Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

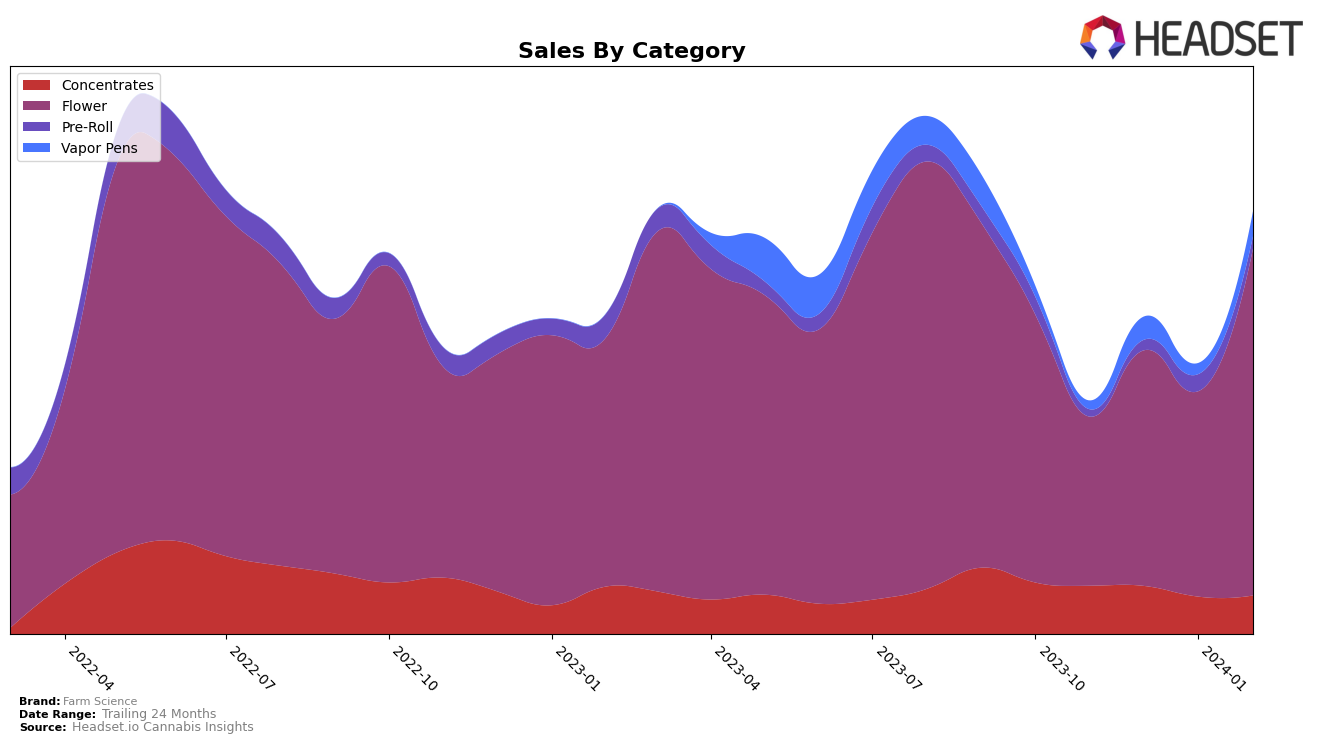

In Michigan, Farm Science has shown a diverse performance across different cannabis categories, each indicating a unique trend in consumer preference and market penetration. Notably, the brand's journey in the Concentrates category has been somewhat challenging, with its rank slipping from 35th in November 2023 to 49th by February 2024. This decline, despite a slight increase in sales from January to February 2024, suggests a competitive landscape that Farm Science is navigating. On a more positive note, the Flower category tells a different story, with a significant leap from a rank of 55th in November 2023 to an impressive 25th by February 2024. This remarkable improvement, coupled with a notable increase in sales, peaking at 878,012 in February, underscores a growing consumer preference for Farm Science's Flower products in Michigan.

The Vapor Pens category offers an intriguing insight into Farm Science's market dynamics. The brand did not rank in the top 30 in November 2023, indicating a potential lack of presence or consumer awareness in this segment at the time. However, a sudden appearance at 83rd in December 2023, followed by a disappearance and then a rise to 72nd by February 2024, suggests a volatile yet positive trajectory. This fluctuation could be attributed to strategic market entries and product launches, hinting at Farm Science's efforts to capture and expand its share in the Vapor Pens category. Although the brand faced challenges in maintaining consistent rankings, these movements indicate a proactive approach to exploring and adapting to consumer preferences in the evolving Michigan market.

Competitive Landscape

In the competitive landscape of the Michigan flower cannabis market, Farm Science has shown a notable improvement in its ranking over the recent months, moving from 55th in November 2023 to 25th by February 2024. This upward trajectory in rank is indicative of a significant increase in sales, underscoring the brand's growing presence and consumer acceptance in a crowded marketplace. Competitors such as Crude Boys and Glorious Cannabis Co. have maintained more stable rankings but have experienced fluctuations in sales, with Crude Boys seeing a decrease and Glorious Cannabis Co. facing a notable drop in January before recovering in February. Everyday Cannabis, despite a higher rank, has seen a decline in sales from December to February, suggesting potential vulnerabilities that Farm Science could capitalize on. The entry of Craft Leaf in February at rank 26, closely trailing Farm Science, introduces a new competitor to the market, indicating an increasingly competitive landscape. This analysis suggests that while Farm Science is on a growth trajectory, the dynamic nature of the Michigan flower cannabis market requires continuous monitoring of competitive movements and consumer preferences to maintain and enhance market position.

Notable Products

In February 2024, Farm Science saw GMOreoz (Bulk) from the Flower category leading the sales with a remarkable figure of 9629 units, securing the top position among their products. Following closely, First Class Funk (Bulk) also from the Flower category, took the second spot with significant sales. Daytona Wedding (Bulk), which was ranked 4th in November 2023, improved its position to the 3rd rank in February 2024, indicating a positive shift in consumer preference within a few months. Apple Cider (28g) and Flap Jacks (3.5g), both from the Flower category as well, were ranked 4th and 5th respectively, completing the top 5 products for the month. This ranking highlights a consistent consumer interest in the Flower category, with notable shifts in product preferences over the recent months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.