Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

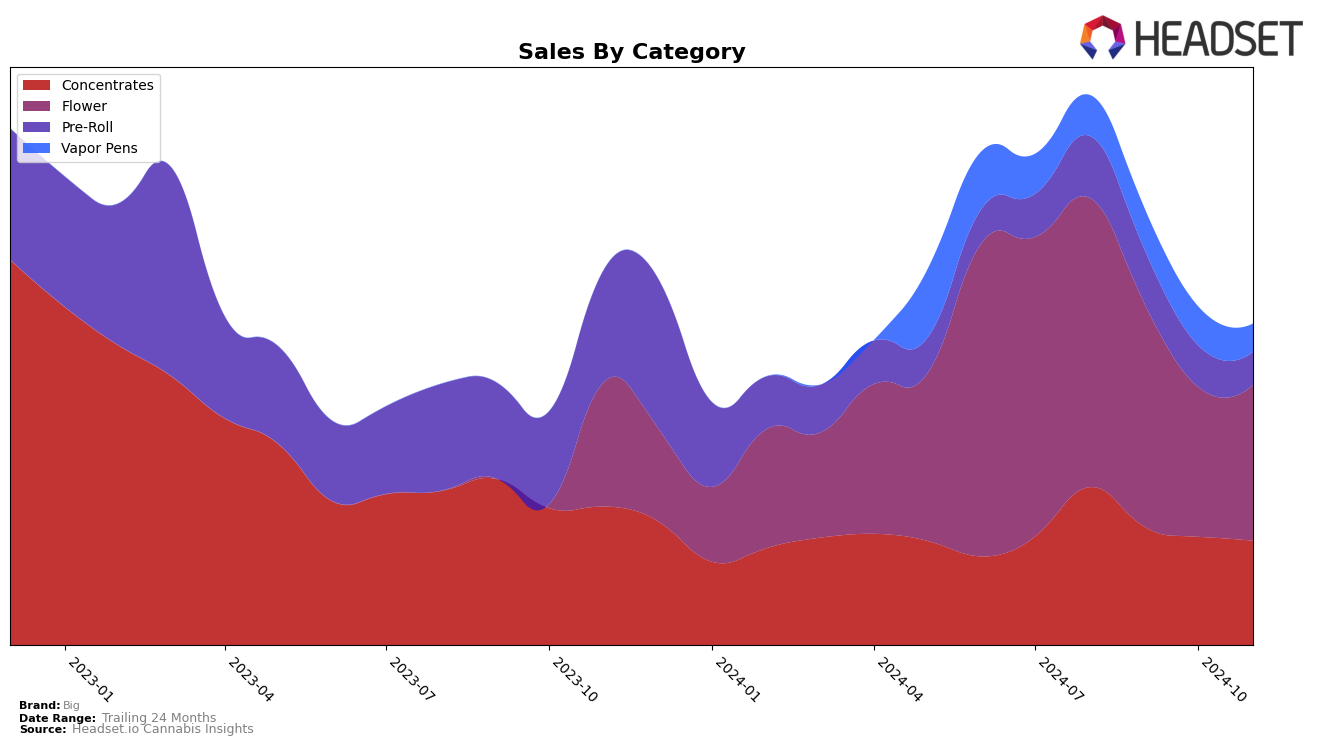

In the province of Ontario, the cannabis brand Big has experienced varied performance across different product categories. In the Concentrates category, Big has seen a consistent decline in its rankings, moving from 17th place in August 2024 to 28th place by November 2024. This decline is accompanied by a decrease in sales, indicating potential challenges in maintaining market share. Meanwhile, in the Flower category, Big's ranking has fluctuated, with a drop from 61st in August to 86th in November. Despite this, the sales figures show a slight rebound in November, suggesting a potential stabilization or strategic adjustment in their approach. The Vapor Pens category presents another story, where Big did not make it into the top 30 brands by November, indicating a significant area for improvement.

Across these categories, Big's performance highlights both challenges and opportunities within the Ontario market. The consistent decline in the Concentrates category suggests a need for strategic reevaluation, possibly in product offerings or marketing efforts. The Flower category's fluctuating rankings, coupled with a slight sales recovery, might indicate a responsive strategy to consumer preferences. However, the absence of a top 30 ranking in Vapor Pens by November is a critical point of concern, possibly reflecting increased competition or a gap in product appeal. These movements across categories underscore the importance of dynamic market strategies and the potential for targeted improvements to regain competitive positioning.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Big has experienced notable fluctuations in its ranking and sales over the past few months. Starting from a strong position in August 2024 with a rank of 61, Big saw a decline to 74 in September and further dropped to 90 in October, before slightly recovering to 86 in November. This downward trend in rank is mirrored by a decrease in sales, which fell from a high in August to a lower point in October, before a slight uptick in November. In comparison, Edison Cannabis Co also experienced a decline in rank from 71 in August to 87 in November, with sales following a similar downward trajectory. Meanwhile, Truro Cannabis Co. maintained a relatively stable rank around the mid-70s, showing less volatility in sales compared to Big. Interestingly, Seeker, which entered the rankings in October at 97, improved its position to 83 by November, indicating a positive sales trend. These dynamics suggest that while Big faces challenges in maintaining its competitive edge, there is potential for recovery if it can capitalize on the upward trends seen by emerging competitors like Seeker.

Notable Products

In November 2024, Indica Black Hash (3g) from Big maintained its top rank in the Concentrates category, despite a slight decline in sales to 696 units. The Banana Pre-Roll 3-Pack (1.5g) continued its strong performance in the Pre-Roll category, holding steady at the second position with sales of 621 units. Hybrid Shatter (1g) showed a notable improvement, climbing to third place in the Concentrates category from fifth in October. Craft (28g) re-entered the rankings, securing the fourth spot in the Flower category with 428 units sold. Meanwhile, Vanilla Ice Live Resin Cartridge (1g) experienced a drop to fifth place in the Vapor Pens category, indicating a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.