Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

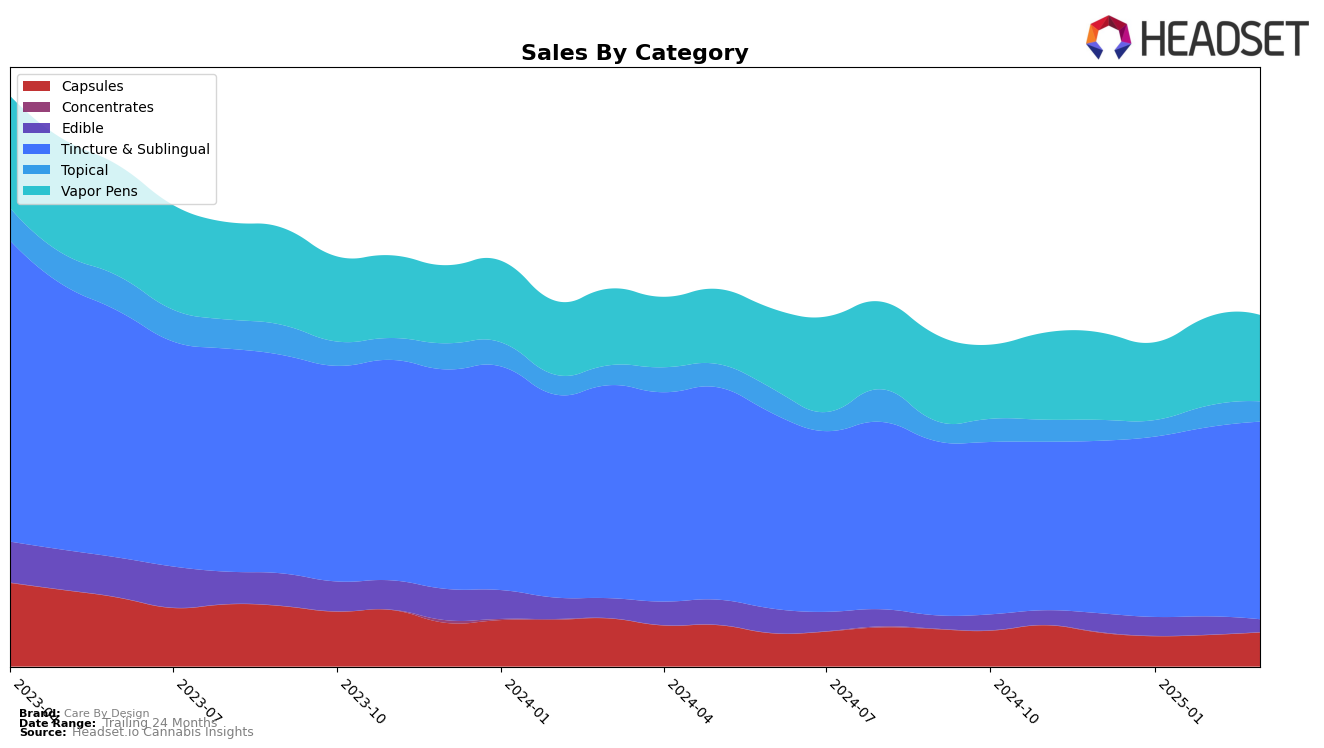

Care By Design has demonstrated a consistent presence in the California market, particularly in the Tincture & Sublingual category, where it has maintained a top-three ranking across recent months, even reaching the number one spot in February 2025. This indicates a strong consumer preference and brand loyalty in this segment. In contrast, their performance in the Edible category has been more volatile, with rankings fluctuating from 56th in December 2024 to 62nd in March 2025, suggesting challenges in maintaining a competitive edge amidst a crowded market. The Capsules category has shown stability, with Care By Design consistently hovering around the 10th and 11th positions, which reflects a steady demand but also highlights room for growth to break into higher rankings.

In the Vapor Pens category, Care By Design has shown a positive trajectory, improving its rank from 71st in December 2024 to 59th by March 2025. This upward movement suggests a growing acceptance and potential expansion in market share within this category. However, in the Topical category, the brand has maintained a consistent 6th place ranking, indicating a stable yet unchanging position in the market. The absence of Care By Design in the top 30 brands in other states or provinces during these months might point to a strategic focus on California or challenges in scaling their operations beyond this state. This concentrated presence in California could either be a strategic decision to dominate the local market or a limitation in broader geographical reach.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Care By Design has demonstrated notable resilience and adaptability. Over the observed period, Care By Design experienced a significant improvement in rank, climbing from third place in December 2024 to securing the top position in February 2025, before settling at second place in March 2025. This upward trajectory in rank is mirrored by a consistent increase in sales, indicating a strong market presence and consumer preference. In contrast, Papa & Barkley, a key competitor, maintained the first position for most of the period but experienced a dip to second place in February 2025, suggesting a potential vulnerability that Care By Design capitalized on. Meanwhile, Yummi Karma remained a steady competitor, consistently holding the third position, while VET CBD maintained a stable fourth place throughout. These dynamics highlight Care By Design's strategic advancements in the market, positioning it as a formidable contender in the California Tincture & Sublingual sector.

Notable Products

In March 2025, the top-performing product from Care By Design was CBD/THC 1:1 Peppermint MAX Drops, maintaining its first position for the fourth consecutive month with sales of 2467 units. The CBD/THC 40:1 Full Spectrum Refresh Drops continued to hold steady in the second spot, though its sales dipped to 1325 units. The CBD/THC 4:1 Medium THC Full Spectrum Cartridge saw an improvement, climbing back to the third rank after slipping to fifth in the previous two months. A new entry in the rankings, CBD/THC 40:1 Drops Tincture, debuted at fourth place. Lastly, the CBD/THC 1:1 Refresh Full Spectrum Sublingual Tincture entered the list at fifth position, showcasing a promising start in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.