Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

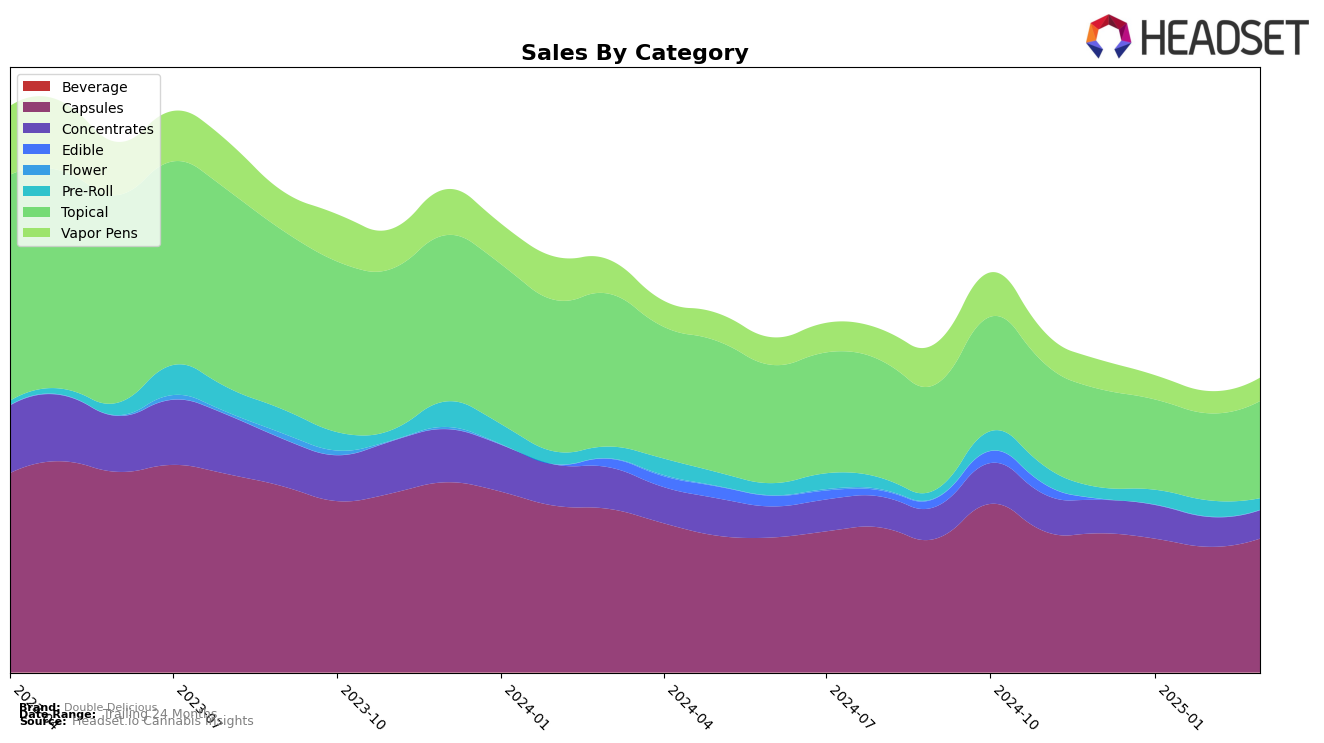

Double Delicious has established a strong presence in the Washington market, particularly in the Capsules category, where it consistently holds the top rank. This consistent performance is indicative of a robust product offering and strong consumer loyalty. However, in the Concentrates category, the brand has not managed to break into the top 50, with rankings fluctuating between 52 and 61 over the observed months. This suggests potential challenges in capturing market share or competing with other brands that dominate this space. In contrast, the brand maintains a solid second place in the Topical category, showing stability and a strong foothold in this segment as well.

The consistent top ranking in Capsules across the months highlights Double Delicious's strength and possibly a strategic focus in this category. Despite a slight dip in sales from December to February, there was a rebound in March, indicating resilience and possibly effective marketing or product adjustments. On the other hand, the brand's position outside the top 30 in Concentrates could be a cause for concern, pointing to either a gap in market strategy or consumer preference. The steady performance in Topicals, maintaining second place, suggests that while they are not the market leader, they are a significant player in this category. This diversified performance across categories provides a nuanced view of Double Delicious's market strategy and areas of potential growth or reevaluation.

Competitive Landscape

In the Washington capsules market, Double Delicious has consistently maintained its top position from December 2024 through March 2025, showcasing its strong brand presence and customer loyalty. Despite a slight dip in sales from December to February, Double Delicious rebounded in March, indicating resilience and effective market strategies. Competitor Fairwinds has consistently held the second rank, with sales figures significantly lower than Double Delicious, yet stable over the months. Meanwhile, Ceres remains in third place, with its sales showing a noticeable fluctuation, particularly a dip in February followed by a recovery in March. This competitive landscape suggests that while Double Delicious continues to dominate, maintaining its lead requires vigilance against consistent performers like Fairwinds and the potential volatility seen in brands like Ceres.

Notable Products

In March 2025, the Indica RSO Capsules 10-Pack (100mg) maintained its position as the top-selling product for Double Delicious, continuing its streak from previous months with sales of 4726 units. The Sativa RSO Capsules 10-Pack (100mg) also held steady in second place, showing a resurgence in sales compared to February. Hybrid Super RSO Infusionz 3-Pack (600mg) saw a notable rise, climbing to third place from fifth in February, indicating growing consumer interest in topicals. Hybrid RSO Capsules 10-Pack (100mg) remained consistent in fourth place, while OG Kush Preroll (1g) experienced a drop to fifth, possibly due to a significant decrease in sales figures. This shift in rankings highlights the consistent dominance of capsules while topicals gain traction in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.