Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

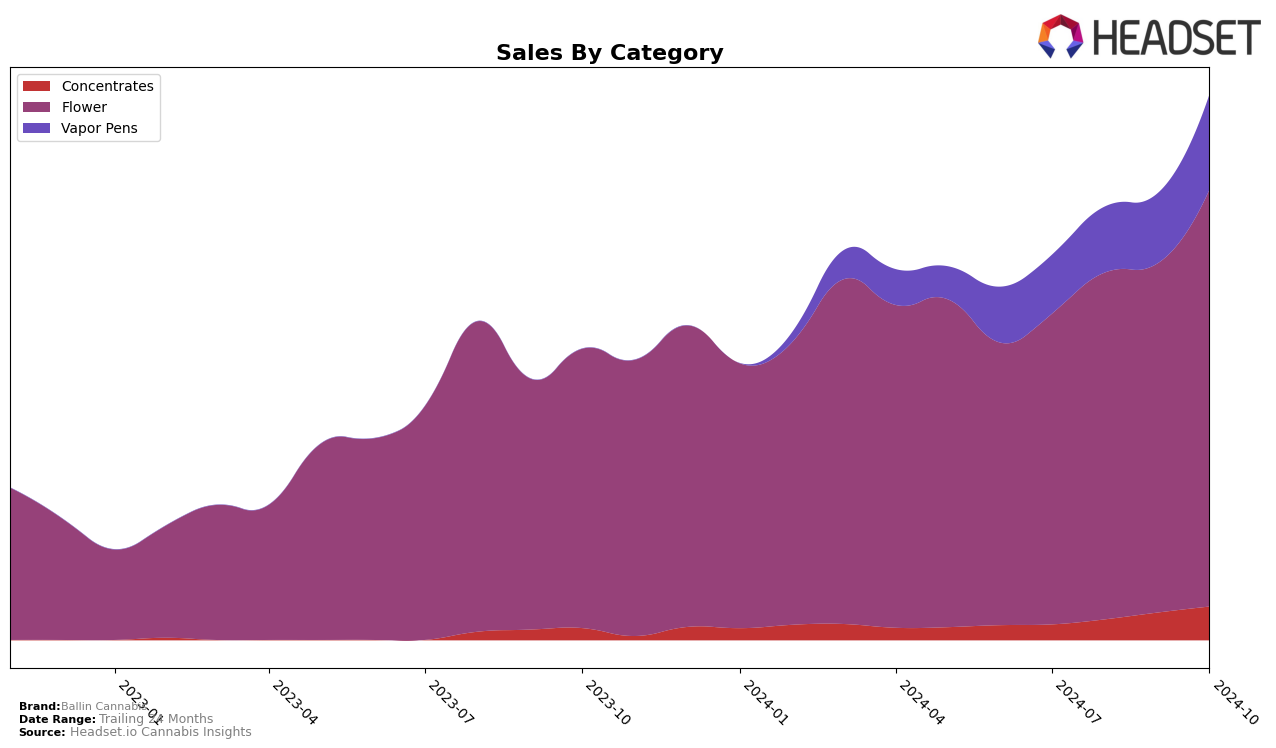

Ballin Cannabis has shown varying performance across different product categories in Washington. In the Flower category, the brand has made significant strides, climbing from a rank of 52 in July 2024 to 27 by October 2024. This upward trajectory is indicative of a strong market presence and growing consumer preference, as evidenced by increasing sales figures. However, the brand's performance in the Concentrates category has not been as notable, as it did not make it into the top 30 rankings from July through October, suggesting room for improvement in this segment. Similarly, in the Vapor Pens category, Ballin Cannabis did not rank in the top 30 until September, when it entered at 97, later improving to 84 by October, indicating a slow but positive trend in consumer acceptance.

While the Flower category appears to be the stronghold for Ballin Cannabis in Washington, the brand's absence from top rankings in other categories like Concentrates highlights potential areas for strategic focus and growth. The Vapor Pens category shows a promising, albeit gradual, increase in rank, suggesting that with the right marketing and product development strategies, Ballin Cannabis could further enhance its market position. These movements across categories and the state provide a clear picture of the brand's current standing and potential areas for growth, offering valuable insights for stakeholders looking to understand the brand's market dynamics.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Ballin Cannabis has shown a notable upward trajectory in its rankings from July to October 2024, moving from a rank of 52 to 27. This improvement highlights a significant gain in market presence, likely driven by strategic marketing or product enhancements. In contrast, Sky High Gardens experienced fluctuations, peaking at rank 18 in August before descending to 25 by October. Similarly, SKÖRD saw a decline from rank 15 in July to 28 in October, indicating potential challenges in maintaining its earlier momentum. Meanwhile, Thunder Chief Farms and Bacon Buds have maintained relatively stable positions, with Thunder Chief Farms slightly improving its rank to 29. These dynamics suggest that Ballin Cannabis is gaining competitive ground, potentially at the expense of brands like SKÖRD, as it continues to climb the ranks in the Washington Flower market.

Notable Products

In October 2024, the top-performing product from Ballin Cannabis was Kush (28g) in the Flower category, which rose to the number one rank with impressive sales figures of 4014. Cookies (28g) also made a significant leap to second place, indicating a strong performance compared to previous months. Kush (3.5g), which previously held the top position in September, slipped to third place despite maintaining robust sales. Haze (3.5g) experienced a slight drop to fourth place, while Haze (28g) re-entered the rankings at fifth position. Overall, there was notable movement in the rankings, with Kush (28g) and Cookies (28g) showing the most significant gains in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.