Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

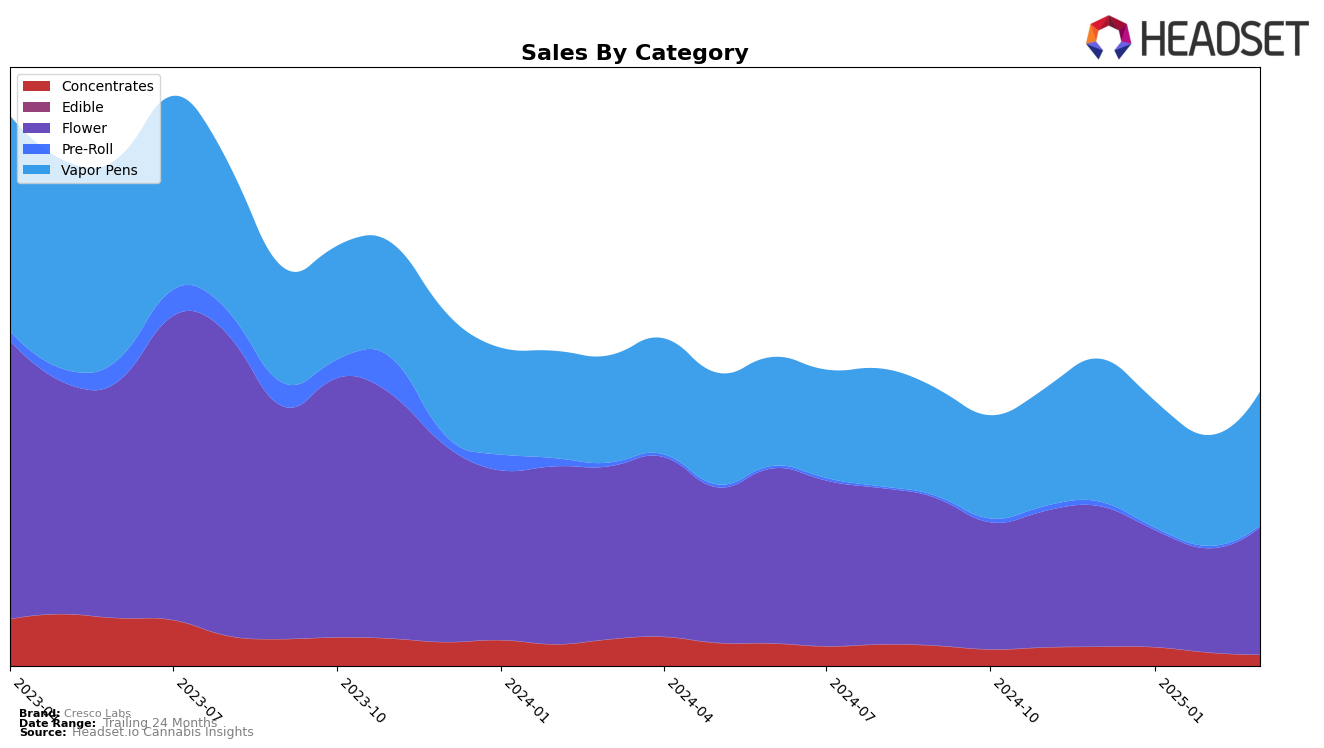

Cresco Labs has shown varied performance across different states and product categories, with notable movements in rankings. In Illinois, Cresco Labs maintained a stable presence in the Vapor Pens category, consistently ranking within the top 10. However, in the Concentrates category, Cresco Labs experienced a decline, dropping out of the top 30 by March 2025, indicating a potential area for improvement. Meanwhile, the Flower category in Illinois exhibited some fluctuations, with Cresco Labs improving its rank from 17th in January 2025 to 13th by March 2025, suggesting a positive trend in consumer preference for their flower products.

In Massachusetts, Cresco Labs demonstrated a strong upward trajectory in the Flower category, moving from 36th in December 2024 to 13th by March 2025. This significant climb highlights a growing market share and increasing popularity in the state. The Vapor Pens category also saw a slight improvement, moving from 29th to 23rd over the same period. Contrastingly, in Michigan, Cresco Labs faced challenges, particularly in the Flower category, where they fell out of the top 30 by March 2025. However, they showed a positive trend in Vapor Pens, improving from 44th in December 2024 to 34th by March 2025, suggesting a potential area of focus for growth in the state.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Cresco Labs has maintained a relatively stable position, ranking 7th in December 2024, January 2025, and March 2025, with a slight dip to 8th in February 2025. This consistency is noteworthy given the competitive pressures from brands like Rove, which improved its rank from 9th to 6th between January and February 2025, and Rythm, which fluctuated between 6th and 8th place during the same period. Despite these fluctuations, Cresco Labs' sales have shown resilience, particularly in March 2025, where they saw an uptick, contrasting with AiroPro's decline in the same month. The consistent top 5 presence of The Essence underscores the competitive environment, as they maintained the 5th position throughout, indicating a strong consumer preference that Cresco Labs must strategize against to enhance its market share.

Notable Products

In March 2025, Pineapple Express (3.5g) reclaimed its position as the top-performing product for Cresco Labs, achieving the number one rank with sales of $7,555. Pineapple Under The Sea (3.5g) emerged as a notable contender, debuting directly at the second position. Rollins (3.5g), which led in February, dropped to third place, indicating a slight decline in momentum. Bio Jesus (3.5g) maintained a steady presence, ranking fourth, while Kush Cream (3.5g) rounded out the top five. Compared to previous months, Pineapple Express (3.5g) showed a significant sales surge, while Rollins (3.5g) experienced a drop from its previous peak.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.