Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

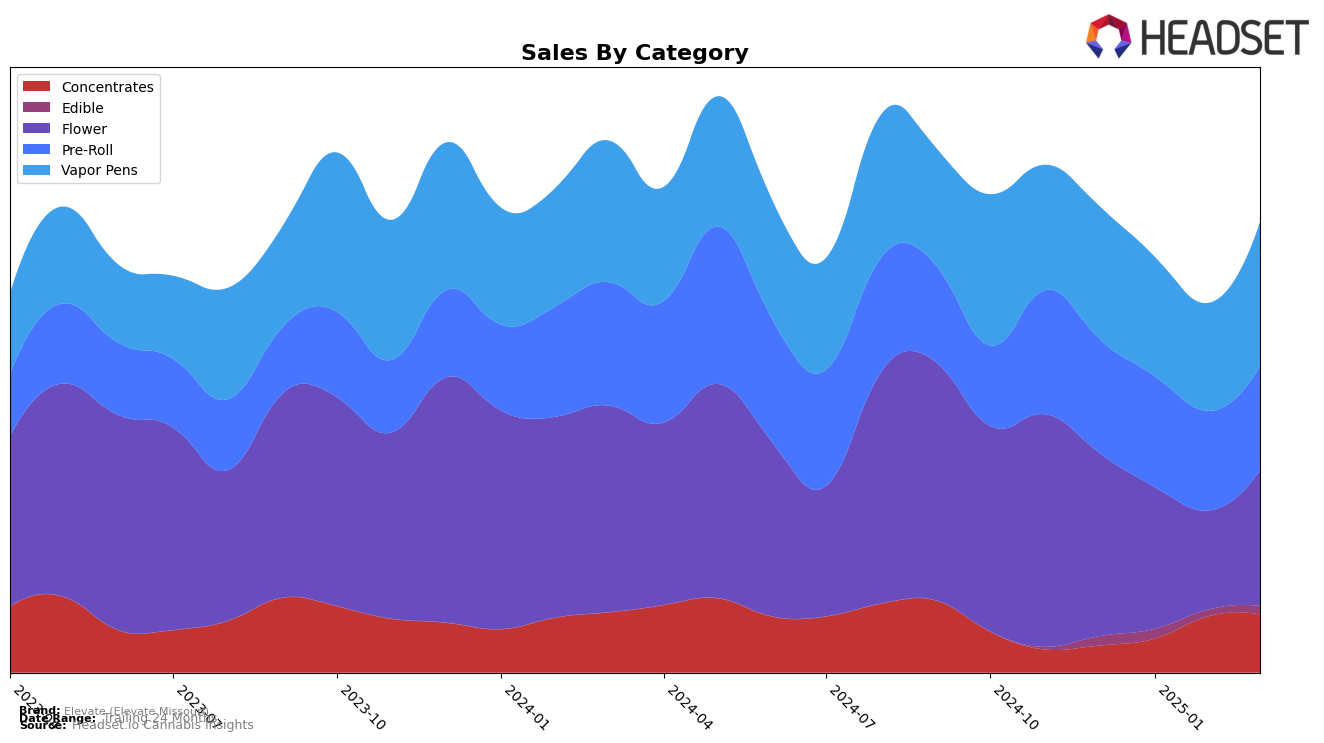

Elevate (Elevate Missouri) has demonstrated notable performance in the Missouri cannabis market across various categories. In the Concentrates category, the brand has shown a remarkable upward trajectory, moving from a rank of 12 in December 2024 to securing the 2nd position by February 2025. This significant improvement suggests a strong consumer preference and effective market strategies. Meanwhile, in the Pre-Roll category, Elevate maintained a consistent presence within the top five, indicating a steady demand and brand loyalty among consumers. However, the Edible category presents a challenge, as Elevate did not make it into the top 30 rankings by February 2025, highlighting potential areas for growth or reevaluation of their product offerings in this segment.

In the Flower category, Elevate experienced some fluctuations, initially dropping from 12th to 17th place by February 2025, before recovering to the 12th position in March 2025. This volatility suggests a competitive landscape, where maintaining a stable rank requires continuous innovation and consumer engagement. On the other hand, the Vapor Pens category saw Elevate holding a strong position, with a slight dip in February 2025 but a swift recovery to the 9th position by March. This indicates a resilient performance and possibly a well-received product line in this segment. Overall, while Elevate excels in certain categories, there remain opportunities for growth and strategic adjustments to bolster their presence in the Missouri cannabis market.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Elevate (Elevate Missouri) has experienced some fluctuations in its market position, which are critical for understanding its performance dynamics. In December 2024, Elevate ranked 8th, but slipped to 11th by February 2025, before rebounding to 9th in March 2025. This fluctuation is indicative of a competitive market, where brands like Sinse Cannabis and Wavelength Extracts have maintained relatively stable positions, with Sinse Cannabis consistently outperforming Elevate by one or two ranks. Notably, Galactic has shown strong performance, consistently ranking higher than Elevate, which suggests a robust competitive edge. Despite these challenges, Elevate's sales saw a significant uptick in March 2025, indicating potential for recovery and growth. This dynamic environment underscores the importance of strategic marketing and product differentiation for Elevate to enhance its competitive standing in Missouri's vapor pen market.

Notable Products

In March 2025, Elevate (Missouri) saw Grease Monkey (3.5g) maintain its top position in the Flower category, continuing its streak as the number one product since January 2025, with sales reaching 5,366 units. Mac and Cheese (3.5g) also held steady at the second rank in the Flower category, mirroring its performance from the previous months. In the Vapor Pens category, Banana Runtz Botanical Terp Distillate Cartridge (1g) emerged as a strong contender, debuting at third place. Grape Goji OG Distillate Botanical Terp Disposable (1g) improved its ranking from fifth in February to fourth in March. Meanwhile, KC Cough Botanical Terp Distillate Disposable (1g) entered the rankings at fifth place, marking its presence in the competitive Vapor Pens market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.