Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

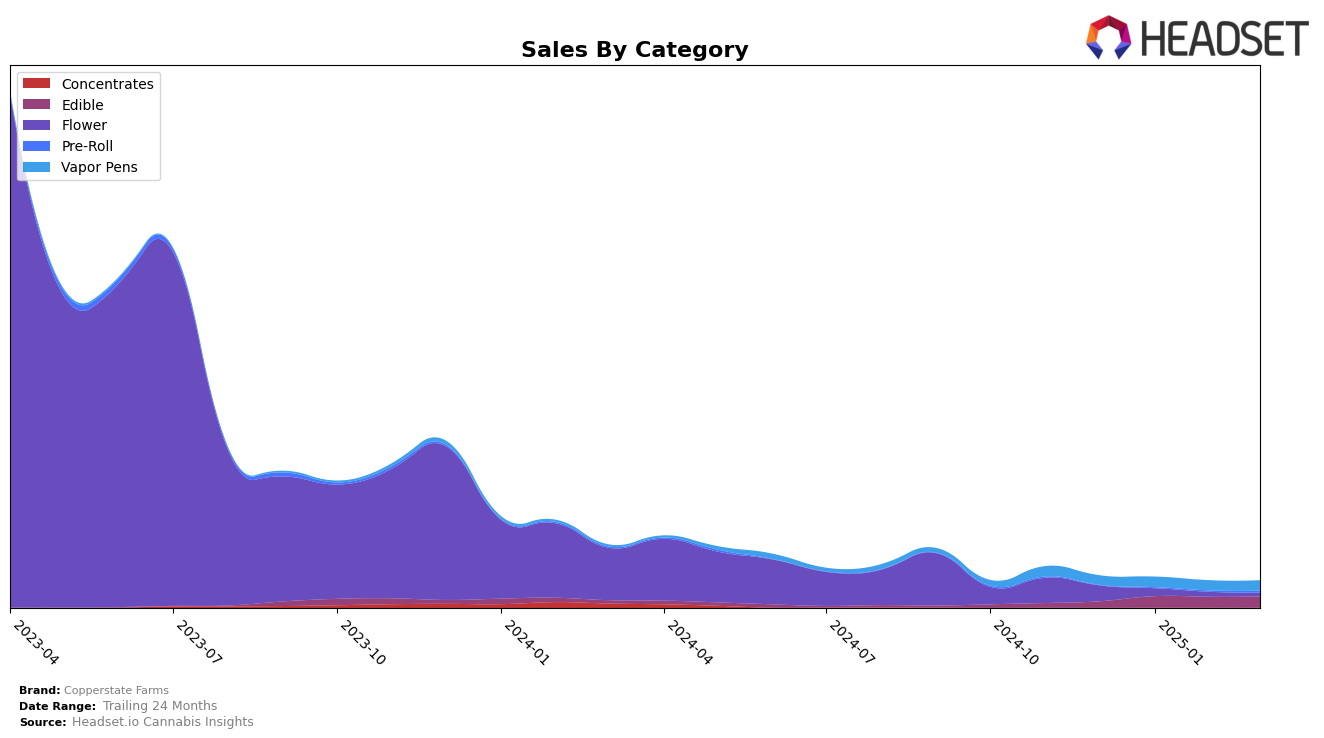

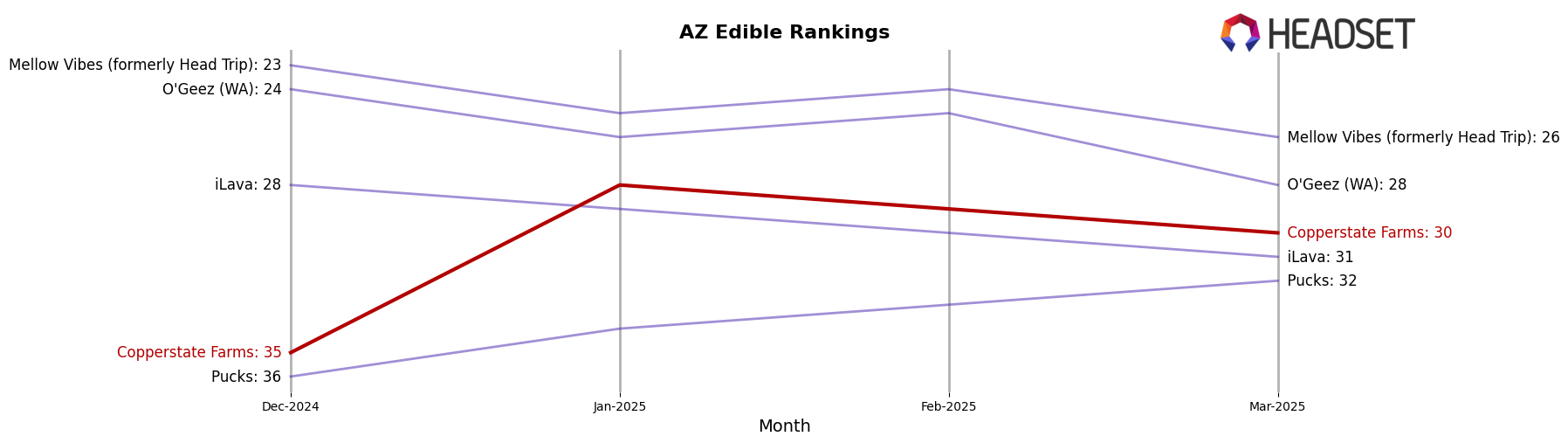

Copperstate Farms has shown a varied performance across different product categories and states, particularly in Arizona. In the Edible category, the brand has demonstrated a consistent presence in the top 30 rankings, moving from the 35th position in December 2024 to 30th by March 2025. This upward trajectory suggests a strengthening foothold in the Edible market, supported by a noticeable increase in sales from December to January. However, in the Flower category, Copperstate Farms did not rank within the top 30, with its position declining from 48th to 64th, indicating potential challenges in maintaining competitive sales volumes.

For Vapor Pens, Copperstate Farms maintained a relatively stable ranking, hovering around the 49th to 53rd positions over the months. While this consistency might seem positive, it also highlights the brand's struggle to break into the top 30, which could be a strategic area for improvement. The sales figures remained fairly steady, suggesting a loyal customer base, but without significant growth in market share. Overall, Copperstate Farms' performance across these categories in Arizona reflects both opportunities for growth in some areas and challenges in others, particularly in the competitive Flower market.

Competitive Landscape

