Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

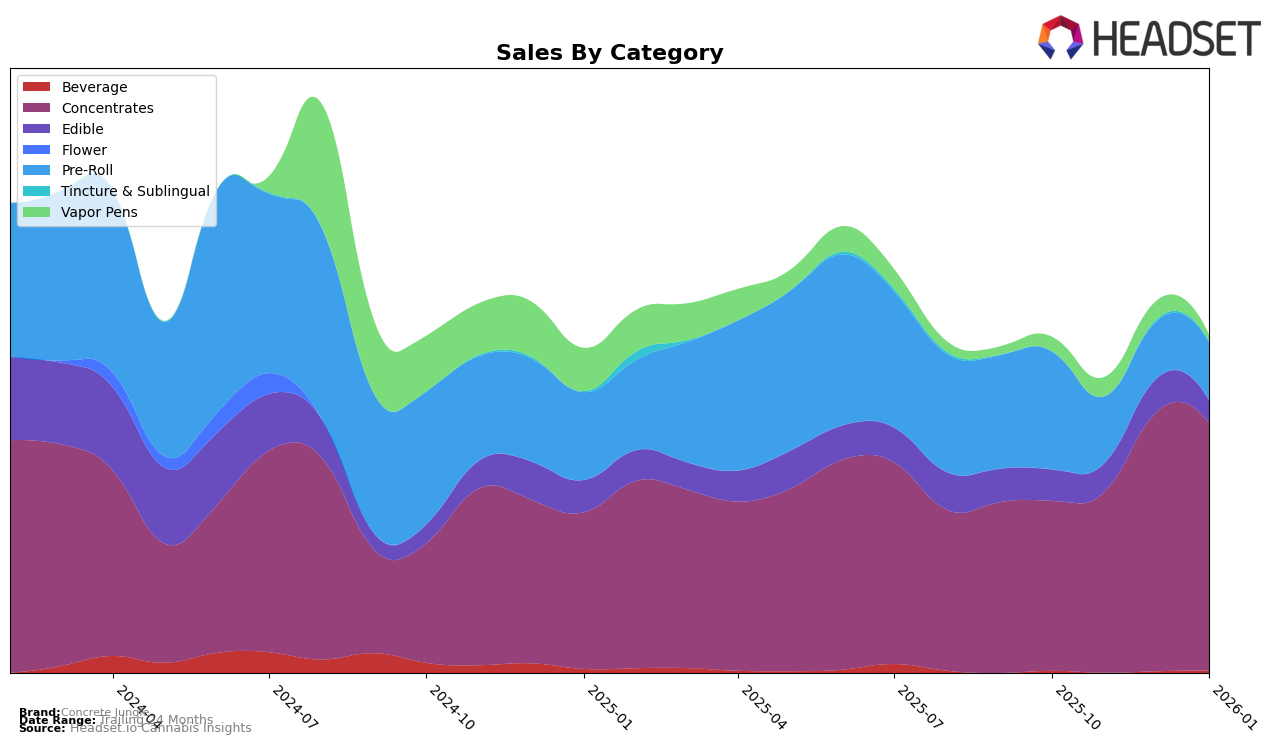

Concrete Jungle has shown varied performance across different categories in Oregon. In the Concentrates category, there has been a notable upward trend, with the brand climbing from 18th place in October 2025 to 12th place by January 2026. This improvement is likely driven by an increase in sales from $98,206 in October to $142,838 in January. However, the Edible category tells a different story, where Concrete Jungle has slipped from the 30th rank in October to falling out of the top 30 by January, indicating a potential area of concern or a shift in consumer preferences.

In the Pre-Roll category, Concrete Jungle's performance has been relatively stable, though not within the top 30 ranks, as it fluctuated between 42nd and 56th place from October 2025 to January 2026. This consistency suggests a steady, albeit modest, presence in the market. Conversely, the Vapor Pens category highlights a more challenging scenario, as the brand did not make it into the top 30 rankings at any point during the observed months. This absence from the top ranks might suggest either a highly competitive space or a need for strategic changes in this product line. Overall, Concrete Jungle's performance in Oregon showcases strengths in Concentrates but also underscores potential areas for growth and improvement in other categories.

