Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

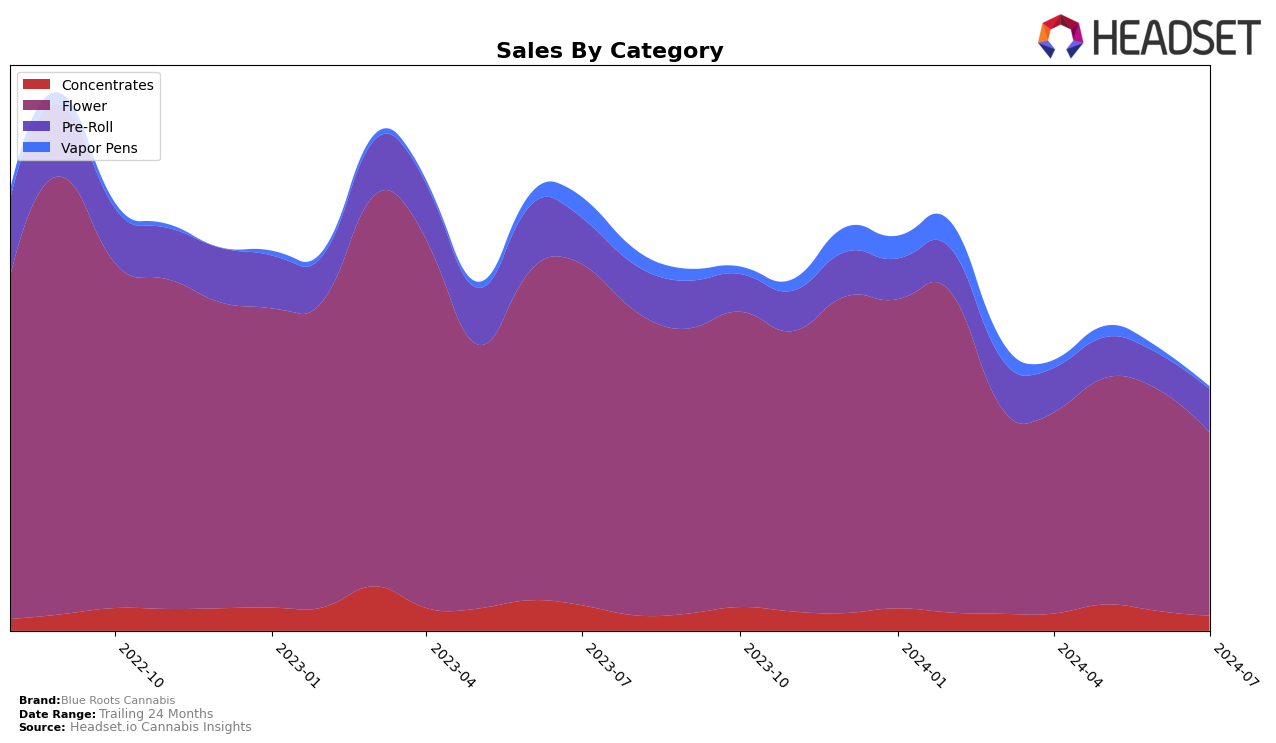

Blue Roots Cannabis has shown variable performance across different product categories in Washington. In the Concentrates category, the brand did not make it into the top 30 rankings from April to July 2024, indicating a need for improvement in this segment. Despite a brief rise to 47th place in May, the brand's ranking dropped again in subsequent months. This fluctuation in rankings suggests that while there was a temporary increase in sales, the brand struggled to maintain a consistent position. In contrast, the Flower category has been a stronger performer for Blue Roots Cannabis, consistently ranking within the top 30. However, a notable decline to 30th place in July from a high of 18th in June indicates potential challenges or increased competition in this category.

Pre-Rolls have been another area where Blue Roots Cannabis has faced difficulties. The brand failed to break into the top 30 rankings at any point from April to July 2024, with rankings fluctuating between 59th and 70th place. This consistent underperformance suggests that the brand might need to reassess its strategy for Pre-Rolls, possibly by innovating or improving product quality. Overall, while Blue Roots Cannabis has shown some strengths in the Flower category in Washington, there are clear areas for improvement in both the Concentrates and Pre-Roll categories to enhance its market presence and competitiveness.

Competitive Landscape

In the Washington Flower category, Blue Roots Cannabis has experienced notable fluctuations in its ranking and sales over the past few months. Starting from a rank of 21 in April 2024, Blue Roots Cannabis climbed to 19 in May and 18 in June, indicating a positive trend in market positioning. However, July saw a drop to rank 30, suggesting increased competition or potential market challenges. Competitors like Harmony Farms and Falcanna have shown more stable performance, with Harmony Farms maintaining a rank within the top 32 and Falcanna consistently staying within the top 29. Meanwhile, Western Cultured and Bacon Buds have struggled to stay within the top 40, indicating that Blue Roots Cannabis is still in a competitive position despite the recent dip. These insights suggest that while Blue Roots Cannabis has the potential to climb the ranks, it must address the factors contributing to its recent decline to maintain and improve its market share.

Notable Products

In July 2024, the top-performing product from Blue Roots Cannabis was Grape Ape (3.5g) in the Flower category, which moved up to the number one spot with sales of $1,109. Maui (3.5g) in the Flower category, which had held the top rank for three consecutive months, dropped to the second position. Sherb Cream Pie (3.5g) in the Flower category climbed to the third spot from the fifth position in June. Dutch Treat (3.5g), also in the Flower category, made its debut in the rankings at fourth place. Lamb's Breath Pre-Roll 2-Pack (1.4g) in the Pre-Roll category entered the rankings in fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.