Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

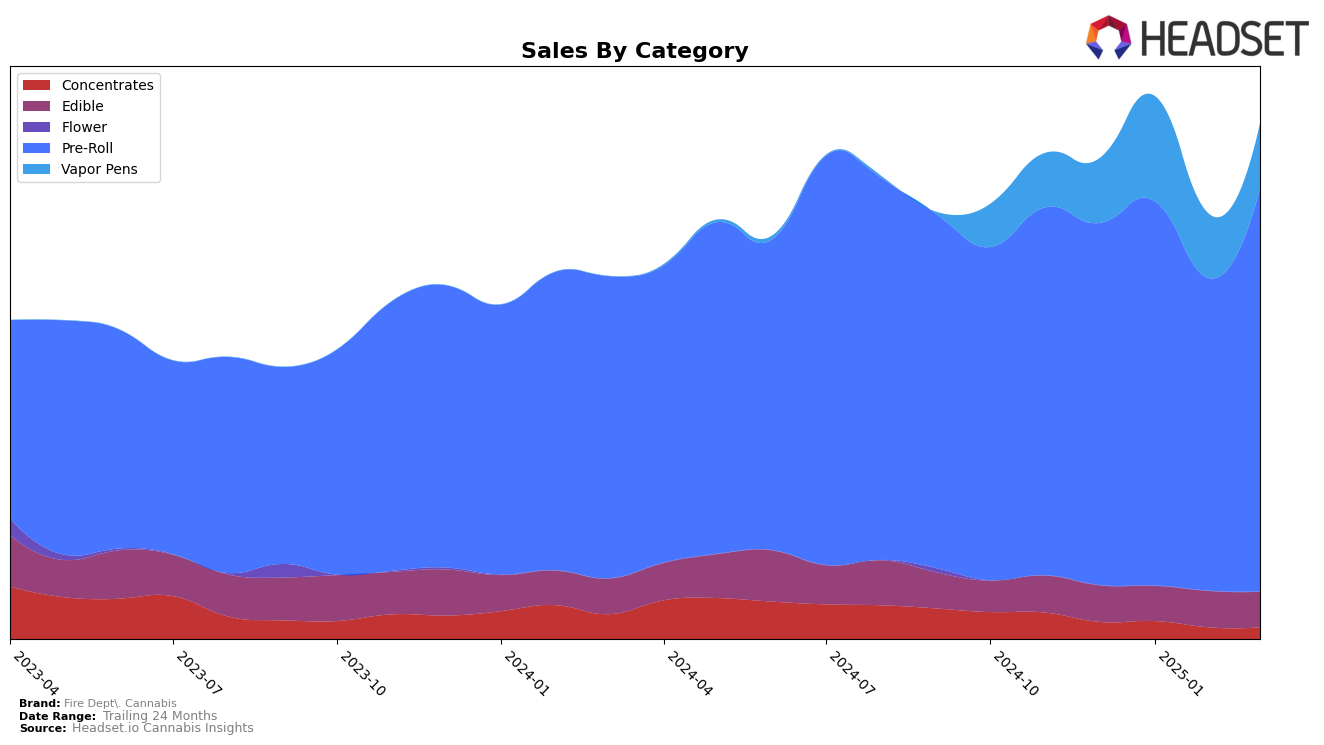

Fire Dept. Cannabis has shown varied performance across different product categories in Oregon. In the Concentrates category, the brand did not make it into the top 30, with rankings fluctuating from 47th in December 2024 to 58th by March 2025, indicating a downward trend. This suggests challenges in maintaining competitiveness in this segment. Conversely, their Edible products have maintained a more stable presence, consistently ranking within the top 20, with a slight improvement from 20th in December 2024 to 18th in January 2025, before settling back to 18th in March 2025. This stability in the Edible category could be indicative of a loyal consumer base or effective product offerings that resonate well with their target market.

The brand's strongest performance is observed in the Pre-Roll category, where Fire Dept. Cannabis consistently holds the 3rd position from December 2024 through March 2025. This consistent top-tier ranking highlights their strong market presence and consumer preference in this category. However, the Vapor Pens category presents a mixed picture; while there was a significant improvement from 42nd in December 2024 to 32nd in January 2025, the ranking then dropped to 39th and remained stable through March 2025. This suggests some volatility and potential challenges in sustaining growth in the Vapor Pens market. Overall, Fire Dept. Cannabis's performance across categories in Oregon indicates areas of strength and opportunities for improvement, particularly in Concentrates and Vapor Pens.

Competitive Landscape

In the competitive landscape of Oregon's pre-roll category, Fire Dept. Cannabis consistently holds the third rank from December 2024 through March 2025, indicating a stable position amidst fluctuating market dynamics. Despite a dip in sales in February 2025, Fire Dept. Cannabis rebounds in March, showcasing resilience and effective market strategies. The brand is closely trailed by Kaprikorn, which has shown a significant improvement from seventh to fourth rank, suggesting a potential threat if the trend continues. Meanwhile, Hellavated maintains a steady second place, with sales consistently higher than Fire Dept. Cannabis, highlighting a gap that could be targeted for growth. Portland Heights remains the leader, though its sales have seen a decline, potentially opening opportunities for Fire Dept. Cannabis to capture more market share. Lastly, STiCKS has risen from ninth to fifth, indicating a dynamic market where Fire Dept. Cannabis must remain vigilant to maintain its competitive edge.

Notable Products

In March 2025, Fire Dept. Cannabis saw Cap Junky Pre-Roll (0.5g) emerge as the top-performing product, climbing from fifth place in December 2024 to first place, with sales reaching 4903 units. Midnight Orgy Pre-Roll (0.5g) secured the second spot, while Gasoline Zest Pre-Roll (0.5g) followed closely in third. American Pie Pre-Roll (0.5g) ranked fourth, demonstrating a strong entry into the top tier. Super Runtz Pre-Roll (0.5g) slipped slightly from third in February to fifth in March, indicating a competitive market dynamic among the pre-roll category. Overall, March saw significant shifts in product rankings, emphasizing the evolving consumer preferences within Fire Dept. Cannabis offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.