Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

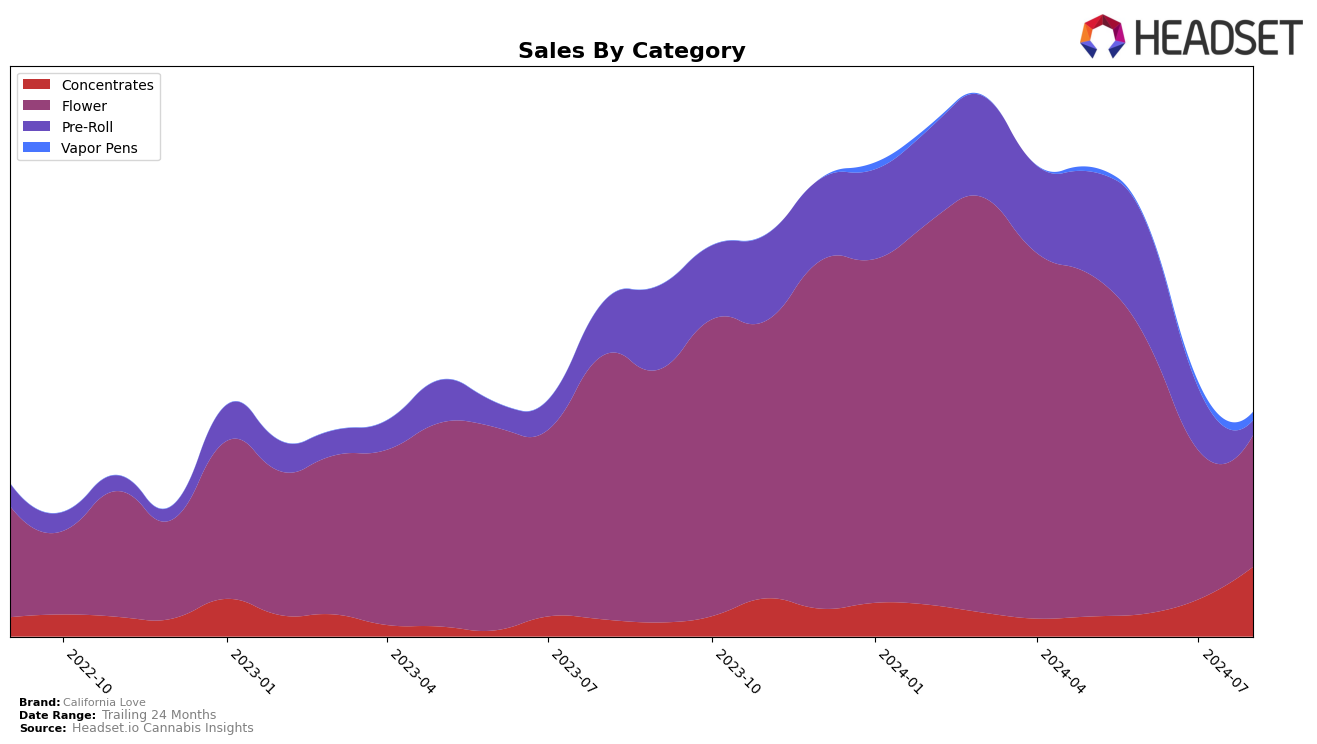

California Love has shown notable progress in the Concentrates category within California. The brand's rank improved from 70th in May 2024 to an impressive 22nd by August 2024, indicating a strong upward trend. This positive movement is accompanied by a significant increase in sales, which more than tripled over the same period. However, in the Flower category, California Love experienced a downward trajectory, dropping from 36th in May to 83rd in August. This decline suggests that while the brand is gaining traction in Concentrates, it faces challenges in maintaining its position in the highly competitive Flower market.

The performance of California Love in the Pre-Roll category within California presents a mixed picture. The brand saw an initial improvement from 50th in May to 42nd in June, but subsequently fell out of the top 30 by August. This fluctuation indicates potential volatility or shifting consumer preferences in the Pre-Roll segment. The absence of a ranking in August is particularly concerning, as it suggests the brand has lost significant ground. Overall, while California Love is making strides in certain categories, it faces ongoing challenges in others, highlighting the dynamic nature of the cannabis market in California.

Competitive Landscape

In the highly competitive California flower market, California Love has experienced notable fluctuations in its rank and sales over the past few months. Initially ranked 36th in May 2024, California Love saw a decline to 45th in June, further dropping to 77th in July, and slightly improving to 83rd in August. This downward trend in rank is mirrored by a significant decrease in sales, from $785,113 in May to $302,376 in August. In comparison, Lolo started strong at 26th in May but also saw a decline, albeit less severe, ending at 81st in August. Meanwhile, Cream Of The Crop (COTC) experienced a similar downward trajectory, falling from 33rd in May to 79th in August. Interestingly, Grizzly Peak Farms and TRENDI were not consistently in the top 20, with TRENDI only appearing in August at 99th. These insights suggest that while California Love is facing challenges, it is not alone in this competitive landscape, indicating a broader market trend that could be affecting multiple brands.

Notable Products

In August 2024, the top-performing product from California Love was Garlic and Bananas Pre-Roll (1g), which secured the number one rank with sales of 3,837 units. Wedding Cake Surf Sauce (1g) made an impressive debut at the second position. Blu Lemonatti Pre-Roll (1g) dropped to the third spot, down from first place in June 2024. OG Crostata Sauce (1g) ranked fourth, while Hawaiian Ice Surf Sauce (1g) completed the top five. Notably, Garlic and Bananas Pre-Roll (1g) showed a significant rise from fifth in May 2024 to first in August 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.