Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

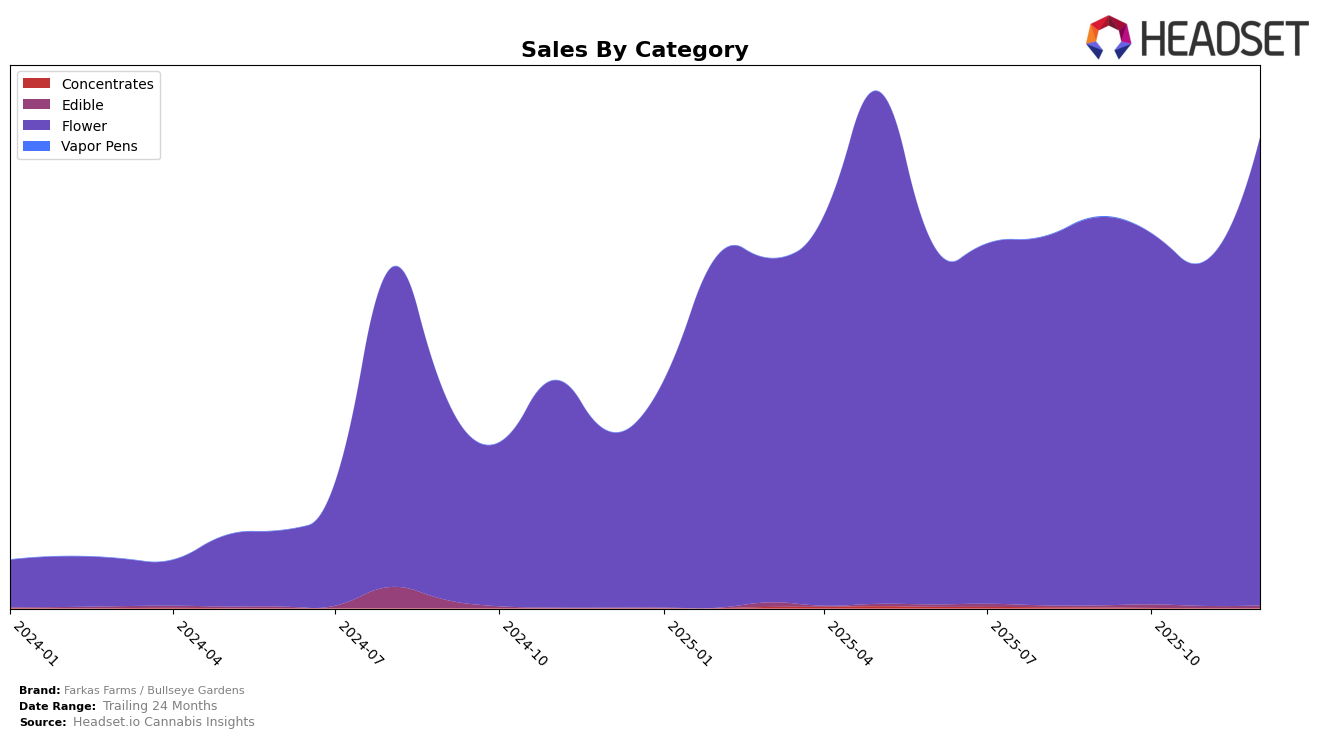

Farkas Farms / Bullseye Gardens has shown notable performance in the Ohio market, particularly in the Flower category. The brand's ranking in this category has experienced some fluctuations over the last few months, with a slight dip from 8th place in September 2025 to 10th in October. However, they managed to recover and climb to 9th in November and further improved to 6th by December. This upward trend in December is especially noteworthy as it coincides with their highest sales figure for the period, suggesting strong consumer demand and effective market strategies.

While Farkas Farms / Bullseye Gardens has maintained a consistent presence in the top 10 for the Flower category in Ohio, it is important to note that their absence from the top 30 in other states or categories might indicate areas for potential growth or challenges in market penetration. The brand's performance in Ohio could serve as a benchmark for expansion strategies in other regions. The data suggests a promising trajectory in Ohio, but further insights into other states and categories would be necessary to fully understand their overall market positioning and potential areas for growth.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Farkas Farms / Bullseye Gardens experienced notable fluctuations in its ranking from September to December 2025. Starting at 8th position in September, the brand saw a dip to 10th in October, before climbing back to 9th in November and achieving a significant rise to 6th by December. This upward trajectory in December suggests a positive shift in consumer preference or strategic improvements by Farkas Farms / Bullseye Gardens. In comparison, Grassroots maintained a relatively stable position, though it slipped from 4th to 8th over the same period. Meanwhile, Neighborgoods showed strong performance, consistently ranking within the top 5, while Klutch Cannabis experienced a peak at 1st in November before dropping to 7th in December. Eden's Trees also demonstrated a remarkable rise, moving from 10th in September to 4th by December. These dynamics indicate a highly competitive environment where Farkas Farms / Bullseye Gardens must continue to innovate and adapt to maintain and improve its market position.

Notable Products

In December 2025, Pineapple Sherb (2.83g) emerged as the top-performing product for Farkas Farms / Bullseye Gardens, reclaiming its first-place rank from September with impressive sales of 4479. Orange Octane (2.83g) rose to second place, showing a significant improvement from its previous third-place ranking in November. Gelatomo (2.83g) secured the third position, dropping from its top spot in November. Banana Headband (2.83g) maintained a consistent performance, holding steady at fourth place for two consecutive months. Fire Cookies (2.83g) re-entered the rankings in fifth place, after previously being unranked in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.