Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Distro 10 has shown notable progress in the Michigan market, particularly within the Concentrates category. Over the span from June to September 2025, the brand climbed from the 28th to the 18th position, indicating a strong upward trajectory in this category. This growth is underscored by a peak in sales during August, followed by a slight decline in September. In contrast, the Edible category paints a different picture, with Distro 10 not making it into the top 30 rankings by September. This downward trend suggests a potential area for strategic reevaluation or increased marketing efforts.

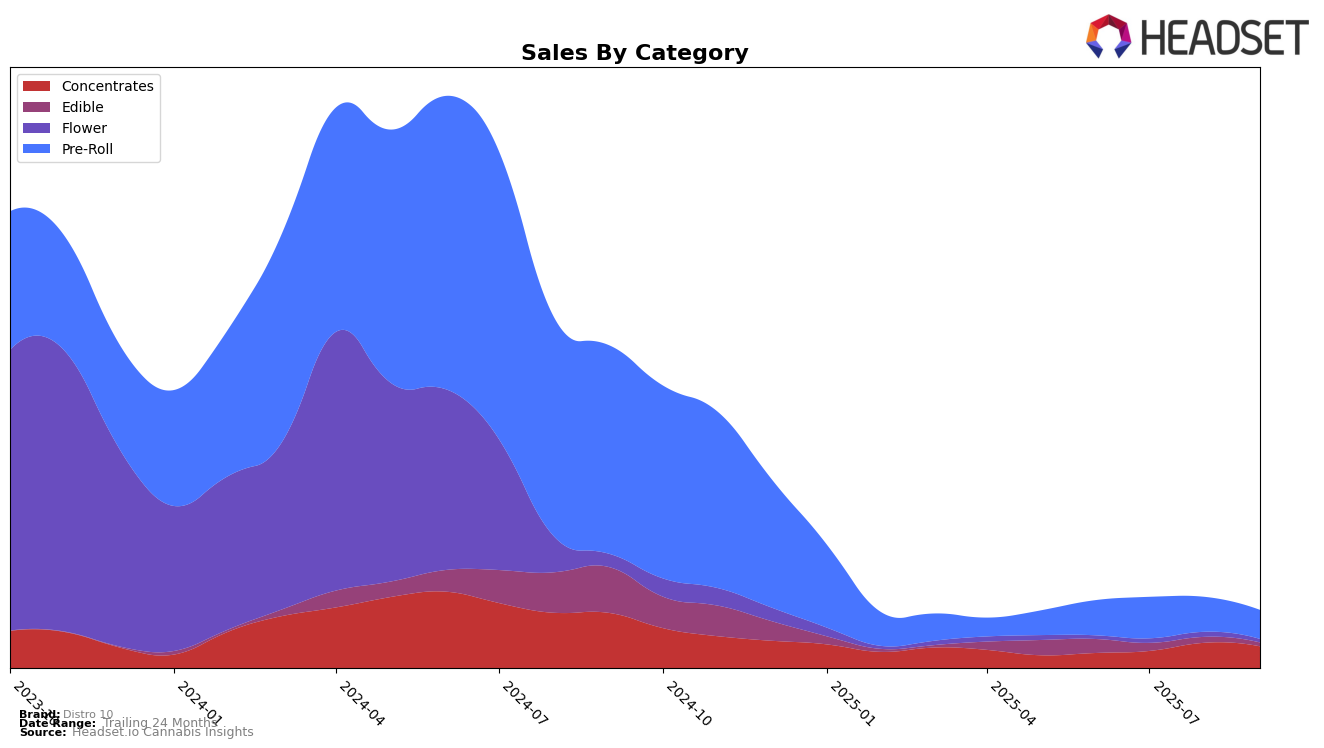

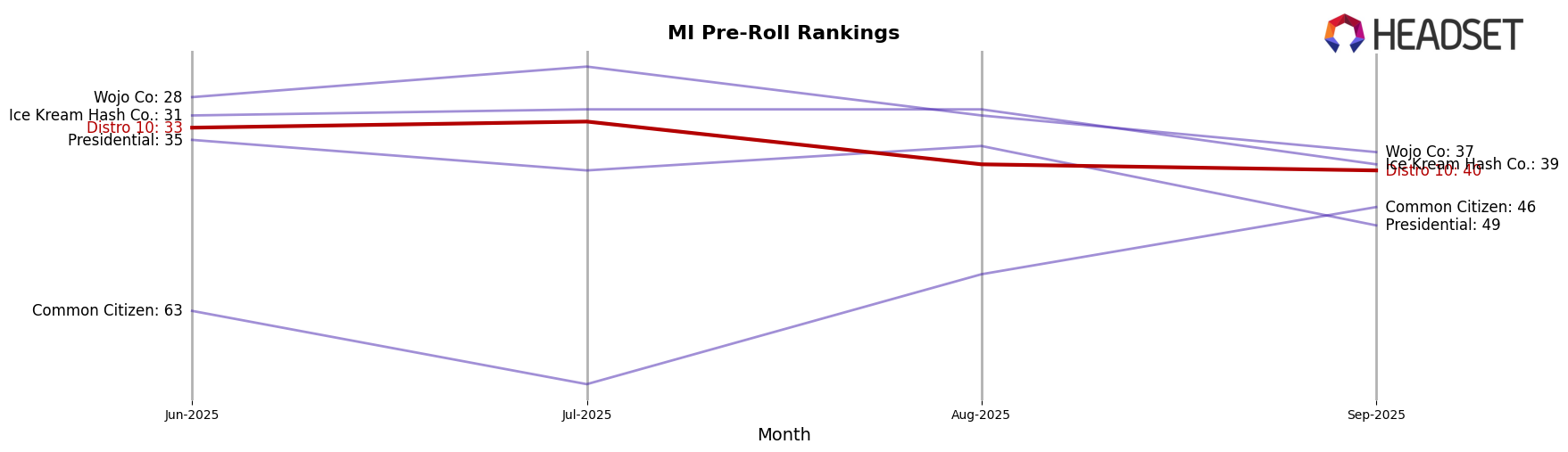

In the Pre-Roll category within Michigan, Distro 10's performance has been relatively stable, though slightly declining over the months. Starting at the 33rd position in June, the brand experienced a minor drop, settling at the 40th position by September. Despite this, the sales figures for Pre-Rolls remained robust, indicating a consistent consumer base. The contrasting performances across these categories highlight the brand's varied market presence and suggest potential opportunities for growth and improvement in specific areas.

Competitive Landscape

In the competitive landscape of the Michigan Pre-Roll category, Distro 10 has experienced a fluctuating rank over the past few months, with its position moving from 33rd in June 2025 to 40th by September 2025. This shift highlights a competitive pressure from brands like