating resilience and potential for regaining its leading position. Meanwhile, Rove consistently held the third position, and Mfny (Marijuana Farms New York) remained stable at fourth, both with lower sales figures compared to Ayrloom. This competitive dynamic suggests that while Ayrloom faces stiff competition, particularly from Jaunty, its strong sales performance positions it well for potential growth and market leadership in the New York vapor pens category.

Notable Products

In March 2025, the top-performing product from Ayrloom was the CBD/THC 1:2 Up Honeycrisp Apple Cider, maintaining its position at rank 1 since January 2025, with sales reaching 19,538 units. The CBD/THC 1:2 Half & Half Lemonade Iced Tea UP held steady at rank 2, showing consistent performance over the months. The CBD/THC 1:2 Cran Apple Cider Up Drink remained at rank 3, reflecting a stable demand since February 2025. The CBD/THC 1:2 Up Black Cherry Sparkling Water continued at rank 4, indicating a gradual increase in sales from December 2024. Lastly, the CBD/THC 1:2 Lemonade Up secured the 5th position, recovering from a dip in February 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.