Competitive Landscape

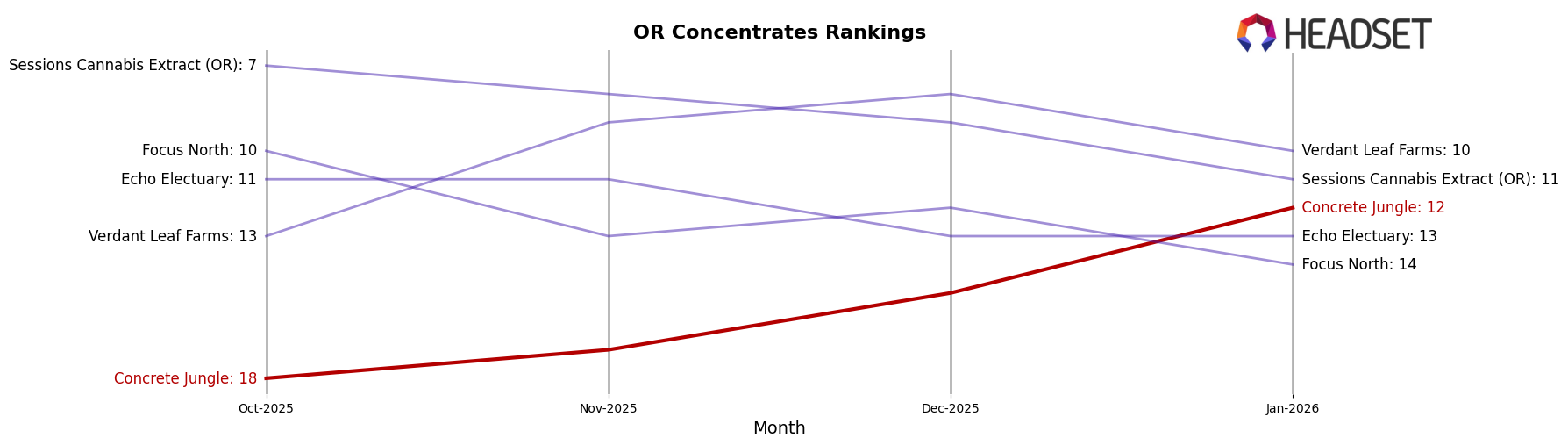

In the Oregon concentrates market, Concrete Jungle has shown a notable upward trajectory in its rankings, moving from 18th place in October 2025 to 12th by January 2026. This improvement in rank is indicative of a positive trend in sales performance, as evidenced by a significant increase in sales from November to December 2025. Despite this progress, Concrete Jungle still trails behind competitors like Echo Electuary and Focus North, which consistently maintained higher ranks, although Focus North experienced a slight decline in January 2026. Meanwhile, Verdant Leaf Farms and Sessions Cannabis Extract (OR) have also shown strong performances, with Verdant Leaf Farms securing a top 10 position in December 2025. Concrete Jungle's ability to climb the ranks amidst such competitive brands suggests a growing consumer interest and potential for further market penetration.

Notable Products

In January 2026, Concrete Jungle's top-performing product was Snow Dog Cured Resin (1g) in the Concentrates category, securing the first rank with sales of 940 units. Following closely was Lemon Cherry Gelato Cured Resin (1g) also in Concentrates, which held the second position. The CBN/THC 1:1 Berry Live Resin Gummy (100mg CBN, 100mg THC), an Edible, maintained its third-place ranking from December 2025, despite a drop in sales from 969 to 700 units. Pink Runtz Cured Resin (1g) and Mule Fuel Live Resin (1g) rounded out the top five, both debuting in January 2026 at fourth and fifth positions, respectively. Notably, the Edible category's performance dipped compared to Concentrates, which dominated the top slots this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.