Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

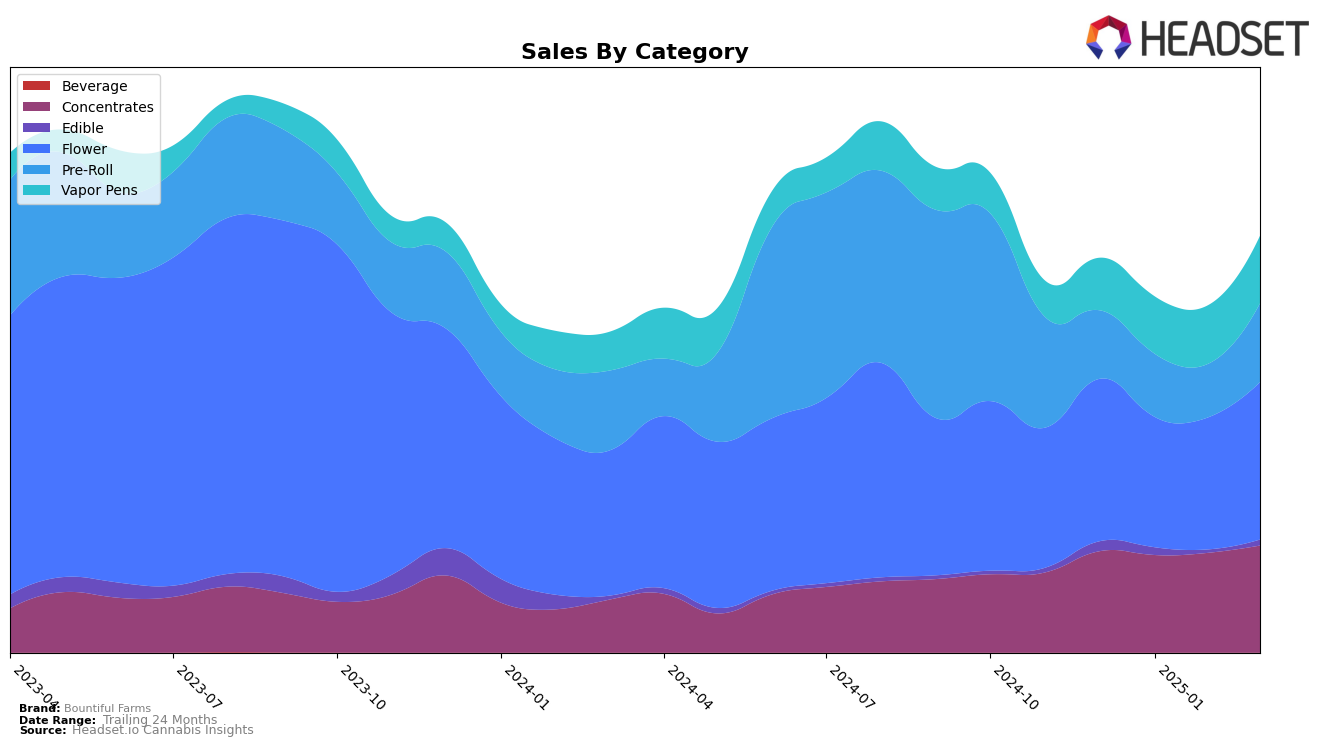

Bountiful Farms has shown a notable performance in the Massachusetts market, particularly in the Concentrates category, where it maintained a strong presence within the top 5 rankings from December 2024 to March 2025. This consistent performance is indicative of a solid market strategy and consumer preference for their concentrate products. On the other hand, the brand's presence in the Edible category did not make it into the top 30 after December 2024, highlighting a potential area for improvement or a shift in consumer demand that the brand might need to address. Additionally, the slight fluctuations in rankings across the Flower and Pre-Roll categories suggest a competitive landscape, with Bountiful Farms managing to regain its position by March 2025 after some dips in the preceding months.

In the Vapor Pens category, Bountiful Farms experienced an upward trend in sales and rankings, moving from 44th in December 2024 to 37th by March 2025. This positive movement indicates a growing consumer interest in their vapor pen products, which could be a strategic focus for the brand moving forward. Despite not being in the top 30 for Edibles after December, the brand's ability to maintain and even improve its rankings in other categories, such as Concentrates and Vapor Pens, demonstrates resilience and adaptability in a competitive market. The overall performance across these categories suggests that while Bountiful Farms has strongholds in certain areas, there is room for growth and strategic adjustments in others to enhance their market position further.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, Bountiful Farms has experienced fluctuating rankings, indicating a dynamic market position. From December 2024 to March 2025, Bountiful Farms' rank varied from 28th to 36th, with a notable improvement in March 2025, climbing back to 28th. This suggests a potential recovery in market presence after a dip in January 2025. In contrast, Root & Bloom consistently outperformed Bountiful Farms, maintaining a top 30 position throughout the period, although it saw a decline from 20th to 27th by March 2025. Meanwhile, Local Roots showed a positive trend, improving its rank from 35th in December 2024 to 26th by March 2025, potentially indicating increased consumer preference or effective marketing strategies. Resinate and The Botanist also demonstrated varied performances, with Resinate peaking at 21st in February 2025 before dropping to 30th, and The Botanist making a significant leap from 51st in February to 31st in March 2025. These shifts highlight the competitive pressures and opportunities for Bountiful Farms to strategize for improved market share and sales growth in the Massachusetts flower category.

Notable Products

In March 2025, the top-performing product from Bountiful Farms was the MSQ Pre-Roll (1g), securing the number one rank with sales of 2726 units. Following closely was the Pina Grande Pre-Roll (1g) in second place, which had not been ranked in the previous months. Sour Power OG Pre-Roll (1g) experienced a slight drop, moving from the top position in February to third place in March. The Mac And Cheese Pre-Roll (1g) made its debut in the rankings at the fourth spot. Meanwhile, Deer Creek Diesel Small (7g) saw a decline, dropping from third in February to fifth in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.