Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

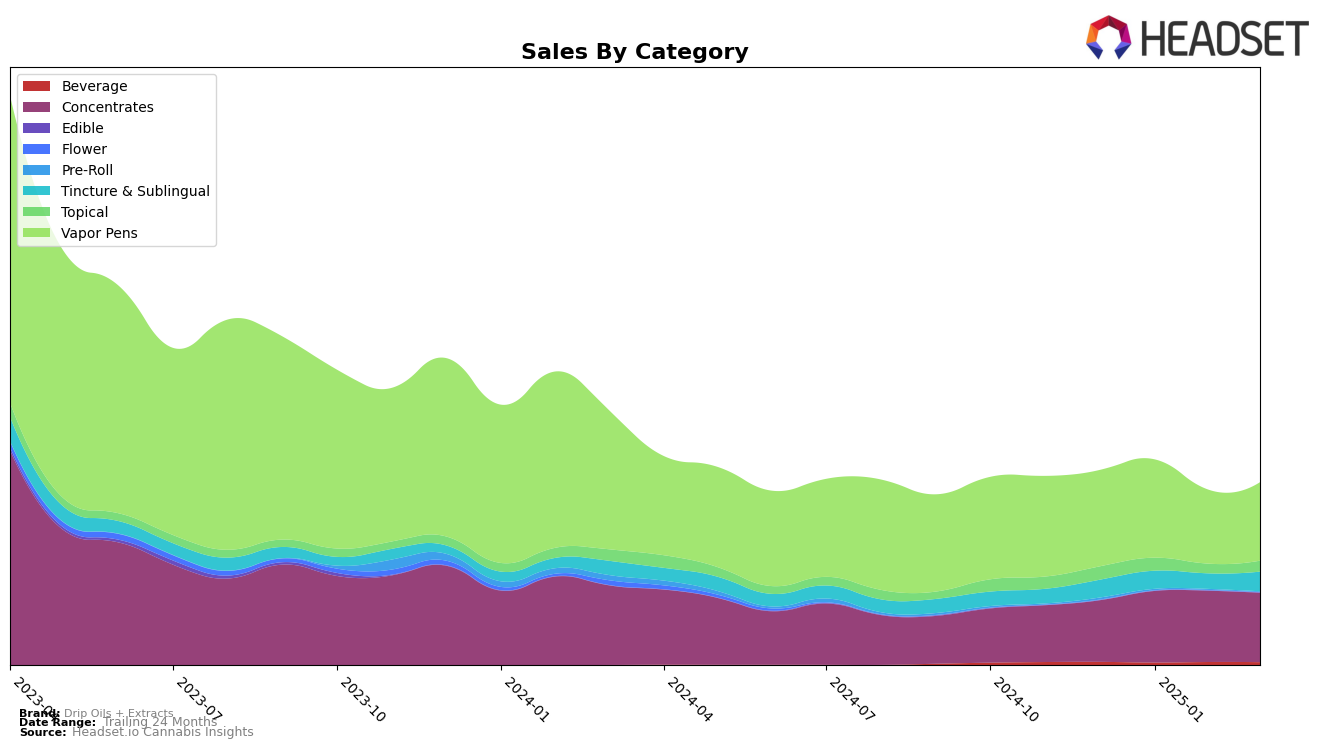

Drip Oils + Extracts has shown a strong presence in the Arizona market, particularly in the Concentrates category where it has consistently climbed the ranks from fifth in December 2024 to third by March 2025. This upward trend is indicative of a solidifying market position. In the Tincture & Sublingual category, the brand has maintained a dominant first-place ranking throughout the same period, showcasing its stronghold in this segment. The Topical category, however, presents a mixed picture; despite starting and ending at third place, there was a dip in the middle of the period, suggesting potential volatility or increased competition.

In contrast, the Vapor Pens category has seen a decline in rankings for Drip Oils + Extracts, dropping from 13th to 16th from December 2024 to March 2025. This downward movement might reflect challenges in maintaining market share or perhaps a shift in consumer preferences within this category. Notably, the brand did not feature in the top 30 for any other states or provinces, which might indicate a need for strategic expansion beyond Arizona to capture new markets. The sales figures, while not detailed here, suggest that despite some category-specific challenges, Drip Oils + Extracts continues to perform robustly in its primary market.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Drip Oils + Extracts has experienced a gradual decline in its market position from December 2024 to March 2025, dropping from 13th to 16th rank. This shift is notable as competitors like Sessions Cannabis Extract (OR) have improved their standing, moving from 25th to 14th, and Turn has climbed from 26th to 15th within the same period. Meanwhile, Mr. Honey Extracts has shown a consistent presence, maintaining a close rank to Drip Oils + Extracts. The entry of Sluggers Hit into the top 20 in March 2025 further intensifies the competition. These dynamics suggest a competitive pressure on Drip Oils + Extracts, as rivals are not only closing sales gaps but also surpassing them in market rank, indicating a need for strategic adjustments to regain momentum in this category.

Notable Products

In March 2025, the top-performing product for Drip Oils + Extracts was High THC RSO (1g) in the Concentrates category, maintaining its number one rank consistently since December 2024, with sales of 3143 units. The CBD/CBG 1:1 Hemp Salve (500mg CBD, 500mg CBG) in the Topical category held steady at the second position, showcasing consistent demand. Blue Dream Distillate Disposable (1g) in the Vapor Pens category ranked third, unchanged from February 2025, indicating stable sales performance. Drops - High CBG Natural Tincture (600mg CBG, 30ml) maintained its fourth-place ranking from February, while Drops - High CBD Natural Tincture (600mg CBD, 30ml) returned to the fifth position after a brief absence in February. The rankings demonstrate a stable market for these products, with little fluctuation in customer preferences over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.