Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

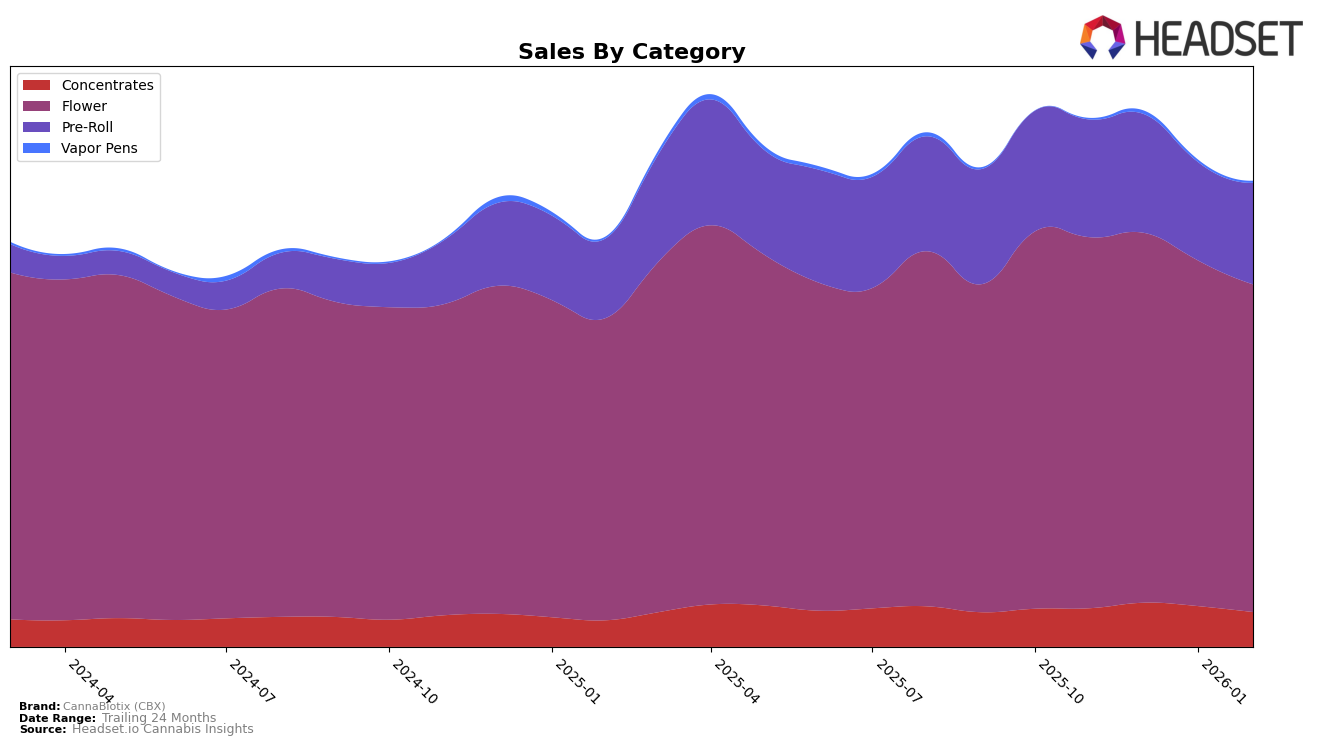

CannaBiotix (CBX) has shown varied performance across different product categories in California. In the Concentrates category, CBX maintained a consistent presence within the top 10, although there was a slight decline from 5th place in November and December 2025 to 7th by February 2026. This indicates some competitive pressure or shifting consumer preferences in this category. Meanwhile, the Flower category has been a stronghold for CBX, where they consistently held the top position, except for a brief dip to 2nd place in December 2025, showcasing their dominance and consumer loyalty in this segment.

In the Pre-Roll category, CBX's performance has been more volatile, with rankings fluctuating between 6th and 8th place over the observed months. Despite these fluctuations, CBX managed to return to 6th place by February 2026, suggesting a potential recovery or stabilization in this category. Notably, the brand's absence from the top 30 in other states or provinces could indicate either a strategic focus on the California market or challenges in expanding their market presence elsewhere. This data suggests that while CBX is a formidable player in California, particularly in the Flower category, there may be opportunities for growth and increased market penetration in other regions and product segments.

Competitive Landscape

In the competitive landscape of the California flower category, CannaBiotix (CBX) has demonstrated resilience and strong market presence. Despite a brief dip to the second position in December 2025, CBX quickly regained its top rank by January 2026, maintaining this lead through February. This fluctuation coincided with a sales decrease, suggesting a potential challenge in sustaining momentum against competitors like STIIIZY, which temporarily overtook CBX in December. Meanwhile, CAM consistently held the third position, indicating a stable but less competitive threat. The data highlights CBX's ability to reclaim and sustain its leading position, emphasizing the brand's strong market strategy and consumer loyalty in the face of fluctuating sales and competitive pressures.

Notable Products

In February 2026, Cereal Milk (3.5g) maintained its position as the top-performing product for CannaBiotix (CBX), despite a slight decrease in sales to 20,467 units. Super Mango Haze Pre-Roll (0.75g) secured the second rank, holding steady from January 2026. Casino Kush Pre-Roll (0.75g) dropped to third place, reflecting a slight decrease from its second-place position in January. The newly ranked Cereal Milk Pre-Roll (0.75g) entered the list at fourth place, while Casino Kush (3.5g) rounded out the top five. Notably, Casino Kush (3.5g) reappeared in the rankings after not being in the top five for December and January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.