Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

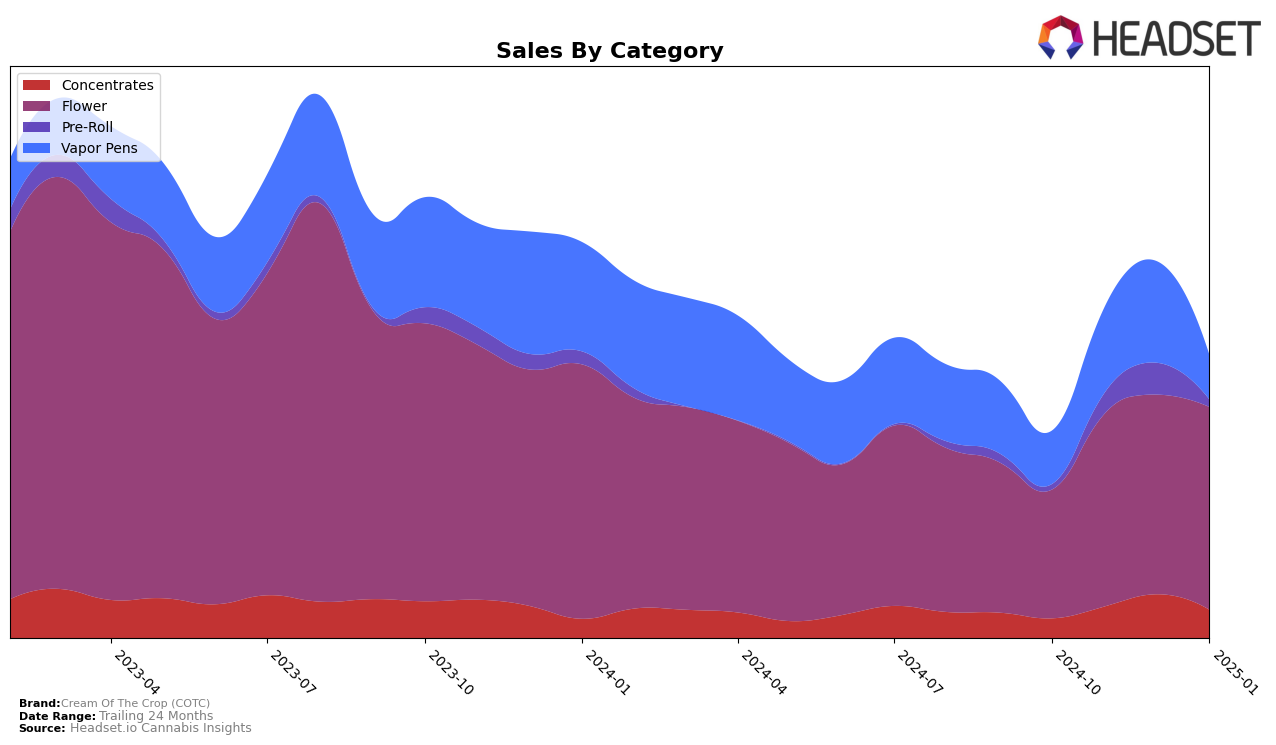

Cream Of The Crop (COTC) has shown a dynamic performance across different product categories in California. In the Concentrates category, COTC made significant strides, improving its rank from 26th in October 2024 to 12th by December 2024, before settling at 19th in January 2025. This upward movement suggests a growing consumer preference for their concentrates, although the dip in January indicates a possible seasonal fluctuation or increased competition. Meanwhile, in the Flower category, COTC consistently improved its position, moving from outside the top 30 in October to 24th by January 2025. This steady climb reflects a robust demand for their flower products, even though they started from a less competitive position.

In the Pre-Roll category, COTC's journey was more volatile, as they were not ranked in the top 30 in October 2024 but managed to secure the 56th position by December, only to drop again to 93rd in January 2025. This inconsistency might indicate challenges in this category or a response to shifting consumer trends. For Vapor Pens, COTC demonstrated a promising upward trend through December, achieving a rank of 34th, before experiencing a decline to 56th in January 2025. The sales trajectory in this category suggests that while there was initial momentum, maintaining a competitive edge remains challenging. Overall, COTC's performance across these categories highlights both opportunities and areas for potential growth, particularly in maintaining consistency and addressing fluctuations in consumer preferences.

Competitive Landscape

In the competitive landscape of the California flower category, Cream Of The Crop (COTC) has shown a notable upward trajectory in brand ranking from October 2024 to January 2025. Starting at rank 40 in October, COTC climbed to rank 24 by January, indicating a consistent improvement in market positioning. This upward trend is particularly significant when compared to competitors like Jungle Boys, which fell from rank 15 to 26 over the same period, and Originals, which fluctuated but ultimately improved from rank 26 to 25. Meanwhile, Decibel Gardens also experienced a positive shift, moving from rank 31 to 23, slightly ahead of COTC by January. Despite these competitive dynamics, COTC's sales growth trajectory suggests a strengthening brand presence, as evidenced by its steady climb in rankings, contrasting with the more volatile performance of some peers. This indicates a robust market strategy that could potentially elevate COTC further in the rankings if the trend continues.

Notable Products

In January 2025, the top-performing product for Cream Of The Crop (COTC) was Galactic Warheads (3.5g) in the Flower category, maintaining its number one ranking from December 2024 with sales of 4045 units. Blue Mintz (3.5g) emerged as the second-highest seller, making a significant debut in the rankings. Super Silver Haze (3.5g) held steady at third place, consistent with its position in December 2024. Key Lime Jack (3.5g) ranked fourth, while Sunday Funday (3.5g) rounded out the top five. Notably, Galactic Warheads (3.5g) showed a remarkable ascent from the third position in November 2024 to the top spot in December 2024 and maintained it into January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.