In the Arizona edible cannabis market, Copperstate Farms has demonstrated a notable upward trajectory in brand ranking from December 2024 to March 2025, moving from 35th to 30th place. This improvement in rank is indicative of a strategic push in sales, as evidenced by the significant jump in sales figures from December to January. In contrast, competitors such as iLava have seen a steady decline in rank, slipping from 28th to 31st, while Mellow Vibes (formerly Head Trip) and O'Geez (WA) have fluctuated within the mid-20s range, indicating a less stable market position. Meanwhile, Pucks has shown a gradual improvement, yet still trails behind Copperstate Farms. The consistent sales growth and upward rank movement of Copperstate Farms suggest a strengthening brand presence in the competitive Arizona edible market, positioning it as a rising contender against established brands.

```

Notable Products

In March 2025, the top-performing product from Copperstate Farms was the CBN:THC:CBD 4:1:1 Dark Cherry Live Rosin Gummies, maintaining its first-place rank from previous months with a sales figure of 1246. Blue Raspberry Live Rosin Gummies surged in popularity, climbing from fifth place in February to second place in March. Pink Lemonade Live Rosin Gummies experienced a slight drop, moving from second place to third. The CBD/THC/CBC 3:1:1 Acai Berry Live Rosin Gummies fell from third to fourth place. Watermelon Live Rosin Gummies, which had previously ranked second in January, settled at fifth place in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.