Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

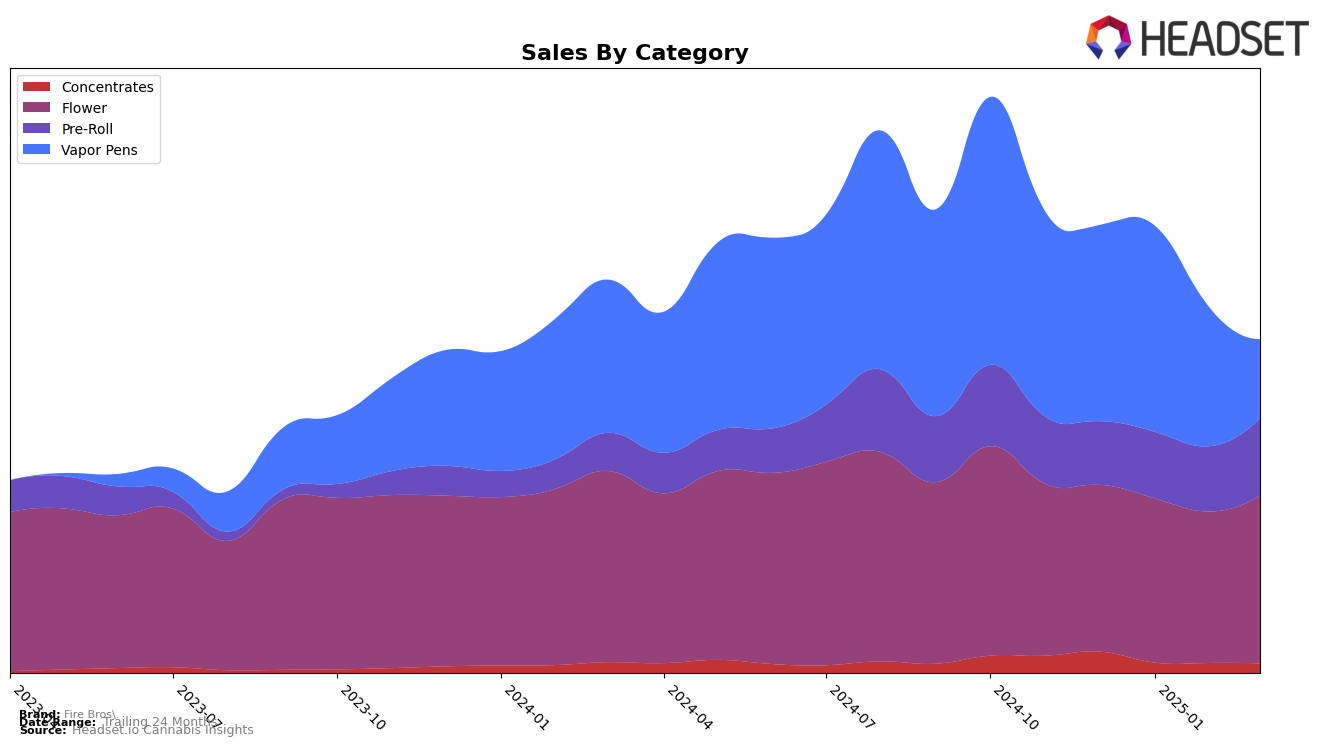

In the state of Washington, Fire Bros. has shown a varied performance across different product categories. Their presence in the Concentrates category has seen some challenges, as evidenced by their ranking slipping from 24th in December 2024 to 46th by March 2025, indicating a decline in market position. This movement suggests potential competitive pressures or shifts in consumer preferences within this category. Conversely, in the Flower category, Fire Bros. has maintained a relatively stable performance, consistently ranking around the 6th and 7th positions, which reflects a strong market presence in this segment. This stability in Flower sales, despite fluctuations in other categories, highlights Fire Bros.'s resilience and stronghold in this particular market.

Fire Bros.'s performance in the Pre-Roll category in Washington has been on an upward trajectory, improving from 17th place in December 2024 to 12th by March 2025. This positive movement is indicative of growing consumer demand or successful marketing strategies in this category. On the other hand, the Vapor Pens category has seen a decline in rankings from 13th in December 2024 to 19th in March 2025, suggesting potential challenges in maintaining consumer interest or facing increased competition. Overall, while Fire Bros. experiences fluctuations across categories, their ability to maintain top-tier rankings in certain areas points to strategic strengths that could be leveraged for future growth.

Competitive Landscape

In the competitive landscape of the Washington flower market, Fire Bros. has maintained a relatively stable position, showing resilience amidst fluctuating ranks and sales. From December 2024 to March 2025, Fire Bros. consistently ranked within the top 10, peaking at 6th place in January and February before slightly dropping to 7th in March. This stability is noteworthy considering the dynamic shifts seen with competitors. For instance, WA Grower experienced a notable rise to 3rd place in February but fell to 6th by March, indicating potential volatility. Meanwhile, Lifted Cannabis Co maintained a strong presence, consistently ranking in the top 5, although their sales showed a downward trend over the months. Viking Cannabis demonstrated a positive trajectory, climbing from 11th in December to 8th in March, suggesting growing consumer interest. Fire Bros.' ability to sustain its rank amidst these shifts highlights its competitive edge, although the slight dip in March suggests a need for strategic adjustments to regain momentum and counteract the advances of rising competitors like Viking Cannabis.

Notable Products

In March 2025, the top-performing product from Fire Bros. was the Lemon Slushee Pre-Roll 2-Pack (1g) in the Pre-Roll category, which climbed to the number one position with sales of 3,566 units. The Rainy Days - Crepe Ape (3.5g) from the Flower category, which had previously held the top rank for three consecutive months, moved to the second position. The Variety Pre-Roll 5-Pack (2.5g) maintained its third-place ranking from February 2025. Jack Black Pre-Roll 2-Pack (1g) improved its position from fifth to fourth place. The Lemon Slushee (3.5g) in the Flower category dropped from fourth to fifth place, indicating a slight decline in its relative performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.