Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

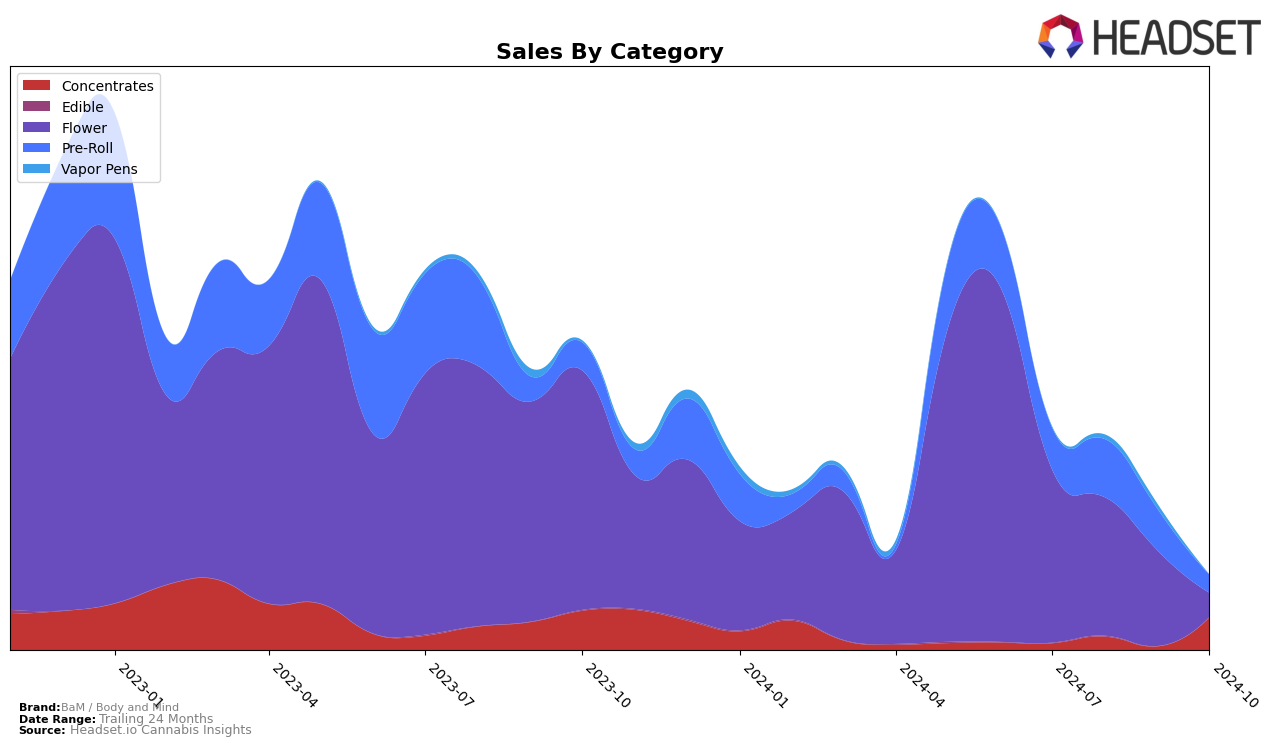

BaM / Body and Mind has experienced noticeable fluctuations in their market performance across different categories and states. In Nevada, the brand's ranking in the Flower category saw a significant decline, dropping from 19th place in July 2024 to 67th by October 2024. This downward trend is reflected in their sales figures, which plummeted from $317,121 in July to just $42,500 in October. In contrast, their performance in the Pre-Roll category in Nevada showed a more stable trajectory, with the brand maintaining a presence within the top 30 for most of the period, albeit with some fluctuations, ending at 41st position by October.

In Ohio, BaM / Body and Mind's presence in the Concentrates category demonstrated a notable comeback. The brand was ranked 27th in both July and August but fell out of the top 30 in September, only to re-enter the rankings impressively at 11th place by October. This resurgence was accompanied by a significant increase in sales, indicating a strong recovery and possible strategic adjustments in their product offerings or marketing efforts. The absence from the rankings in September suggests a period of challenges, but the October rebound highlights their ability to capture market share effectively in Ohio.

Competitive Landscape

In the competitive landscape of the Ohio concentrates market, BaM / Body and Mind has shown a remarkable upward trajectory in recent months. After not ranking in September 2024, BaM / Body and Mind surged to the 11th position by October 2024, indicating a significant improvement in market presence and sales performance. This leap can be contrasted with competitors like Vapen, which maintained a strong presence, ranking consistently in the top 10, although it experienced a slight drop from 5th to 9th place. Meanwhile, Superflux also showed a positive trend, climbing from 29th in August to 10th in October. The Standard and Buckeye Relief exhibited more stable rankings, with The Standard fluctuating between 11th and 13th, and Buckeye Relief maintaining a steady position around 12th. The dynamic shifts in rankings highlight BaM / Body and Mind's potential to capitalize on market opportunities and enhance its competitive stance in the Ohio concentrates sector.

Notable Products

In October 2024, Cocobamba Shatter (0.84g) emerged as the top-performing product for BaM / Body and Mind, climbing to the number one position in the Concentrates category with sales of 2623 units. Rainbow Runtz Pre-Roll (1g) maintained a strong presence, advancing to second place in the Pre-Roll category, despite a drop from the top rank in August. Blizz Berry Pre-Roll (1g) made its debut in the rankings at third place, showing a promising entry. Wedding Cake Pre-Roll (1g) saw a slight decline, moving down to fourth place from its previous third position in July. High Octane Gelato Pre-Roll (1g) rounded out the top five, having slipped slightly from its third-place ranking in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.