Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

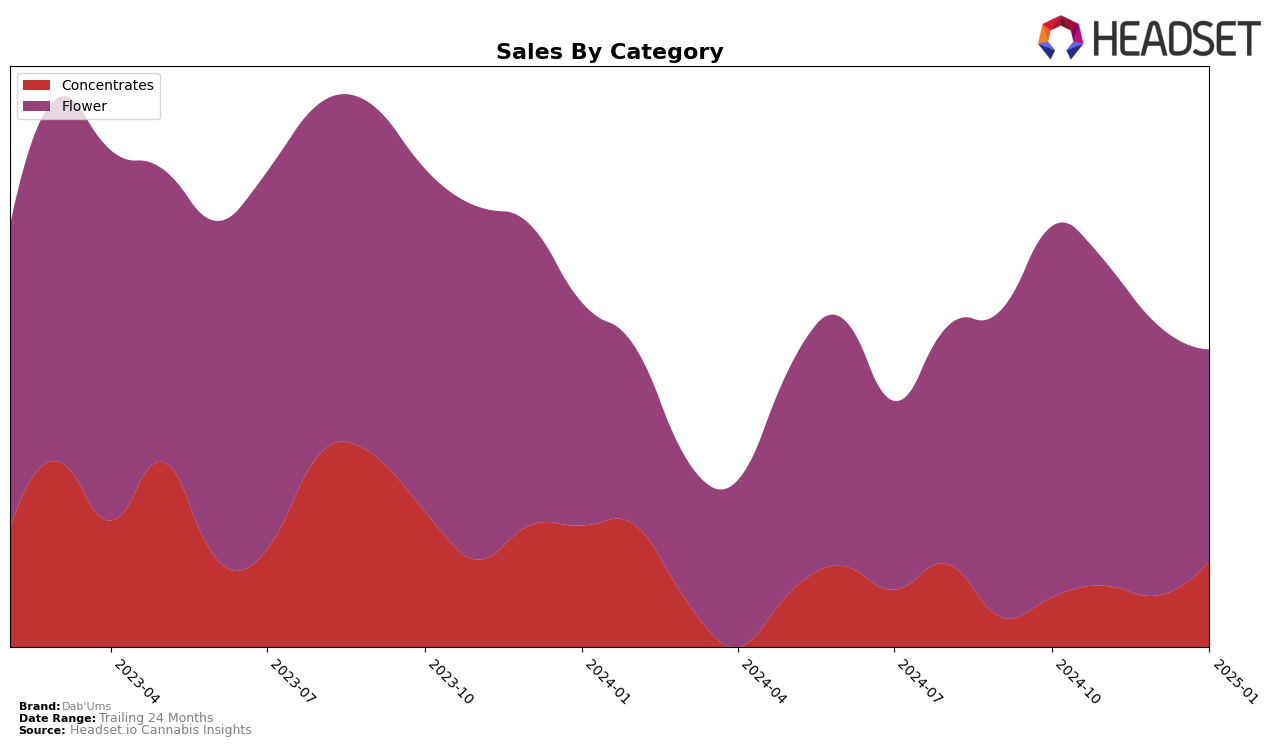

In the state of Washington, Dab'Ums has shown notable movement in the Concentrates category. While they started outside the top 30 in October 2024 at rank 39, they made a steady climb to reach the 25th position by January 2025. This upward trajectory suggests a growing popularity and acceptance of their products within this segment. The increase in sales from $48,868 in October to $57,129 in January aligns with their improved ranking, indicating a positive reception of their offerings. However, the absence of a top 30 ranking in October highlights the competitive nature of the market and the significant strides Dab'Ums has made to improve their standing.

Conversely, Dab'Ums' performance in the Flower category in Washington tells a different story. The brand's ranking has seen a downward trend, starting at 77th in October 2024 and dropping to 89th by January 2025. This decline is mirrored in their sales figures, which decreased from $121,086 in October to $85,168 in January, suggesting challenges in maintaining consumer interest or facing increased competition. The lack of a top 30 position throughout the observed months highlights the hurdles Dab'Ums faces in this category, contrasting with their success in Concentrates. This divergence in performance across categories emphasizes the varying dynamics and consumer preferences within the cannabis market.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Dab'Ums has seen a fluctuating performance in terms of rank and sales over the past few months. Starting from October 2024, Dab'Ums was ranked 77th, but despite a slight improvement to 75th in November, it experienced a downward trend, falling to 81st in December and further to 89th by January 2025. This decline in rank is mirrored by a consistent drop in sales figures over the same period. In contrast, Supernova (WA) showed a more stable performance, maintaining a rank within the 80s, although it also faced a sales dip in January. Meanwhile, Incredibulk and O'Geez have been trailing behind Dab'Ums in terms of sales, yet they have shown resilience in maintaining or slightly improving their ranks. This competitive dynamic suggests that while Dab'Ums started with a stronger position, its recent decline indicates a need for strategic adjustments to regain its footing against these competitors.

Notable Products

In January 2025, the top-performing product from Dab'Ums was Peyote Cookies Wax (1g) in the Concentrates category, maintaining its number one rank from the previous two months with a notable sales figure of 1286 units. Peach Gelato BHO Wax (1g) improved to the second position from third in December 2024, showing a positive trend. Death Star Wax (1g) experienced a slight decline, dropping to third place from second in December 2024. Granddaddy Purple RSO (1g) remained steady at fourth position, continuing its upward sales trajectory since November 2024. Bubba Cheesecake Wax (1g) entered the rankings for the first time in January 2025, securing the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.