Ice Kream Hash Co., which maintained a more stable rank, hovering around the 30th position, and Wojo Co, which consistently ranked higher, peaking at 23rd in July 2025. Despite these challenges, Distro 10's sales figures reveal a resilient performance, particularly in July 2025, where it saw a notable increase in sales compared to June. However, the subsequent decline in both rank and sales by September suggests a need for strategic adjustments to regain momentum. Meanwhile, Common Citizen showed a significant improvement in rank, climbing from 75th in July to 46th in September, indicating a potential shift in consumer preferences that Distro 10 might need to address to enhance its competitive stance.

Notable Products

In September 2025, the top-performing product for Distro 10 was Crumb Cake Infused Pre-Roll (1.2g) in the Pre-Roll category, achieving the number one rank with impressive sales of 23,961 units. Bubba Burst Infused Pre-Roll (1.2g) followed closely, dropping to the second position from its previous top spot in July and August. Purple Plum Infused Pre-Roll (1.2g) maintained a steady presence in the top three, while Cherry Swirl Infused Pre-Roll (1.2g) consistently held the fourth position over the past months. Strawberry Float Infused Pre-Roll (1.2g) re-entered the rankings in fifth place after missing out in August, indicating a resurgence in sales. Overall, the rankings reflect a dynamic shift in consumer preferences, with Crumb Cake Infused Pre-Roll emerging as a new favorite.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.