Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

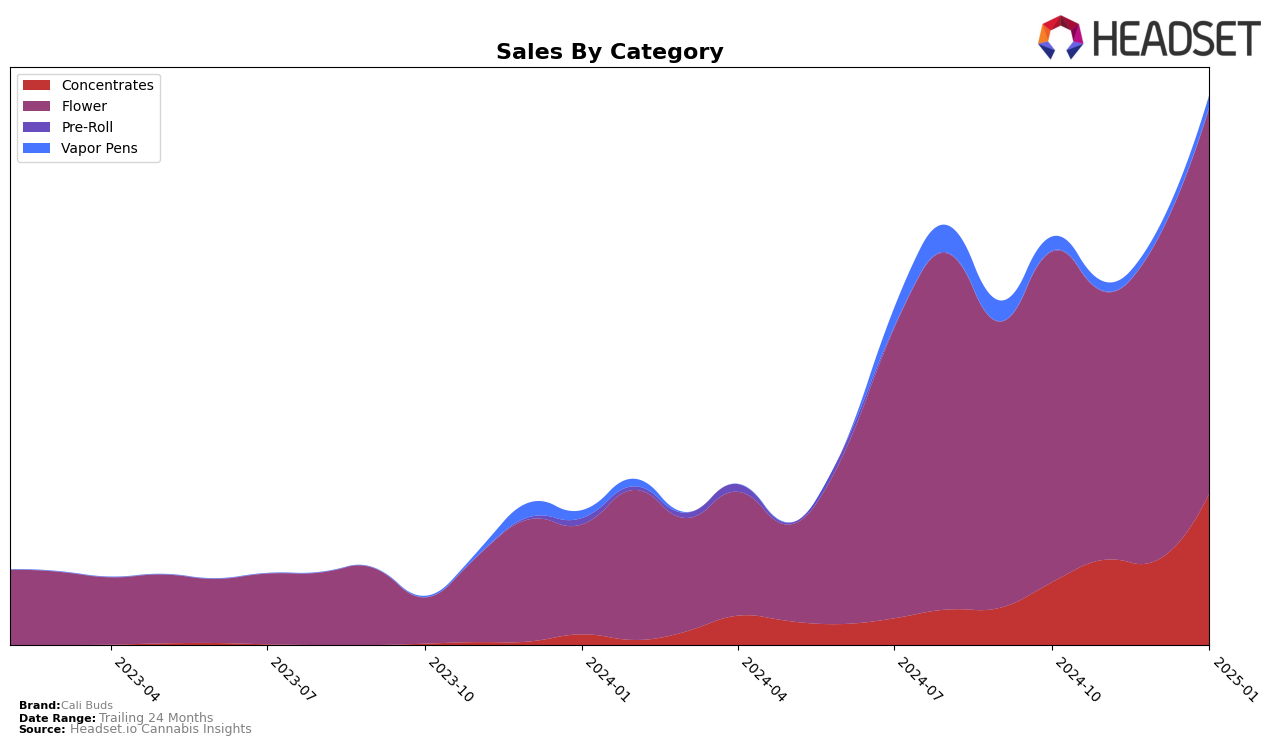

In the California market, Cali Buds has shown notable progress in the Concentrates category. Starting from a rank of 58 in October 2024, they climbed to 26 by January 2025, indicating a significant upward trajectory. This movement suggests a growing consumer preference for their concentrates, which is further supported by a steady increase in sales over the same period. In contrast, the Flower category tells a different story. Despite a slight improvement from 95 in November to 75 in January, Cali Buds did not manage to break into the top 30 brands, which highlights a competitive challenge in this segment. The fluctuations in their ranking suggest that while there is potential, the brand faces stiff competition in the Flower category.

The absence of Cali Buds from the top 30 in both categories for several months underscores the competitive landscape in California. However, the brand's ability to eventually climb into the top 30 for Concentrates by January 2025 is a positive indicator of their strategic adjustments and consumer appeal. It will be crucial for Cali Buds to leverage this momentum to improve their standings in the Flower category, where the rankings have been less consistent. The data suggests that while Cali Buds has made strides in Concentrates, there is still considerable room for growth and improvement in other categories, especially if they aim to capitalize on the expansive California market.

Competitive Landscape

In the competitive landscape of the California Flower category, Cali Buds has shown a notable upward trajectory in rank from October 2024 to January 2025, moving from 85th to 75th place. This improvement is significant when compared to competitors such as White Label / White Lvbel (NV), which experienced a more volatile ranking, ending at 72nd in January 2025 after dropping to 93rd in December 2024. Meanwhile, Roll Bleezy maintained a relatively stable position, fluctuating slightly but ending close to Cali Buds at 76th. Notably, Autumn Brands and Seed Junky Genetics consistently ranked higher, with Autumn Brands starting at 59th and ending at 69th, and Seed Junky Genetics starting at 55th and ending at 79th. Despite these competitors having higher sales figures, Cali Buds' steady climb suggests a positive reception in the market, potentially driven by strategic marketing or product differentiation efforts.

Notable Products

In January 2025, Cali Buds' top-performing product was Cali OG (3.5g) in the Flower category, maintaining its consistent rank of 1 since October 2024, with sales reaching 3,370 units. The Concentrates category saw Carbon Fiber Badder (1g) rise to the second position, introduced in the rankings this month with notable sales. Pookie Badder (1g) climbed to third place from its previous fifth position in November 2024, showing a significant increase in popularity. Orange Cookie Crumble (1g) debuted in fourth place, while Racefuel Badder (1g) dropped to fifth from its third-place standing in December 2024. This data indicates a strong performance by Cali OG in maintaining its top position, while other Concentrates products showed dynamic changes in rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.