Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

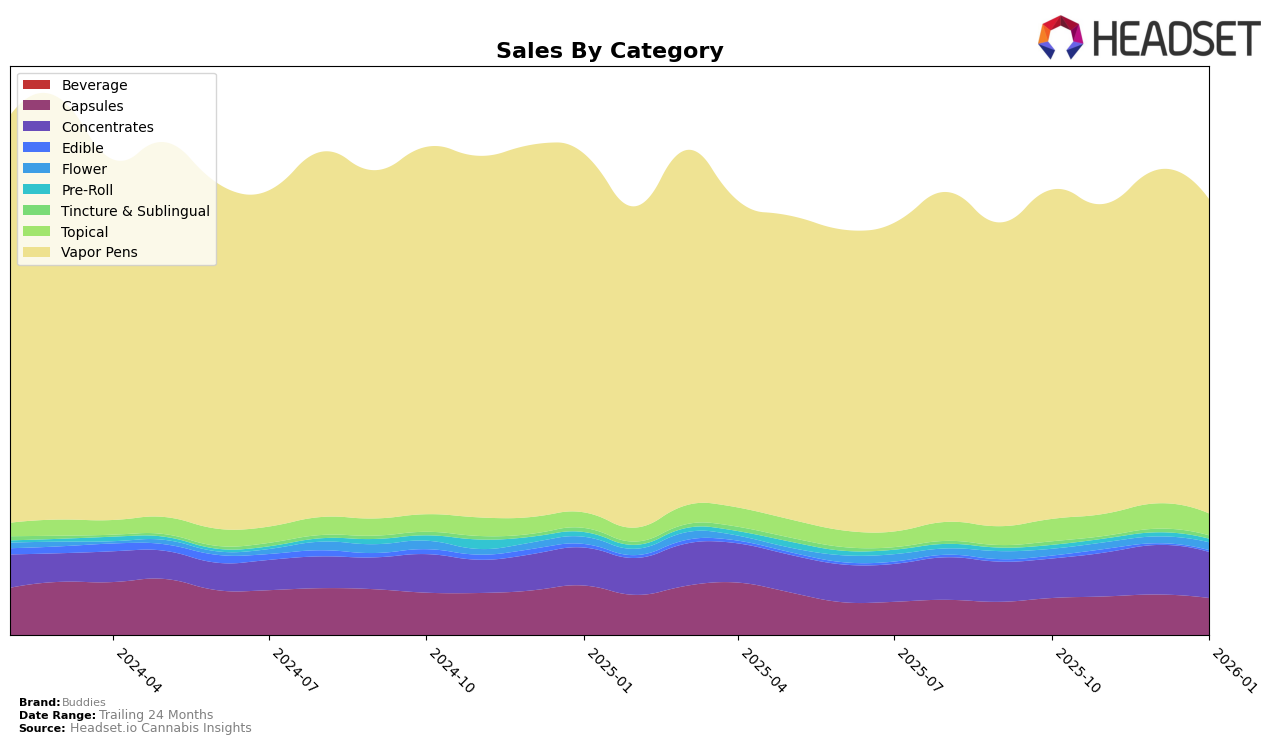

Buddies has shown a varied performance across different product categories and states. In California, the brand maintained a consistent ranking in the Capsules and Topical categories, holding steady at fifth and third place, respectively, from October 2025 to January 2026. However, their performance in the Concentrates category saw some fluctuations, with rankings oscillating between 27th and 37th place, which indicates a competitive market. The Vapor Pens category showed an upward trend, moving from 30th to 23rd place by January 2026, suggesting an improvement in their market presence. Despite these movements, the brand was not in the top 30 for Concentrates in Washington until January 2026, which could be seen as a positive development or a sign of previous underperformance.

