Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

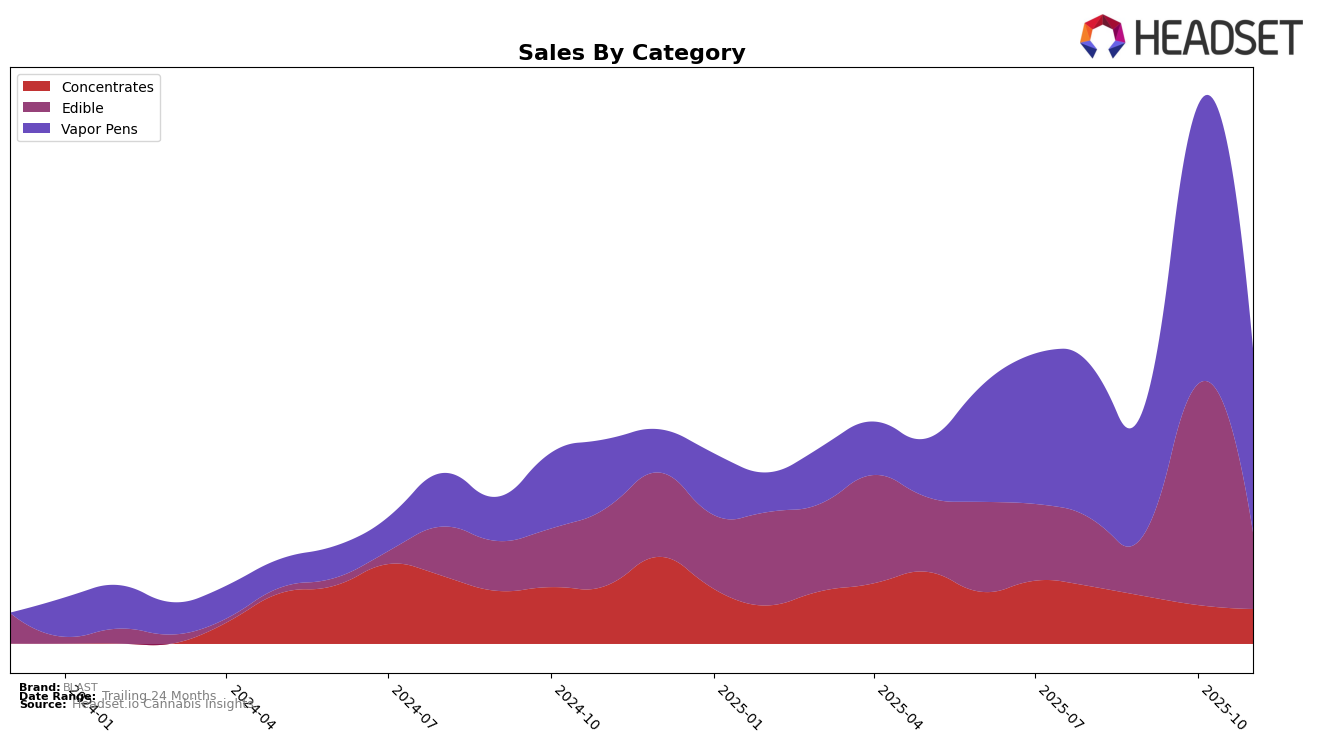

The cannabis brand BLAST has shown varied performance across different categories and regions in recent months. In British Columbia, BLAST's presence in the Concentrates category has fluctuated, with a noticeable drop from 21st in August to 36th in October, before recovering slightly to 27th in November. This indicates some volatility in consumer preference or competitive dynamics in this category. Conversely, their performance in the Edible category in British Columbia has been more robust, peaking at 9th place in October, suggesting a strong consumer reception and possibly successful marketing strategies or product offerings during that period.

In Alberta, BLAST's presence in the Vapor Pens category has been relatively stable, although they have not broken into the top 30, with rankings of 74th and 78th in recent months. This indicates room for growth and potential opportunities for market penetration. Meanwhile, in Ontario, BLAST's Vapor Pens have struggled to gain a significant foothold, consistently ranking outside the top 90. On a more positive note, Illinois has seen a steady improvement in the same category, maintaining a position around 61st in the last two months, which could signal a growing brand recognition or consumer base in the state.

Competitive Landscape

In the competitive landscape of Vapor Pens in Illinois, BLAST has shown a notable improvement in its market position over the past few months. Starting from a rank of 68 in August 2025, BLAST has climbed to a consistent rank of 61 by November 2025, indicating a positive trajectory in its market presence. This upward movement is significant when compared to competitors like FloraCal Farms and Superflux, which have maintained relatively stable rankings around the mid-50s but have not seen similar improvements. Additionally, while Grow Sciences entered the top 20 in October and improved further in November, BLAST's consistent sales growth suggests a strengthening brand loyalty and market strategy. Meanwhile, Mile High Melts has also shown improvement, but BLAST's steady rank and sales increase position it as a formidable competitor in the Illinois Vapor Pens market.

Notable Products

In November 2025, the top-performing product for BLAST was the Animal Style Sour Wild Raspberry Live Rosin Soft chews (10mg) in the Edible category, reclaiming its top spot after briefly dropping to second place in October. This product achieved impressive sales of 6619 units. Following closely was the LA Kush Cake Sour Pineapple Live Rosin Gummy (10mg), which maintained its strong performance by securing the second rank, having swapped positions with the top product from the previous month. The Cosmic Cotton Candy Live Resin Cartridge (1g) in the Vapor Pens category climbed to third place, showing a noteworthy improvement from its absence in the rankings in previous months. Meanwhile, the Flawless Victory Live Rosin Disposable (1g) and Black Hole Supreme Cured Resin (1g) held steady at fourth and fifth places, respectively, indicating consistent sales performance for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.