Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

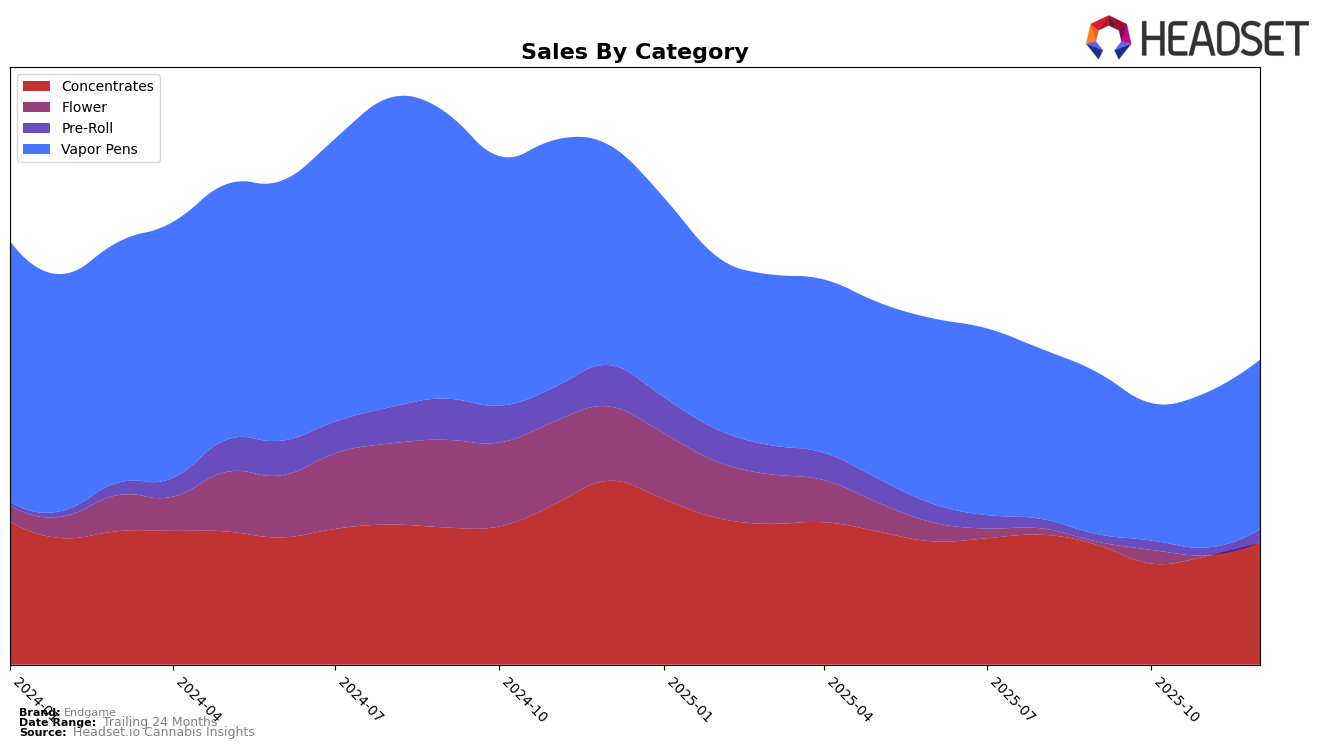

Endgame has demonstrated a strong presence in the concentrates category across multiple Canadian provinces. In Alberta, the brand maintained a consistent second-place ranking from September to December 2025, showcasing stability in this category. Meanwhile, in British Columbia, Endgame held the top spot in concentrates for most of the observed months, except for a brief dip to second place in October. This indicates a strong consumer preference and market penetration in the concentrates category in these regions. In Ontario, Endgame consistently ranked third, indicating a steady performance but also room for growth to reach the top. Notably, in Saskatchewan, the brand jumped to first place in October and November, although it was not ranked in September, highlighting a significant upward movement in this market.

In the vapor pens category, Endgame's performance varied across provinces. In Alberta, the brand's ranking fluctuated, moving from tenth in September to fifteenth in December, suggesting a competitive landscape. In British Columbia, Endgame's presence was inconsistent, missing from the top 30 in October but reappearing in December. This indicates potential volatility in consumer preferences or market competition in the region. Ontario showed a positive trend for Endgame in vapor pens, with the brand climbing from fourteenth in September to tenth in December, hinting at increasing popularity. In Saskatchewan, Endgame was absent in September but made a notable entry at twenty-first in October and improved to eleventh by December, suggesting a growing foothold in the vapor pens market.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Endgame has shown a promising upward trajectory in terms of rank and sales. From September to December 2025, Endgame improved its rank from 14th to 10th, indicating a positive shift in market positioning. This upward movement is particularly notable when compared to competitors such as Versus, which saw a decline from 8th to 12th place over the same period. Meanwhile, Weed Me and DEBUNK maintained relatively stable positions, with Weed Me holding steady at 9th and DEBUNK consistently at 8th. Despite the competitive pressure, Endgame's sales figures have shown a steady increase, particularly in December, where it surpassed Jays (Canada), which fluctuated in rank but ended slightly lower at 11th. This data suggests that Endgame is effectively capturing market share and could be poised for further growth in the Ontario vapor pen market.

Notable Products

In December 2025, Endgame's top-performing product was the Mimosa x Blood Orange Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place rank for four consecutive months with sales reaching 11,277 units. The Hard Hitters - Blueberry Octane Liquid Diamond Cartridge (1g) also performed well, securing the second position, consistent with its placement in November. Notably, the Hard Hitters - Psycho Citrus Liquid Diamond Cartridge (1g) improved its rank from fifth in November to third in December, indicating a resurgence in popularity. In the Concentrates category, Astro Pink THCA Isolate (1g) held steady at fourth place, while Face Lock Shatter (1g) entered the rankings at fifth position. Overall, the Vapor Pens category continued to dominate sales for Endgame, with little change in the top ranks compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.