Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

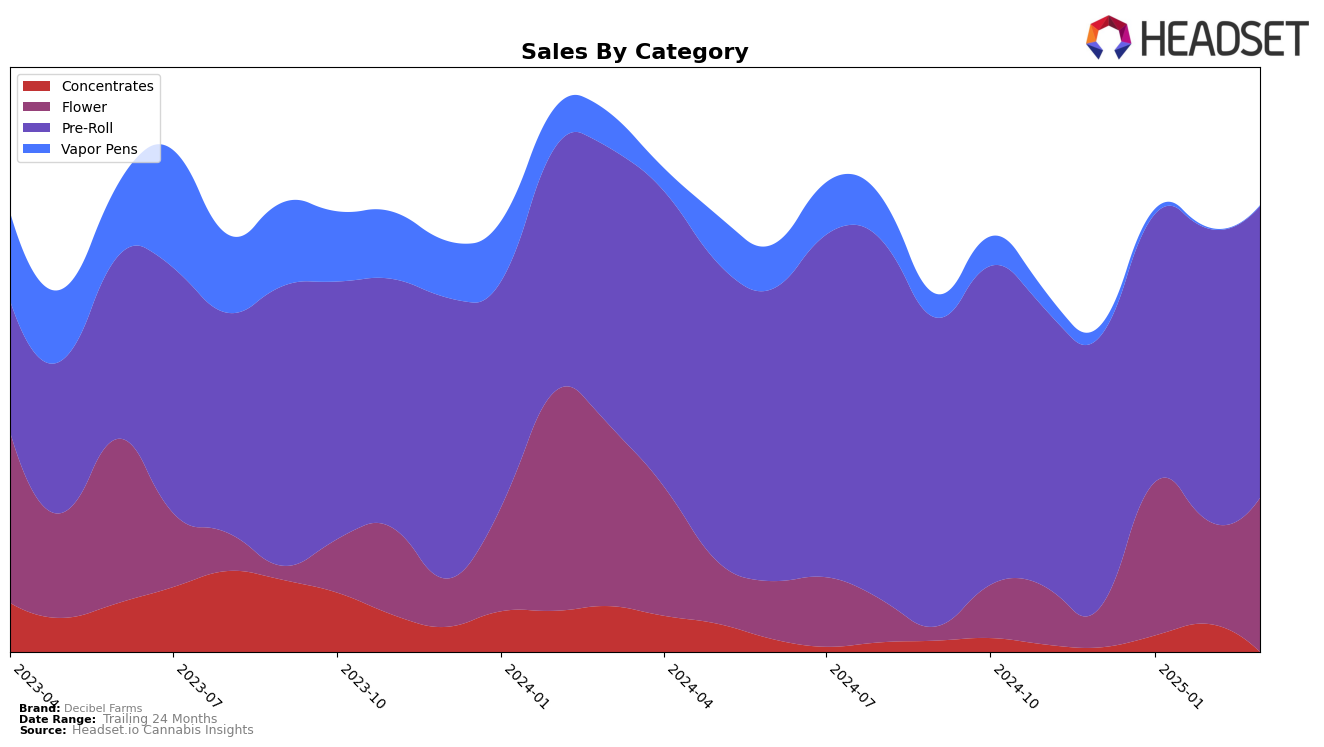

Decibel Farms has shown varied performance across different product categories in Oregon. In the Concentrates category, the brand did not rank in the top 30 as of December 2024 but saw some improvement by January 2025, ranking 49th and moving up to 42nd by February 2025. This upward trajectory suggests a potential for growth, although the brand has yet to break into the top 30. In contrast, the Flower category saw a dip in performance, with Decibel Farms ranking 39th in January 2025, dropping to 63rd in February, but then recovering to 44th by March. This fluctuation indicates some instability in their market position for Flower products.

The Pre-Roll category has been a strong performer for Decibel Farms, consistently ranking within the top 15 in Oregon. Starting at 14th in December 2024, the brand improved to 12th in January 2025 and further climbed to 9th in February, before slightly dropping to 11th in March. This consistent high ranking in Pre-Rolls highlights a strong market presence and consumer preference for their products in this category. However, the Vapor Pens category presents a stark contrast, as Decibel Farms was ranked 86th in December 2024 and did not appear in the top 30 in subsequent months, indicating a significant challenge in capturing market share in this segment.

Competitive Landscape

In the competitive landscape of Oregon's Pre-Roll category, Decibel Farms has shown a fluctuating performance in recent months. As of December 2024, Decibel Farms was ranked 14th, improving to 12th in January 2025, peaking at 9th in February, and then slightly declining to 11th in March. This indicates a positive trend in early 2025, with a notable improvement in rank compared to December. In contrast, PRUF Cultivar / PRŪF Cultivar consistently outperformed Decibel Farms, maintaining a top 10 position throughout the period, despite a slight drop from 4th in January to 10th in March. Meanwhile, Dog House and Cabana also demonstrated competitive stability, with Cabana notably improving from 11th to 9th by March. Decibel Farms' sales figures show a steady increase from January to March, suggesting a strengthening market presence, although still trailing behind top competitors like PRUF Cultivar. This dynamic indicates that while Decibel Farms is gaining traction, there is room for growth to match the consistent performance of leading brands in the Oregon Pre-Roll market.

Notable Products

In March 2025, Trebles - Indica Blend Infused Pre-Roll 2-Pack (1g) retained its position as the top-performing product for Decibel Farms, with sales reaching 2260 units. Following closely, Trebles - Sativa Blend Bubble Hash Infused Pre-Roll 2-Pack (1g) climbed to the second position, showing a notable increase from third place in February. Basslines Duets - Sativa Infused Pre-Roll 6-Pack (3g) also improved its standing, moving up to the third position from fourth in the previous month. Meanwhile, Basslines Duets - Indica Infused Pre-Roll 6-Pack (3g) saw a drop in rank, falling to fourth place from second in February. The newly introduced Bassline - Durban Poison x Banana Poison Infused Pre-Roll 6-Pack (3g) entered the rankings in March at fifth place, indicating a strong debut performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.