Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

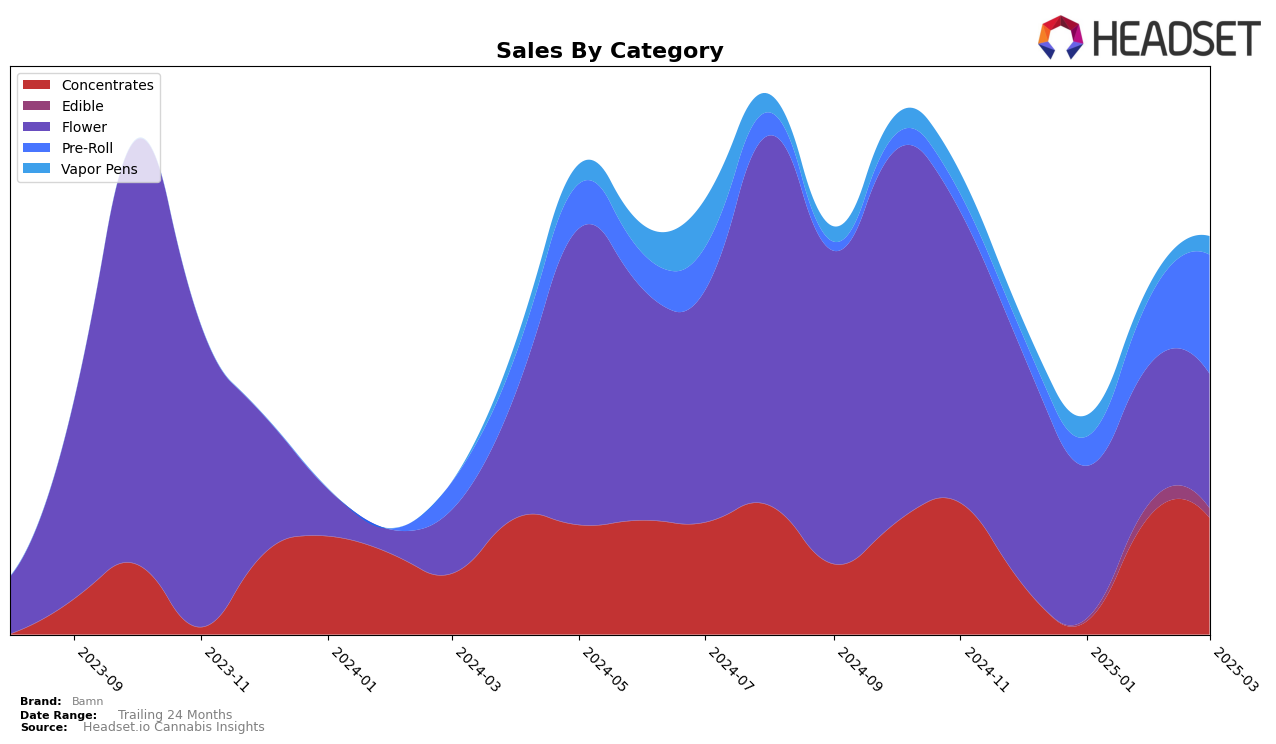

Bamn has shown a dynamic performance across different categories in the state of Michigan. In the concentrates category, Bamn made a significant leap from being ranked 80th in January 2025 to 14th in February 2025, demonstrating a strong upward trend. This improvement is notable considering their lower rank in December 2024. In contrast, their performance in the flower category has seen a decline, with rankings dropping from 54th in December 2024 to 81st by March 2025. Such fluctuations suggest a shifting consumer preference or competitive pressures in these categories. Meanwhile, in the pre-roll category, Bamn climbed from 85th position in January 2025 to reach the 30th spot by March 2025, indicating a growing acceptance or strategic improvements in this segment.

In the realm of edibles and vapor pens, Bamn's presence is less pronounced. The brand only entered the top 100 in the edibles category by February 2025, ranking at 73rd, but then slightly slipped to 81st by March. This suggests a nascent but challenging position in the edibles market. Similarly, Bamn was ranked 96th in vapor pens in January 2025, but was not in the top 30 by February, only reappearing at 94th in March. The absence of Bamn in the top 30 for several months in these categories highlights potential areas for growth or the need for strategic adjustments to improve their standing. The brand's varied performance across these categories underscores the competitive nature of the cannabis market in Michigan and the importance of targeted strategies to capture market share.

Competitive Landscape

In the competitive landscape of the Michigan Flower category, Bamn has experienced a noticeable decline in rank and sales from December 2024 to March 2025. Starting at rank 54 in December, Bamn dropped to 81 by March, indicating a significant competitive pressure. This decline is mirrored in sales, which decreased consistently over the months. In contrast, Seed Junky Genetics also saw a downward trend, though it maintained a higher rank than Bamn throughout the period, starting at 48 and ending at 74. Meanwhile, Galenas showed a positive trajectory, re-entering the top 100 in March at rank 78, suggesting a potential threat to Bamn if this upward trend continues. The absence of Willie's Reserve and Michigander Fire from the top 20 during these months indicates they are not immediate threats, but their sales figures suggest they are still relevant players in the market. These dynamics highlight the need for Bamn to reassess its strategies to regain its competitive edge in Michigan's Flower market.

Notable Products

In March 2025, the top-performing product for Bamn was GMO Pre-Roll (1g), leading the sales with a notable figure of 23,954 units sold. Following closely, Rainbow Gelato Pre-Roll (1g) secured the second position, showing a significant improvement from its fourth place in January. Chem 91 Pre-Roll (1g) ranked third, marking its first appearance in the top rankings for this year. Triangle Kush Pre-Roll (1g) dropped to fourth place after holding the third spot in February. Lastly, Platinum Zkittlez Pre-Roll (1g) rounded out the top five, maintaining a consistent presence in the rankings since February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.