Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

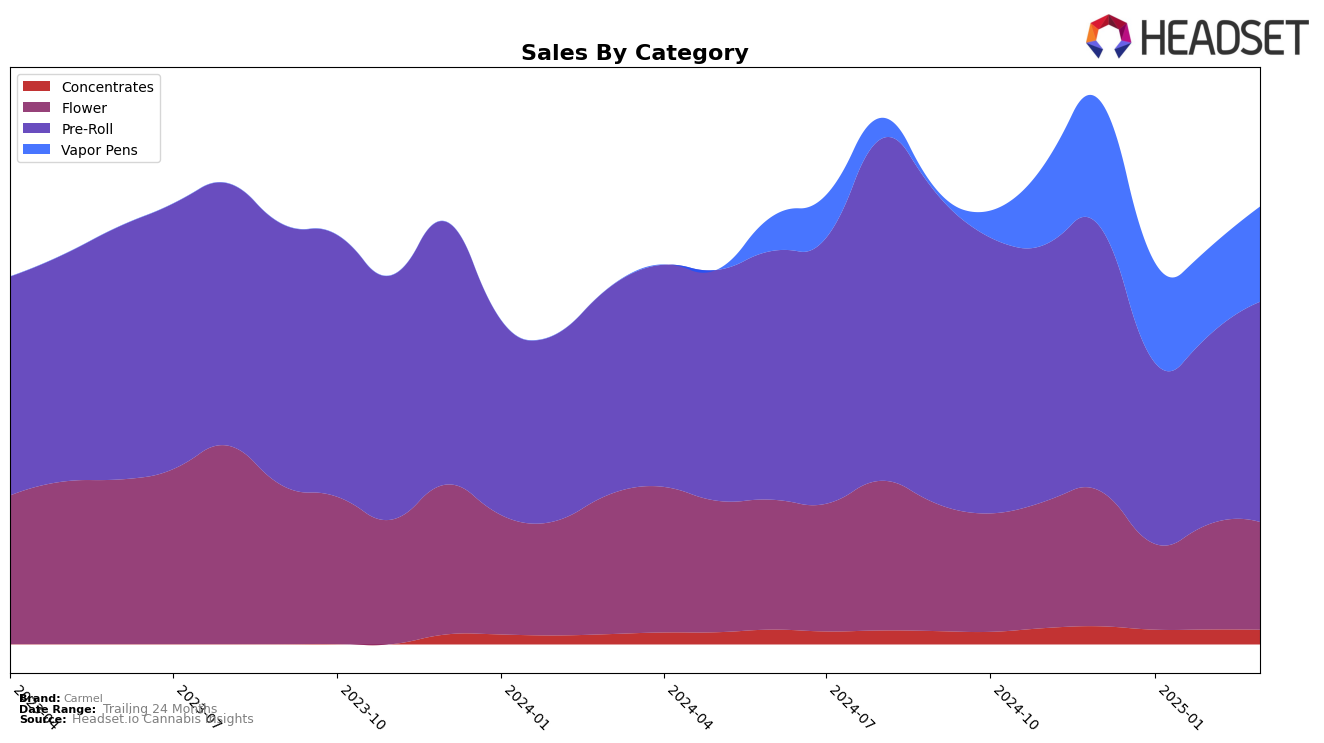

Carmel's performance in the Canadian provinces showcases a varied landscape across different product categories. In Alberta, the brand has shown resilience in the Pre-Roll category, maintaining a consistent presence within the top 20. Notably, they held the 13th position in December 2024, which slightly dipped but remained steady at 14th by March 2025. On the contrary, their Flower category saw a dip in January 2025, ranking 39th, but rebounded to 19th in February, indicating a positive recovery trend. Meanwhile, in the Vapor Pens category, Carmel experienced minor fluctuations but maintained a position around the 20th rank, suggesting a stable demand in Alberta.

In Ontario, Carmel's performance in the Pre-Roll category has been robust, consistently ranking in the top 10, which reflects a strong consumer preference for their products. However, their Vapor Pens category experienced a downward trajectory, dropping from 19th in December 2024 to 27th by March 2025, pointing towards potential challenges or increased competition in this segment. Over in British Columbia, Carmel's Vapor Pens have shown a promising upward trend, climbing from 31st in December 2024 to 21st by March 2025, highlighting a growing market presence. However, their Pre-Roll category did not make it to the top 30, which could indicate either a highly competitive market or an area for potential growth and improvement.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Carmel has experienced notable fluctuations in its market position over the months from December 2024 to March 2025. Starting at 8th place in December, Carmel saw a dip to 11th in January, before recovering slightly to 10th in February and 9th in March. This trajectory indicates a struggle to maintain a stable rank amidst strong competition. Notably, Shred consistently held a higher rank, maintaining the 7th position from January to March, which suggests a stronger market presence. Meanwhile, MTL Cannabis showed a downward trend, falling from 6th in December to 10th in March, briefly ranking below Carmel in February. Thumbs Up Brand improved its position from 13th to 8th, surpassing Carmel by February. These dynamics highlight the competitive pressures Carmel faces, emphasizing the need for strategic efforts to regain and sustain higher market rankings.

Notable Products

In March 2025, Carmel's top-performing product was the Animal Face Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its number one rank consistently from December 2024 with sales of 23,930. The Animal Face Pure Live Resin Cartridge (1g) in Vapor Pens held its steady position at number two, reflecting a consistent demand. The Candy Gas Face Pre-Roll 3-Pack (1.5g) emerged strongly in the Pre-Roll category, ranking third, a position it has maintained since its introduction in February 2025. The Animal Face Pre-Roll 12-Pack (6g) remained at fourth place, showing a slight improvement from its fifth-place rank in February. Lastly, the Animal Face (3.5g) in the Flower category stayed at fifth place, indicating stable performance over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.