Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

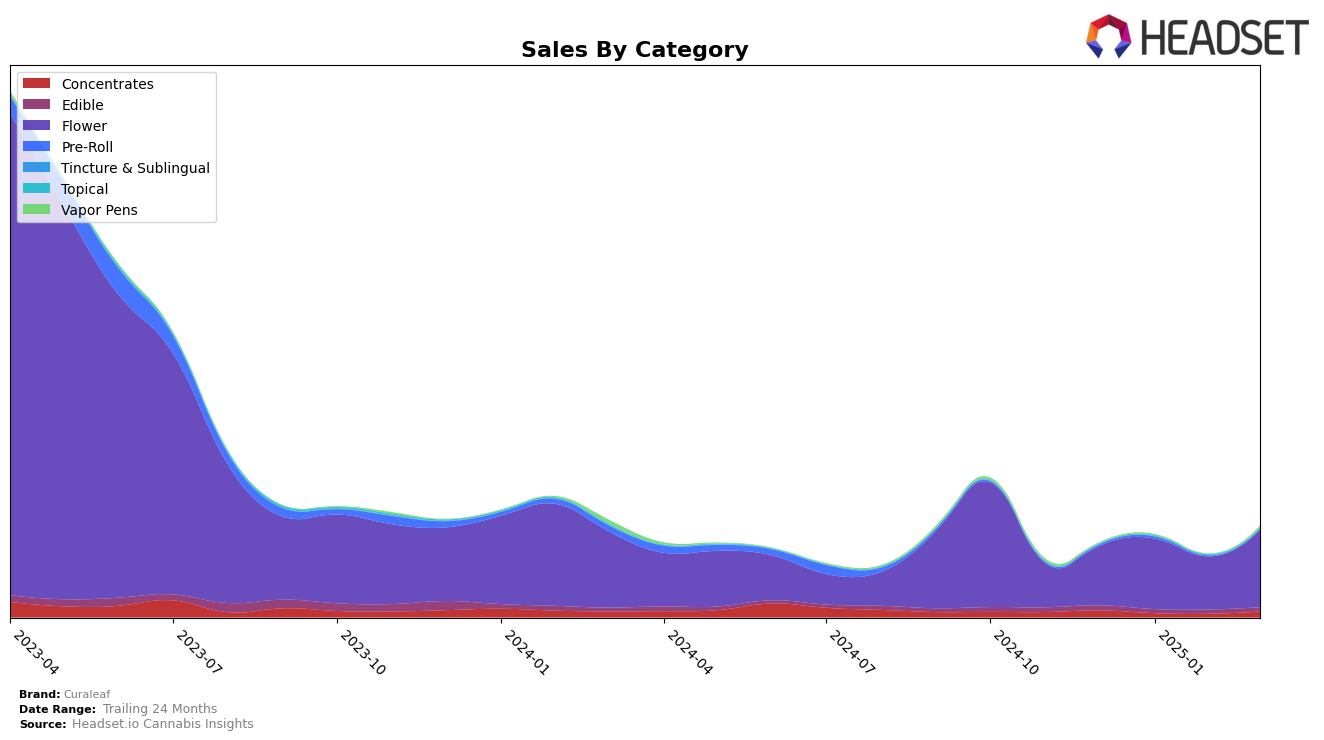

Curaleaf's performance in the Arizona market shows notable variability across different product categories. In the concentrates category, Curaleaf experienced a decline in rankings from December 2024 to February 2025, dropping to 28th place, but rebounded to 19th place by March 2025. This suggests a potential recovery or strategic adjustment in their product offerings or marketing efforts. Meanwhile, their flower category performance in Arizona is particularly strong, maintaining a top 20 position throughout the period and achieving a significant sales increase from December to March. However, Curaleaf's presence in the edible category in Arizona remained consistently outside the top 30, indicating a potential area for growth or reevaluation.

In Nevada, Curaleaf's performance in the flower category did not rank in the top 30 as of February 2025, pointing to challenges in this competitive market. However, their entry into the pre-roll category in January 2025 at 42nd place suggests a strategic expansion into different product lines. The situation in Ohio presents a mixed picture: while their flower ranking fluctuated, ending March 2025 at 25th place, the edible category remained consistently out of the top 30, indicating room for improvement. Meanwhile, in Massachusetts, Curaleaf's vapor pen sales appeared in March 2025, marking their entry into this category, though it was not enough to secure a top 30 ranking, hinting at initial efforts to penetrate this market segment.

Competitive Landscape

In the competitive landscape of the Arizona flower category, Curaleaf has demonstrated notable progress in its market positioning over the early months of 2025. Starting from a rank of 20 in December 2024, Curaleaf made a significant leap to 9th place in January 2025, showcasing a robust increase in market presence. Although it experienced a slight dip to 12th place in February, it regained momentum to secure the 10th position by March 2025. This upward trend in rank is mirrored by a consistent increase in sales, indicating a strengthening brand presence. In comparison, Alien Labs maintained a steady rank around the 8th position, while DTF - Downtown Flower fluctuated slightly but remained within the top 15. Meanwhile, Savvy showed a remarkable rise from 18th to 9th place by March, suggesting a competitive push in the market. Grassroots, though starting outside the top 20, climbed to 11th place by March, indicating a potential emerging competitor. Curaleaf's ability to climb the ranks amidst such dynamic competition highlights its strategic efforts to capture a larger share of the Arizona flower market.

Notable Products

In March 2025, Glueball (14g) emerged as the top-performing product for Curaleaf, achieving the number one rank with sales of 3357 units. Hippie Crasher (14g) maintained its strong position, ranking second, a notable rise from its absence in February's top ranks. Motor Breath (14g) climbed to the third position, improving from fourth place in February. Garlic Cookies Smalls (14.15g) secured the fourth rank, demonstrating a strong entry in the rankings. Retro Rootz (14g) rounded out the top five, marking its first appearance in the rankings for March.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.