Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

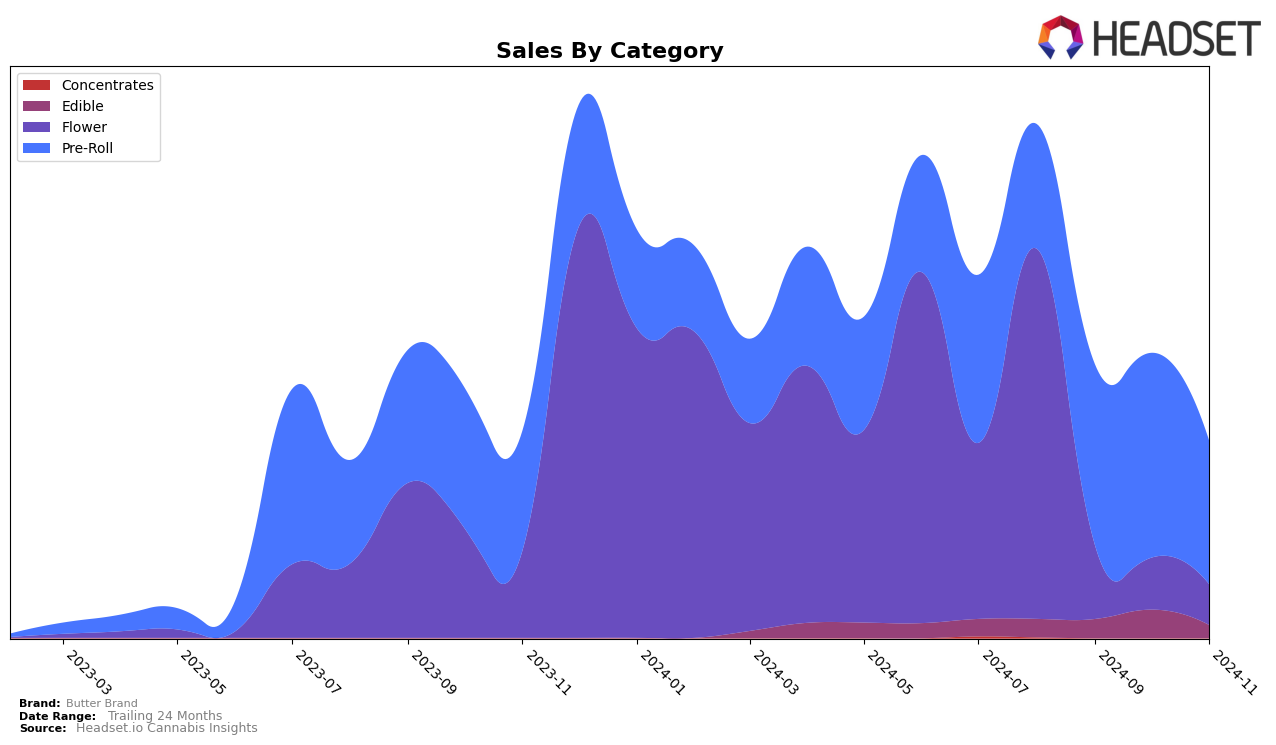

Butter Brand's performance in the Michigan market displays a mixed trajectory across different categories. The Edible category saw fluctuating rankings, with a notable dip in November 2024, dropping to 80th place from a peak of 61st in October. This decline is mirrored in sales, which fell sharply after a high in October. In the Flower category, Butter Brand did not maintain a top 30 ranking beyond August, indicating a potential area for growth or a shift in market focus. The Pre-Roll category in Michigan also saw Butter Brand exit the top 30 after September, which could suggest increasing competition or changing consumer preferences.

In New York, Butter Brand's performance in the Pre-Roll category was more promising, maintaining a presence in the top 30 from September through November. The brand improved its ranking from 21st in September to 15th in October, before experiencing a slight drop to 18th in November. Despite this minor decline, the consistency in rankings suggests a stable market position in New York compared to Michigan. The upward trend in sales from September to October indicates a growing consumer base or successful marketing strategies within this category. However, the decrease in November could point to seasonal trends or emerging competition.

Competitive Landscape

In the competitive landscape of the New York pre-roll category, Butter Brand has shown a dynamic shift in its market position over the past few months. After not ranking in the top 20 in August 2024, Butter Brand surged to 21st in September, climbed to 15th in October, but then slightly dipped to 18th in November. This fluctuation suggests a competitive and volatile market environment. Notably, Rolling Green Cannabis has been a strong contender, moving from 24th in September to 15th in November, indicating a consistent upward trend. Meanwhile, Back Home Cannabis Co. experienced a significant jump from 26th in October to 16th in November, which could pose a potential challenge to Butter Brand's market share. Additionally, CRU Cannabis and Slap That S Exotics (S.T.A. Exotics) have shown varied performances, with CRU Cannabis reaching 20th in November and S.T.A. Exotics maintaining a steady presence around the 19th position. These competitive dynamics underscore the importance for Butter Brand to strategize effectively to maintain and improve its ranking in this highly competitive market.

Notable Products

In November 2024, Butter Brand's top-performing product was the Peanut Butter Milk High Dose Bertha Chocolate Bar (200mg) in the Edible category, maintaining its number one rank from the previous two months despite a drop in sales to 1886 units. The Petrone Pre-Roll 10-Pack (5g) rose to second place, improving from fourth in October. The Gator Pre-Roll (1g) made a notable entry, securing the third position. Tangerine Cream Pre-Roll (1g) saw a decline, moving from second to fourth place. Lastly, the Petrone Pre-Roll (1g) entered the rankings at fifth place, showcasing a diverse range of top-performing products for the brand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.