Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

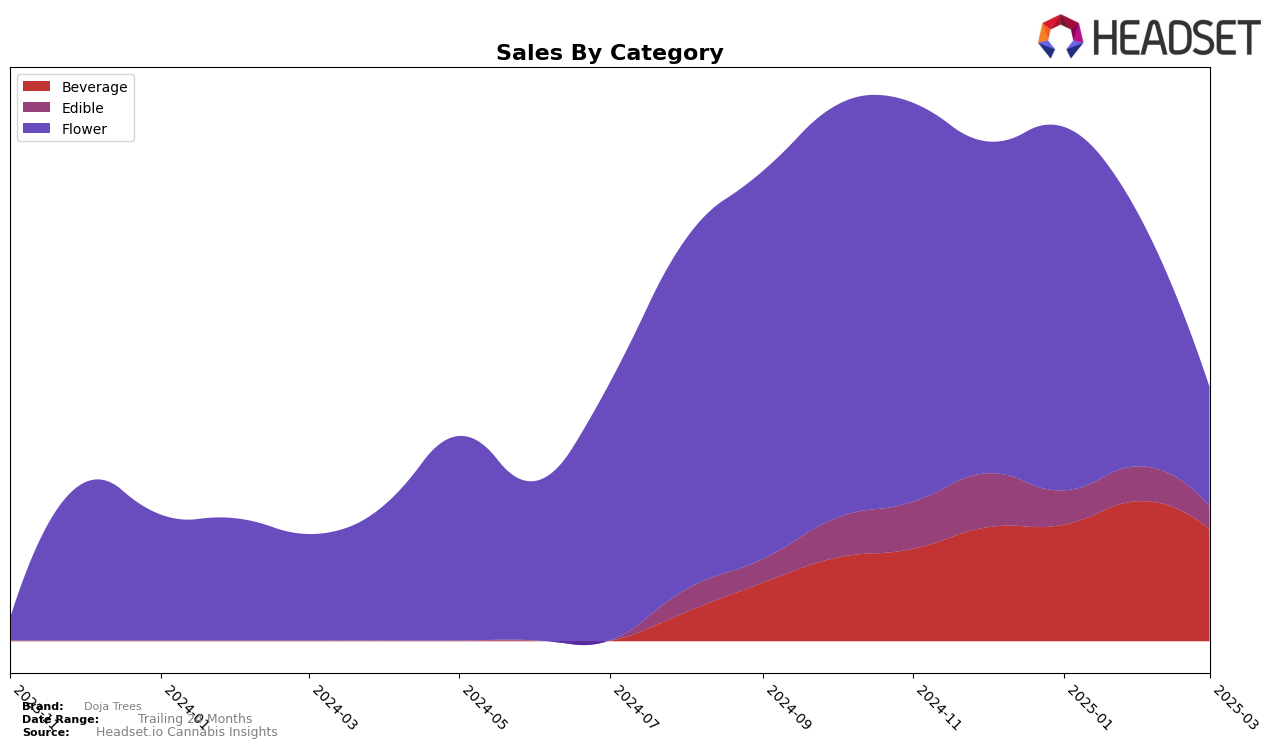

In the state of Washington, Doja Trees has shown a consistent performance in the Beverage category, maintaining a stable position around the 10th to 11th rank over the months from December 2024 to March 2025. This stability is indicative of a solid market presence and consumer preference within this category. Notably, the brand experienced a peak in February 2025, reaching the 10th rank, which could suggest a strategic push or seasonal demand. Conversely, in the Edible category, Doja Trees has faced challenges, slipping from the 29th position in December 2024 to 36th by March 2025, indicating a potential need for innovation or increased marketing efforts to regain traction in this competitive segment.

When examining the Flower category, Doja Trees did not make it into the top 30 rankings by March 2025, which could be a cause for concern given the competitive nature of the cannabis market in Washington. Their highest rank was 46th in January 2025, followed by a drop to 64th in February, and they fell out of the top 30 altogether by March. This decline might reflect shifting consumer preferences or increased competition. Understanding the dynamics behind these shifts could provide valuable insights for the brand's strategy moving forward. Despite these challenges, the brand's overall sales figures in the Beverage category remain a bright spot, showcasing potential areas for growth and investment.

Competitive Landscape

In the competitive landscape of the Washington beverage category, Doja Trees has maintained a steady presence, consistently ranking around the 10th to 11th position from December 2024 to March 2025. This stability is noteworthy, especially when compared to competitors such as Blaze Soda, which consistently ranks higher at the 10th position, and Hot Shotz, which has fluctuated between 7th and 9th positions. Despite CQ (Cannabis Quencher) and Sungaze showing some variability in their rankings, Doja Trees has managed to outperform them in February 2025, reaching the 10th spot. This indicates a potential for upward momentum, although sales figures suggest a need for strategic marketing efforts to close the gap with higher-ranking brands like Blaze Soda and Hot Shotz, which have shown stronger sales performance in the same period.

Notable Products

In March 2025, the top-performing product for Doja Trees was Kush Berry Shot (100mg) in the Beverage category, maintaining its first-place position consistently from December 2024. Blue Raspberry Shot (100mg) held steady at the second spot for the fourth consecutive month. Grape God Shot (100mg) climbed back to third place after briefly dropping in February 2025. Watermelon Punch Shot (100mg) experienced a slight drop to fourth place, while Lemon Haze Shot (100mg) entered the rankings at fifth place after being unranked in February. Notably, Kush Berry Shot had a sales figure of 2324 units in March 2025, indicating a decrease from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.