Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

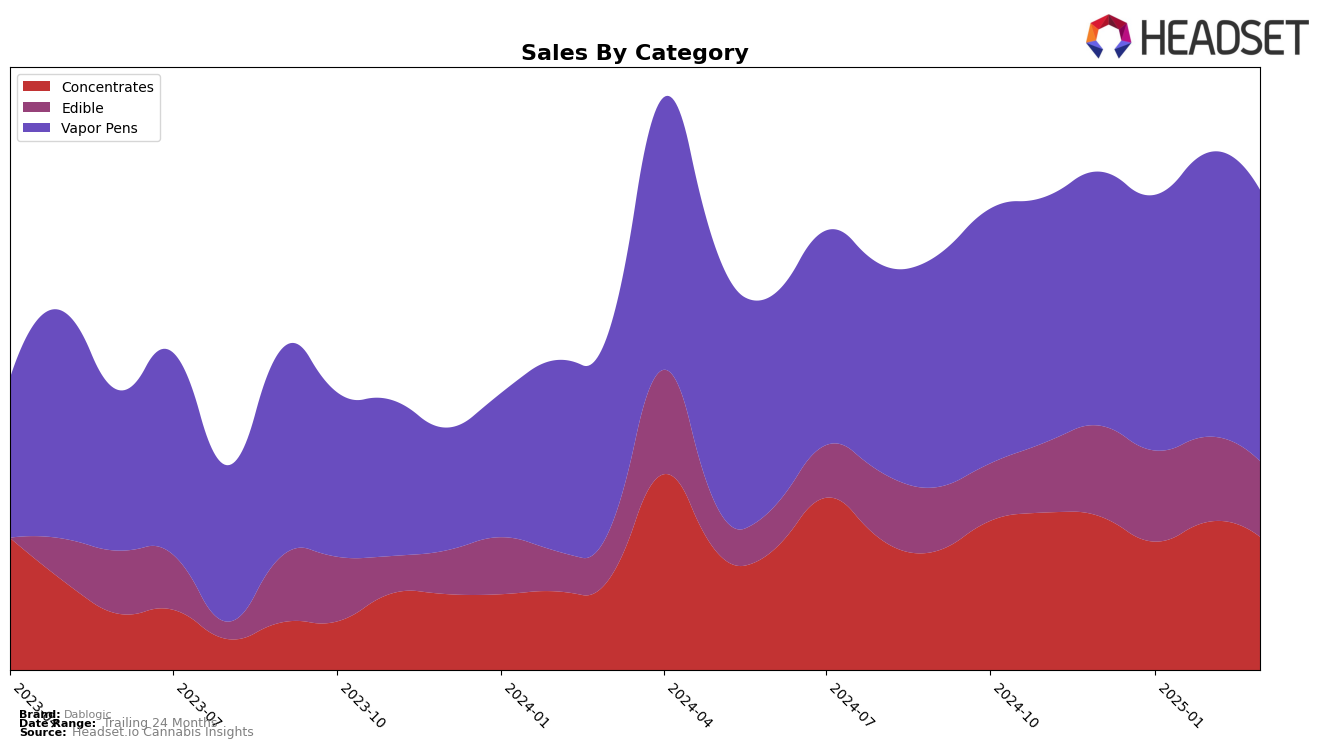

Dablogic has demonstrated a notable performance in the Colorado market, particularly within the Concentrates category. Over the first quarter of 2025, Dablogic improved its ranking from 15th in January to 11th by February, maintaining this position through March. This upward trend highlights the brand's growing presence and competitiveness in the Concentrates segment. In contrast, the Edible category saw Dablogic's ranking fluctuate slightly, with a peak at 15th in February before dropping to 17th in March. This movement suggests a more volatile performance in Edibles, which could indicate either increased competition or changing consumer preferences.

In the Vapor Pens category, Dablogic has shown a consistent presence, hovering around the mid-20s in rank. From December 2024 to March 2025, the brand improved its position from 25th to 23rd, suggesting a steady, albeit modest, growth trajectory. It's worth noting that Dablogic's absence from the top 30 brands in other states or provinces might indicate a more localized focus or varying levels of competition in those markets. Such insights could be crucial for stakeholders looking to understand the brand's strategic positioning and potential areas for expansion or increased marketing efforts.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Dablogic has shown a steady presence, maintaining a rank within the top 25 from December 2024 to March 2025. While Dablogic's rank has slightly fluctuated between 22nd and 25th, it has consistently outperformed brands like Binske and Sauce Essentials in terms of sales growth. Notably, Tastebudz has seen a decline in rank, falling out of the top 20 by February 2025, which could indicate a potential opportunity for Dablogic to capture more market share. Meanwhile, Mile High Xtractions (MHX) has experienced a volatile rank, suggesting a less stable market position compared to Dablogic. As Dablogic continues to maintain its rank, the brand's ability to capitalize on the declining performance of competitors could be crucial for its growth in the Colorado vapor pen market.

Notable Products

In March 2025, Dablogic's top-performing product was Blood Orange Rosin Fruit Chew 10-Pack (100mg) in the Edible category, which climbed from third place in February to first place, with notable sales of 1924 units. Lemon Meringue Pie Live Rosin Gummies 10-Pack (100mg) secured the second position, a significant jump from its absence in the rankings in February. Sour Cherry Live Rosin Fruit Chew 10-Pack (100mg) dropped from first in January to third place in March. Strawberry Lemon Drop Mixed Micron Live Rosin Cartridge (0.5g) entered the rankings at fourth position, marking its debut. Meanwhile, Strawberry Lemonade Live Rosin Fruit Chew 10-Pack (100mg) appeared for the first time in the rankings at fifth place, rounding out the top five for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.