Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

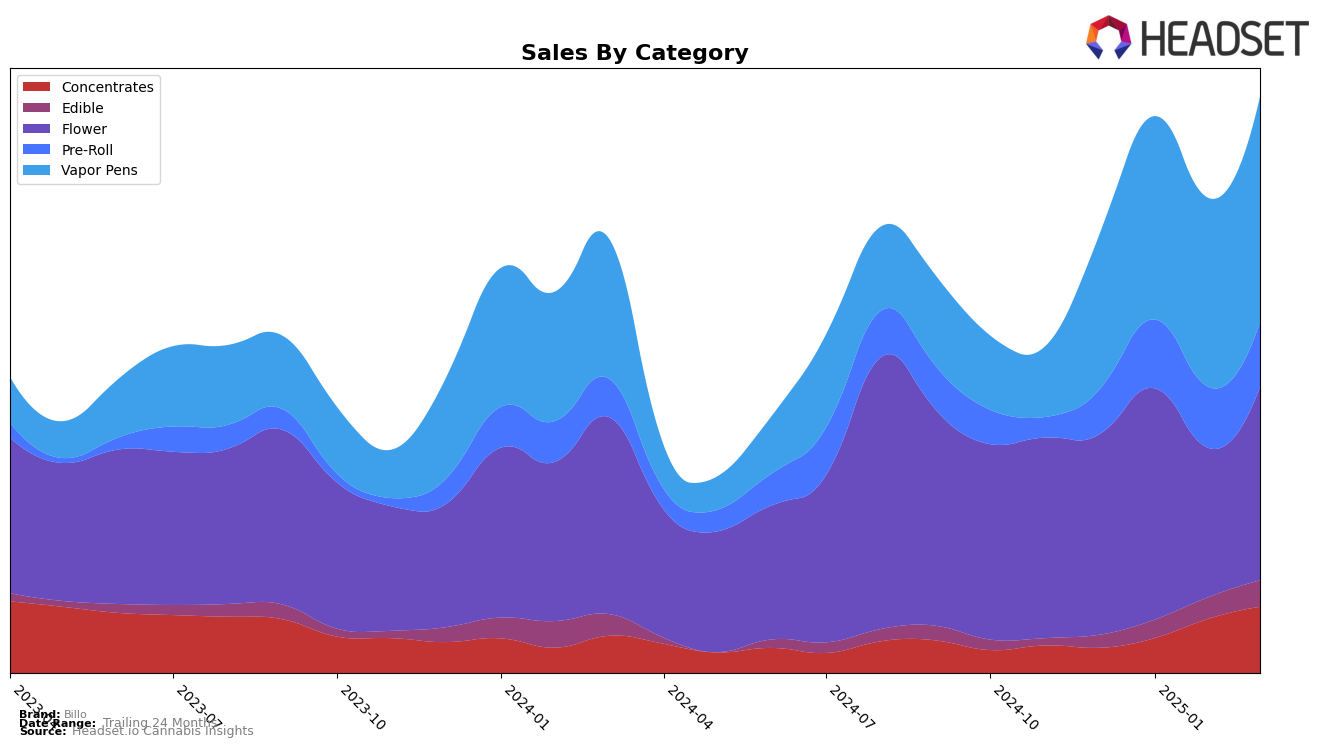

Billo has demonstrated notable performance improvements in the Colorado market, particularly in the Concentrates category. Starting from a rank of 31 in December 2024, Billo climbed to 13 by March 2025, indicating a strong upward trajectory. This impressive movement is mirrored in their sales figures, which show a substantial increase over the same period. However, it's worth noting that Billo did not initially rank in the top 30 for Concentrates, making their subsequent rise a significant achievement. In contrast, their performance in the Flower category saw a slight dip in February 2025 before recovering in March, suggesting potential volatility or seasonal demand fluctuations.

In the Edible category, Billo maintained a steady upward movement, improving from rank 30 in December 2024 to 22 by March 2025. This consistent progress highlights their growing foothold in this segment. Meanwhile, the Vapor Pens category saw Billo rise from rank 22 to 11, showcasing one of their strongest performances across categories. Their journey in the Pre-Roll category was less linear, with a peak at rank 13 in January and February, followed by a slight drop to 16 in March. This mixed performance across categories in Colorado provides insights into consumer preferences and the competitive landscape, offering a glimpse into areas where Billo might focus for future growth.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Billo has shown a notable improvement in its market position over recent months. Starting from a rank outside the top 20 in December 2024, Billo climbed to the 14th position in January 2025 and maintained a steady presence, reaching 11th by March 2025. This upward trajectory is indicative of a positive shift in sales, with March 2025 figures surpassing those of December 2024. In comparison, The Clear and Spectra have experienced fluctuating ranks, with The Clear improving from 18th to 13th and Spectra maintaining a relatively stable position around the 12th rank. Meanwhile, Green Dot Labs and Eureka have seen a slight decline in their rankings, suggesting a potential opening for Billo to capture more market share. This competitive analysis highlights Billo's potential to continue its growth trajectory amidst a dynamic market environment.

Notable Products

In March 2025, Billo's top-performing product was Juicy Limes Pre-Roll (0.75g) from the Pre-Roll category, climbing to the number one spot with impressive sales of 2425 units. Lilac Diesel Pre-Roll (0.75g) held the second position, a slight drop from its top rank in February 2025, while Banana MAC (Bulk) emerged in third place, marking its debut in the rankings. Sour Sage Pre-Roll (0.75g) secured the fourth position, improving from fifth in February. Crescendo Sour Cookies Pre-Roll (0.75g) rounded out the top five, maintaining a consistent presence despite fluctuating rankings in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.