Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

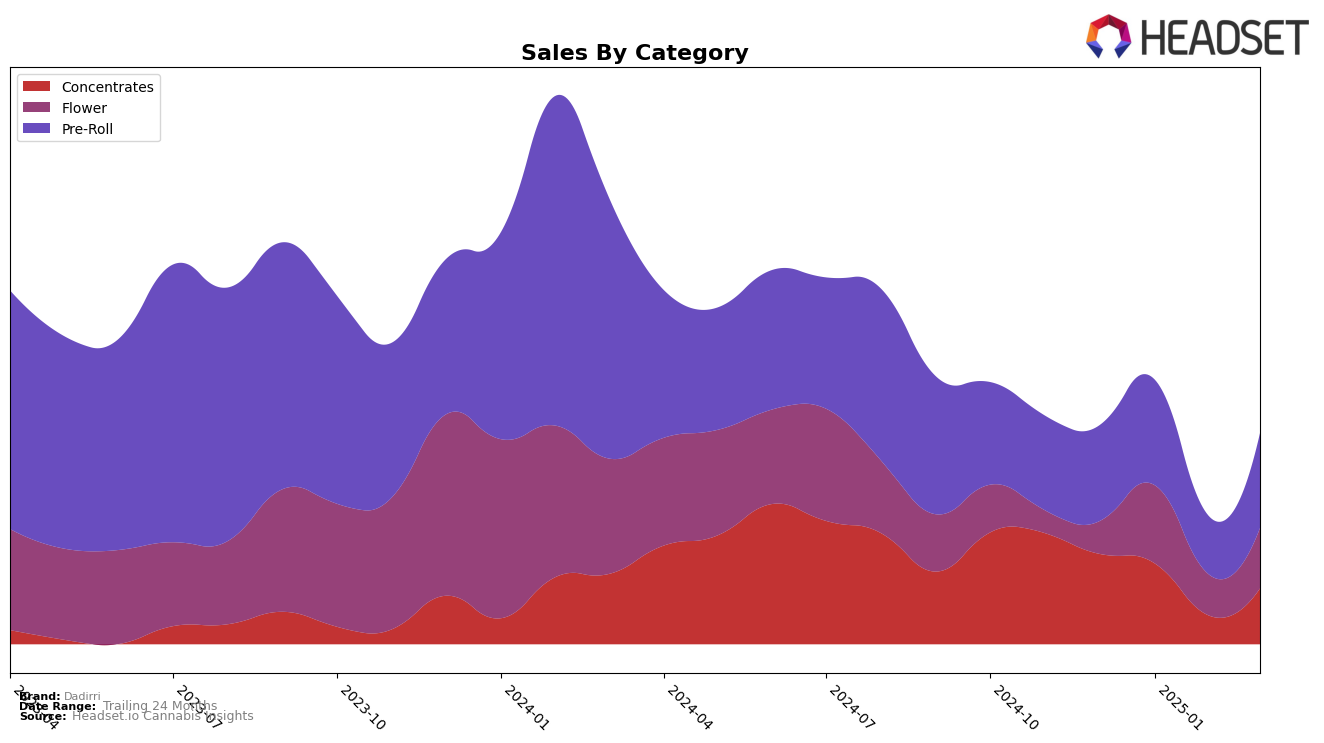

In Colorado, Dadirri's performance across various cannabis categories shows a mixed trend. In the Concentrates category, Dadirri struggled to maintain a position within the top 30, with rankings slipping from 38th in December 2024 to 42nd by March 2025, indicating challenges in gaining a competitive edge. Meanwhile, the Flower category saw an improvement from 96th place in December 2024 to 75th in January 2025, but the brand failed to sustain this momentum and dropped out of the top 30 by March. Pre-Rolls, however, presented a more stable performance, with Dadirri consistently hovering around the 40s, suggesting a more reliable foothold in this segment. This indicates that while some categories show potential, others require strategic adjustments to enhance market presence.

In Nevada, Dadirri's standing in the Concentrates category fluctuated, maintaining a top 30 position initially but dropping out in February 2025, before reappearing at 26th in March. This suggests a volatile market presence that could benefit from targeted marketing efforts. The Flower category in Nevada was particularly notable, as Dadirri managed to climb to 68th place by March 2025 after not ranking in December, indicating a positive upward trend. However, the Pre-Roll category showed a slight decline, with rankings dropping from 45th in December 2024 to 52nd in March 2025. This mixed performance across categories and months highlights areas of opportunity for growth, especially in maintaining consistency and capitalizing on emerging strengths in the Flower category.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Colorado, Dadirri has experienced fluctuating rankings over the months from December 2024 to March 2025, indicating a dynamic market presence. While Dadirri's rank improved from 48th in December 2024 to 39th in January 2025, it slipped back to 49th in February before recovering to 41st in March. This volatility suggests a competitive market where brands like Vera and Next1 Labs LLC maintain more stable positions, with Vera consistently ranking between 33rd and 38th, and Next1 Labs LLC showing a downward trend from 27th to 45th. Despite these fluctuations, Dadirri's sales saw a notable rebound in March 2025, surpassing its February figures, which could indicate effective marketing strategies or product improvements. Meanwhile, The Clear and The Organic Alternative did not make it into the top 20 during this period, underscoring the competitive pressure in this segment. For Dadirri, maintaining momentum and capitalizing on its recent sales growth will be crucial to climbing the ranks further in this competitive environment.

Notable Products

In March 2025, Dadirri's top-performing product was Tokyo Drift Infused Flower (1g) in the Flower category, securing the number one rank with sales of 511 units. The Caviar Bitty - Dos Si Dos Caviar Infused Pre-Roll (0.5g) followed closely in second place, while the Caviar Bitty - Sativa Caviar Infused Pre-Roll (0.5g) climbed to third from fifth place in February 2025. Jokerz Candy Infused Flower (1g) held the fourth position, and the Caviar Bitty - Taffie Caviar Infused Pre-Roll (0.5g) rounded out the top five. Notably, the Caviar Bitty - Sativa Caviar Infused Pre-Roll demonstrated significant growth, moving up two ranks since February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.