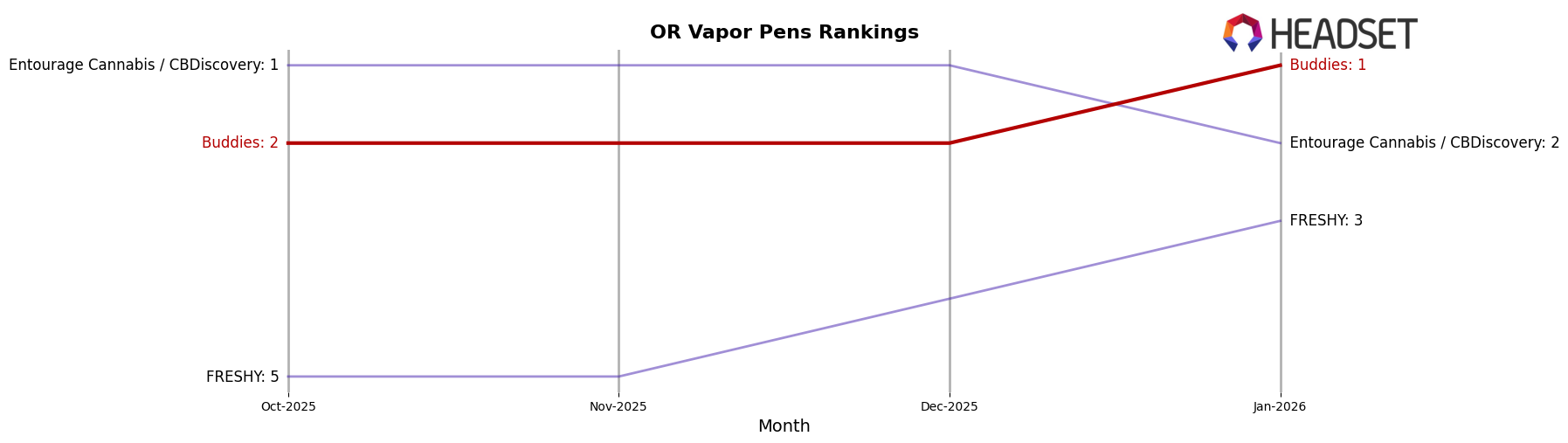

In Oregon, Buddies displayed strong performance in the Vapor Pens category, consistently ranking second until achieving the top spot in January 2026. This suggests a dominant position in this segment within the state. The Concentrates category also saw a positive trajectory, with Buddies climbing from eighth to fifth place by December 2025, although it slightly slipped to sixth in January 2026. In Washington, Buddies' ranking in the Vapor Pens category fell from 15th to 20th by January 2026, indicating a potential challenge in maintaining their competitive edge. Despite this, the brand's entry into the top 30 for Concentrates in January 2026 could signal a new opportunity for growth in this market.

Competitive Landscape

In the Oregon Vapor Pens category, Buddies has demonstrated a notable upward trajectory in brand ranking and sales performance from October 2025 to January 2026. Initially holding the second position, Buddies managed to surpass Entourage Cannabis / CBDiscovery by January 2026, claiming the top spot. This shift indicates a strategic gain in market share and consumer preference, as Buddies consistently maintained close sales figures to its primary competitor. Meanwhile, FRESHY also showed a positive trend, climbing from fifth to third place, suggesting a competitive landscape where Buddies must continue innovating to retain its newfound lead. The dynamic changes in rankings highlight the importance of continuous market analysis for brands aiming to capitalize on evolving consumer trends and competitor movements.

Notable Products

In January 2026, the top-performing product from Buddies was Pink Lemonade Flavored Distillate Cartridge (1g) in the Vapor Pens category, reclaiming its number one spot with sales of 4,389 units. Tropical Blast Flavors Distillate Cartridge (1g) made a notable entrance, ranking second. Orange Soda Flavored Distillate Cartridge (1g) rose to third place, showing a significant improvement from its absence in December 2025. Strawberry Cough Flavored Distillate Cartridge (1g) maintained a steady performance, securing the fourth position. Blue Ox Distillate Cartridge (1g) entered the rankings at fifth place, indicating a resurgence in popularity compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.