Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

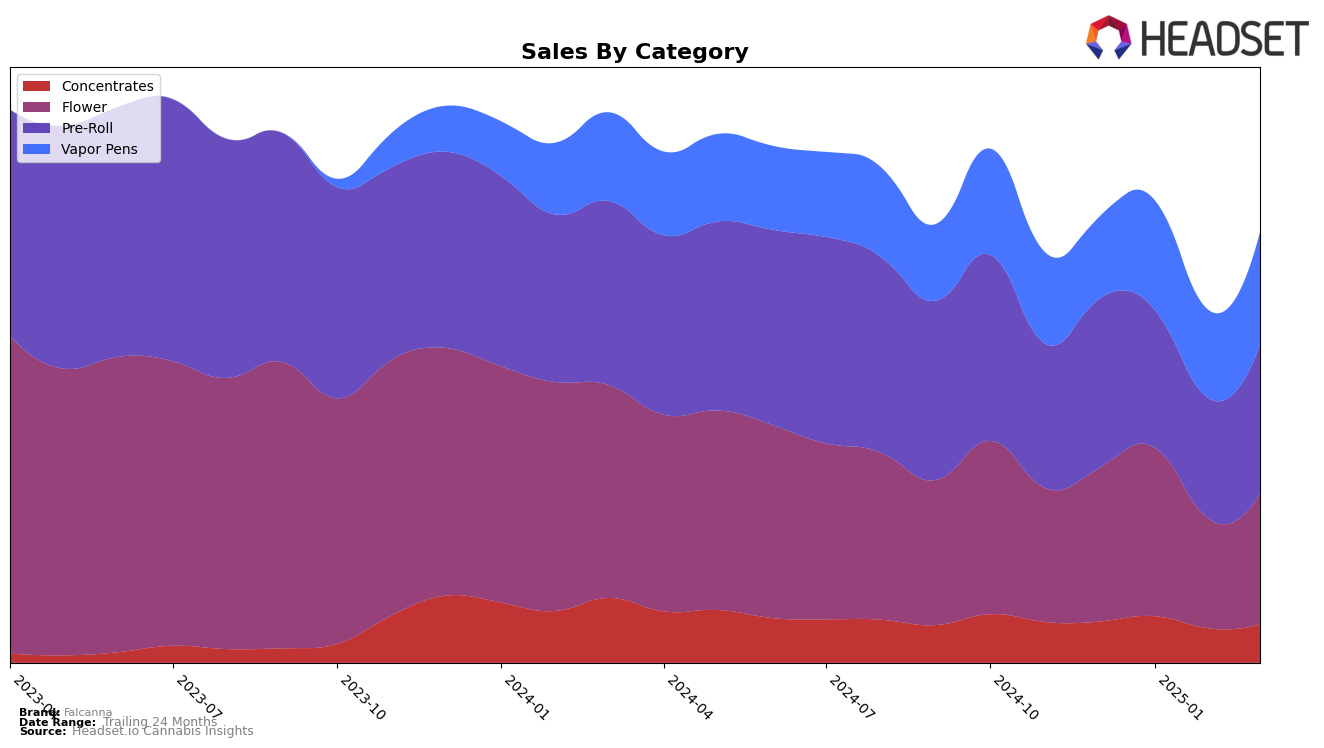

Falcanna's performance in the Washington cannabis market demonstrates a varied trajectory across different product categories. In the Concentrates category, Falcanna showed a positive movement by climbing from 38th in December 2024 to 32nd in January 2025, though it fell out of the top 30 by February and March, indicating potential volatility or increased competition in this segment. The Flower category presented a similar pattern; although Falcanna improved its ranking from 42nd to 35th in January, it struggled to maintain its position, dropping back outside the top 30 in February before slightly recovering in March. This fluctuation suggests challenges in sustaining growth in these categories, possibly due to market dynamics or seasonal demand shifts.

In contrast, Falcanna maintained a more stable presence in the Pre-Roll category within Washington, consistently ranking around the 20th position from December through March, which indicates a steady demand for their products in this segment. Meanwhile, their performance in the Vapor Pens category showed notable improvement, moving from 55th in December 2024 to 38th by March 2025, suggesting effective strategies or product offerings that resonated well with consumers. Despite not breaking into the top 30, the upward trend in Vapor Pens highlights potential growth opportunities for Falcanna in this segment, which could be pivotal for their overall market presence in Washington.

Competitive Landscape

In the competitive landscape of the Washington Pre-Roll category, Falcanna has experienced some fluctuations in its market position from December 2024 to March 2025. Starting at rank 18 in December 2024, Falcanna saw a slight dip to rank 21 in January 2025, maintaining a similar position in February and March. This indicates a relatively stable performance compared to competitors like Redbird (formerly The Virginia Company), which improved its rank from 22 to 20 over the same period, and Bacon Buds, which climbed from 25 to 19. Despite these shifts, Falcanna's sales rebounded in March, suggesting potential for regaining its competitive edge. Meanwhile, Artizen Cannabis and Honey Tree Extracts have shown more volatility, with ranks fluctuating outside the top 20, highlighting the dynamic nature of this market segment.

Notable Products

In March 2025, the top-performing product for Falcanna was Candy Queen Pre-Roll 2-Pack (1.2g) in the Pre-Roll category, maintaining its leading position from February with sales reaching 1466. Deep Sea Pre-Roll 2-Pack (1.2g) climbed from its previous third position in February to second place, tying with Diesel Thai Pre-Roll 2-Pack (1.2g) which held its February rank. Pacific Purple Pre-Roll 2-Pack (1.2g) re-entered the top ranks at third place after not being ranked in January and February. Charlotte's Web Pre-Roll 12-Pack (7.2g) consistently held the fourth position across the months, showing steady sales performance. Overall, Candy Queen Pre-Roll continues to dominate, while the other products exhibit minor shifts in rankings, indicating stable demand for Falcanna's Pre-Roll offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.