Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

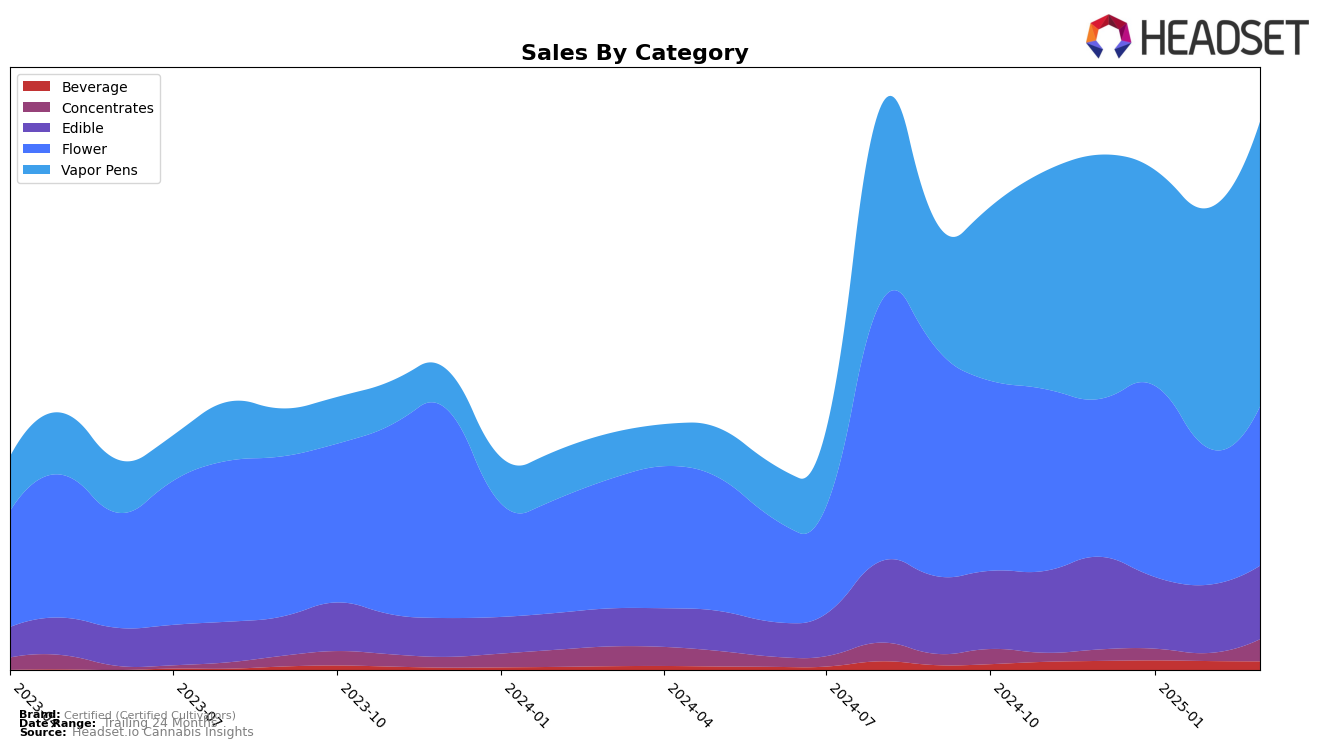

Certified (Certified Cultivators) has demonstrated a strong presence in the Ohio cannabis market, particularly in the beverage and vapor pen categories. The brand maintained its top position in beverages throughout December 2024 and January 2025, only slightly dropping to the second position in February and March. This consistency suggests a robust consumer base and effective market strategies. In the vapor pen category, Certified achieved a notable improvement, moving from the second rank to first in March 2025, indicating a growing preference for their products in this segment. Meanwhile, the brand's performance in the concentrates category showed significant volatility, with a notable absence from the top 30 rankings in February 2025, only to rebound to the second position by March. This fluctuation could point to either supply chain challenges or shifting consumer preferences, which may require further analysis.

In the edible category, Certified's performance remained relatively stable, with minor fluctuations between the second and third positions over the months. This steadiness in the rankings, despite a dip in sales from December 2024 to February 2025, suggests a resilient demand for their edible products. The flower category, however, presented more challenges, with the brand slipping from the seventh to the eleventh position before recovering to ninth in March. This downward trend in rankings might reflect increased competition or a need for product innovation to capture more market share. Overall, while Certified (Certified Cultivators) has shown strength in certain categories, there are areas where strategic adjustments could enhance their market positioning in Ohio.

Competitive Landscape

In the Ohio vapor pens category, Certified (Certified Cultivators) has demonstrated a significant competitive shift, particularly in the first quarter of 2025. Initially holding a steady second place from December 2024 through February 2025, Certified surged to the top rank by March 2025, overtaking Klutch Cannabis, which had maintained the leading position for the previous three months. This rise in rank for Certified coincides with a notable increase in sales, contrasting with the fluctuating sales of Select, which consistently held the third position. The competitive landscape in Ohio's vapor pen market indicates a dynamic shift, with Certified's upward trajectory suggesting a growing consumer preference and market influence, while Klutch Cannabis experienced a slight decline in rank despite an overall increase in sales by March 2025.

Notable Products

In March 2025, Larry's Breath #7 (2.83g) emerged as the top-performing product for Certified (Certified Cultivators), achieving the number one rank in the Flower category with sales of 11,984 units. The Cream (2.83g) maintained a strong presence, securing the second position after being the top product in February. The CBN/THC 1:2 Acai Sapphires Gummies 10-Pack (110mg THC, 50mg CBN) held steady at the third rank, showing consistency in the Edible category from January through March. Tangerine Citrus Gummies 10-Pack (100mg) remained in fourth place, although its sales slightly declined from previous months. Notably, Miracle Mints (2.83g) debuted at the fifth position, indicating a positive reception in the Flower category.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.