Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

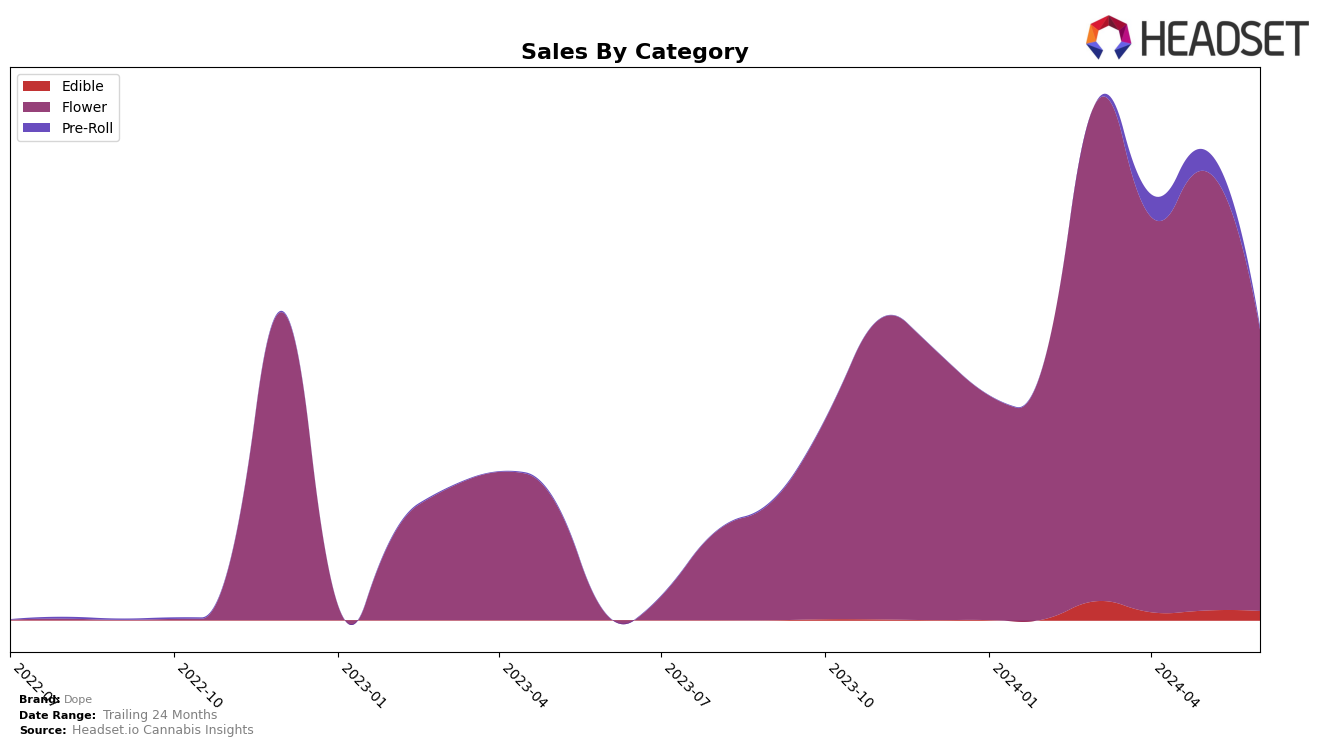

Dope's performance across different states and categories has shown notable variability. In Michigan, the brand did not make it into the top 30 rankings for Edibles from April through June 2024, which could indicate a need for strategic adjustments in this category. On the other hand, in Nevada, Dope demonstrated a more consistent presence in the Flower category, maintaining a position within the top 30, albeit with some fluctuations. Specifically, their ranking improved from 27th in April to 20th in May, before dropping to 29th in June. This suggests that while Dope has a foothold in the Nevada Flower market, there is room for stability and growth.

In the Pre-Roll category in Nevada, Dope's performance has been less impressive, with the brand not making it into the top 30 in March and June 2024. They did, however, enter the rankings at 60th in April and slightly dropped to 64th in May. This shows a relatively weak presence in the Pre-Roll market in Nevada, indicating potential areas for improvement. Overall, while Dope has shown some strong points, particularly in the Flower category in Nevada, there are clear opportunities for growth and enhancement in other categories and states.

Competitive Landscape

In the competitive landscape of the Nevada Flower category, Dope has experienced notable fluctuations in its ranking and sales over recent months. In March 2024, Dope was ranked 21st, but it dropped out of the top 20 in April, only to re-enter at 20th in May before falling to 29th in June. This volatility contrasts with the more stable performance of competitors like Firestar, which consistently maintained a higher rank, peaking at 13th in April. Despite a similar downward trend in June, Firestar's sales remained significantly higher than Dope's. Another competitor, Cookies, showed a steady improvement in rank from 37th in March to 30th in May, suggesting a growing market presence. Meanwhile, Superior (NV) and Verano have also shown resilience, with Verano making a notable entry into the rankings in May and June. These trends indicate that while Dope has faced challenges in maintaining its market position, competitors are capitalizing on opportunities to enhance their visibility and sales in the Nevada Flower market.

Notable Products

In June 2024, the top-performing product for Dope was Apple Fritter x Sunset Sherbert (14g) in the Flower category, maintaining its number one rank from May 2024 with sales of 1066 units. Block Berry (14g), also in the Flower category, debuted strongly at the second position with 1055 units sold. The CBD/THC/CBN 1:1:1 Blueberry PM Gummies 10-Pack (50mg THC, 50mg CBD, 50mg CBN) ranked third, down from the fourth position in May 2024, indicating a slight improvement in its ranking. THC/CBD/CBG 1:1:1 Lemon Lime Gummies 10-Pack (50mg THC, 50mg CBD, 50mg CBG) held steady at the fourth position. Big Apple x Kush Mints (14g) saw a significant drop, moving from first place in May 2024 to fifth place in June 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.