Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

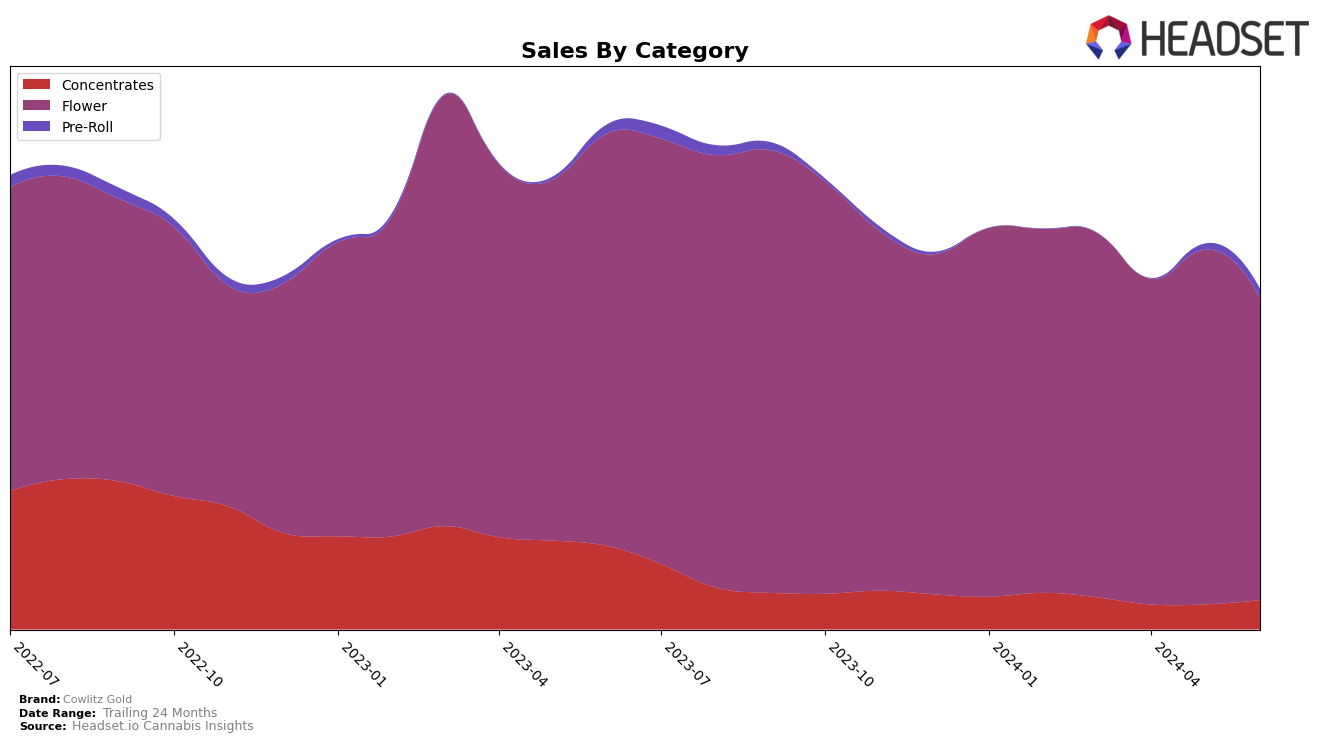

Cowlitz Gold's performance in the Washington cannabis market has shown notable trends across different categories. In the Concentrates category, the brand saw a significant improvement in its ranking from March to June 2024, moving from 60th to 47th place. This upward trajectory, coupled with a steady increase in sales from $28,665 in April to $32,272 in June, indicates a growing consumer preference for their concentrates. However, it is important to note that Cowlitz Gold was not in the top 30 brands for this category during this period, which suggests there is still considerable room for growth and market penetration.

In the Flower category, Cowlitz Gold experienced a more fluctuating performance. The brand's ranking dropped from 21st in March to 29th in June 2024, reflecting a downward trend. This decline in rank is accompanied by a decrease in sales, with a notable dip from $299,338 in May to $256,405 in June. The brand's consistent presence in the top 30, however, underscores its established market position in the Flower category within Washington. Despite the recent decline, Cowlitz Gold's ability to maintain a top 30 ranking suggests resilience and potential for recovery with strategic adjustments.

Competitive Landscape

In the competitive landscape of the Washington flower market, Cowlitz Gold has experienced notable fluctuations in its rank and sales over recent months. Despite a strong start in March 2024 with a rank of 21, Cowlitz Gold saw a decline to 29 by June 2024. This downward trend in rank is mirrored by a decrease in sales from $307,756 in March to $256,405 in June. Competitors such as Binx Buds and Gabriel have shown more stable or improving performance, with Binx Buds reaching a peak rank of 20 in May and Gabriel maintaining a consistent rank around the low 20s. Meanwhile, Dama and Bondi Farms have also demonstrated competitive sales figures, though their ranks have been more volatile. These shifts indicate a highly competitive market where maintaining or improving rank requires strategic adjustments. For Cowlitz Gold, understanding these trends and the strategies of top-performing brands could be crucial for regaining and sustaining a higher market position.

Notable Products

In June 2024, Granddaddy Purple Pre-Roll (1g) maintained its top position as the best-selling product from Cowlitz Gold, with a notable sales figure of 1314 units. Pineapple Express Pre-Roll (1g) climbed to the second rank, showing a steady increase from its fifth position in May. Fruit Rollupz Wax (1g) secured the third spot, improving its rank from fourth in May. Green Crack Pre-Roll (1g) dropped one position to fourth, while Alaskan Thunder Fuck Pre-Roll (1g) fell to fifth from its previous second position. These shifts indicate a dynamic change in consumer preferences within the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.