Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

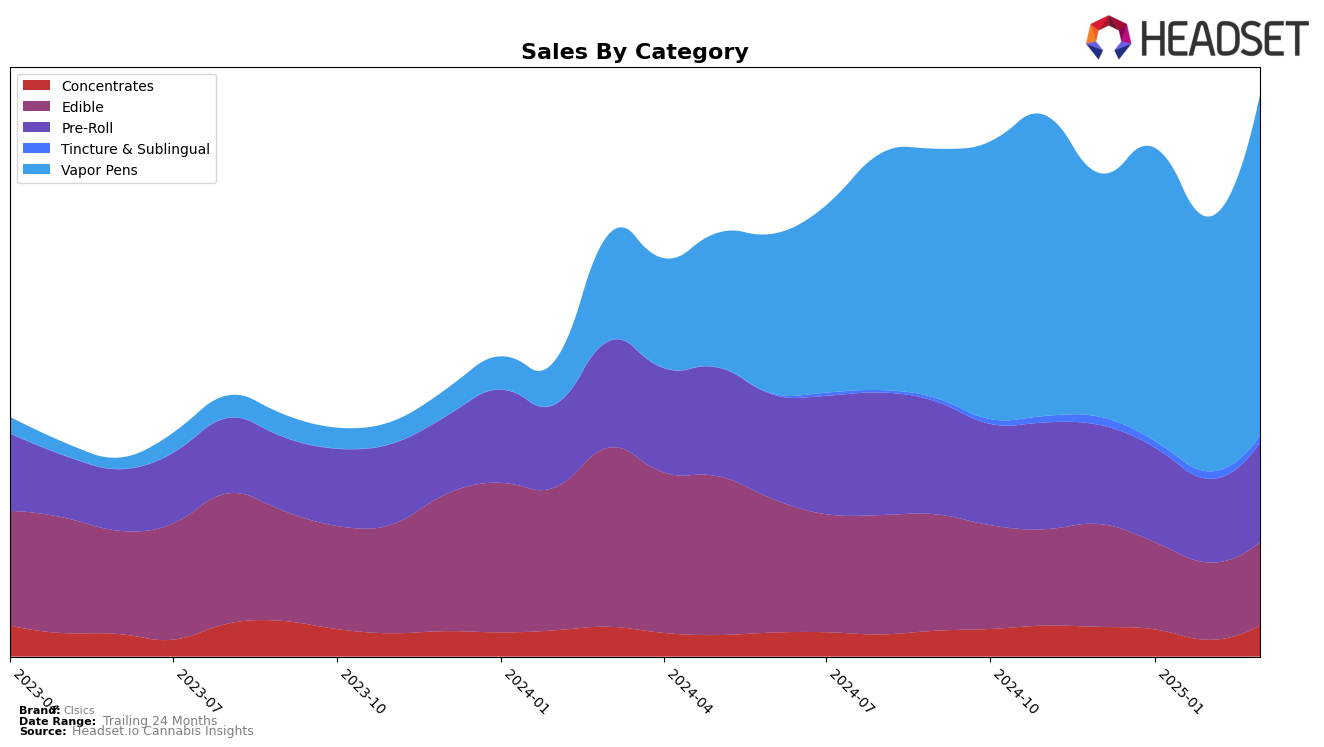

Clsics has shown varied performance across different product categories in California. In the Concentrates category, the brand experienced a fluctuating journey, starting at rank 32 in December 2024, dropping to 45 in February 2025, but then making a notable recovery to rank 26 by March 2025. This indicates a potential resurgence in consumer interest or strategic adjustments by the brand. Meanwhile, in the Edible category, Clsics maintained a relatively stable presence, hovering around the 15th to 17th rank over the months, suggesting consistent performance in this segment. Such stability can be indicative of a loyal customer base or a well-received product line.

In the Pre-Roll category, Clsics held steady with minimal rank fluctuations, maintaining its position between 27 and 29 over the four-month period. This consistency could highlight a solid footing in a competitive market. The Vapor Pens category, however, tells a slightly different story. Clsics improved its rank from 20 in December 2024 to 17 in January 2025, dropped slightly in February, but regained to 17 by March 2025. This upward trend in Vapor Pens, accompanied by a notable increase in sales, might reflect growing consumer preference or successful marketing strategies. The absence of Clsics in the top 30 in some categories in certain months could indicate areas where the brand might need to focus more efforts to enhance its market presence.

Competitive Landscape

In the competitive landscape of vapor pens in California, Clsics has shown notable fluctuations in its market position from December 2024 to March 2025. Initially ranked 20th in December 2024, Clsics improved to 17th by January 2025, indicating a positive reception and increased sales momentum. However, its rank dipped to 19th in February before climbing back to 17th in March, suggesting a volatile but resilient market presence. In comparison, Bloom maintained a consistent 15th rank throughout this period, highlighting its stable market performance. Meanwhile, Gelato experienced a slight decline from 13th to 16th, which may have opened opportunities for Clsics to capture more market share. Papa's Herb also showed a positive trend, moving from 19th to 17th, mirroring Clsics' trajectory. These dynamics underscore the competitive nature of the vapor pen category in California, where Clsics' ability to rebound and improve its rank suggests potential for further growth amidst shifting consumer preferences.

Notable Products

In March 2025, the top-performing product from Clsics was Blue Crack Live Rosin Disposable (1g) in the Vapor Pens category, which climbed to the number one spot with sales of 3,437 units. Rainbow Beltz Live Rosin Disposable (1g) also performed impressively, securing the second position. Blackberry Fire Live Rosin Gummies 10-Pack (100mg) maintained its strong presence in the Edible category, ranking third, consistent with its performance in February. Clockwork Lemon Rosin Gummies 10-Pack (100mg) remained stable in the fourth position, mirroring its February rank. Berry Prism Live Rosin Disposable (1g) entered the rankings at fifth place, marking its debut in the top five for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.