Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

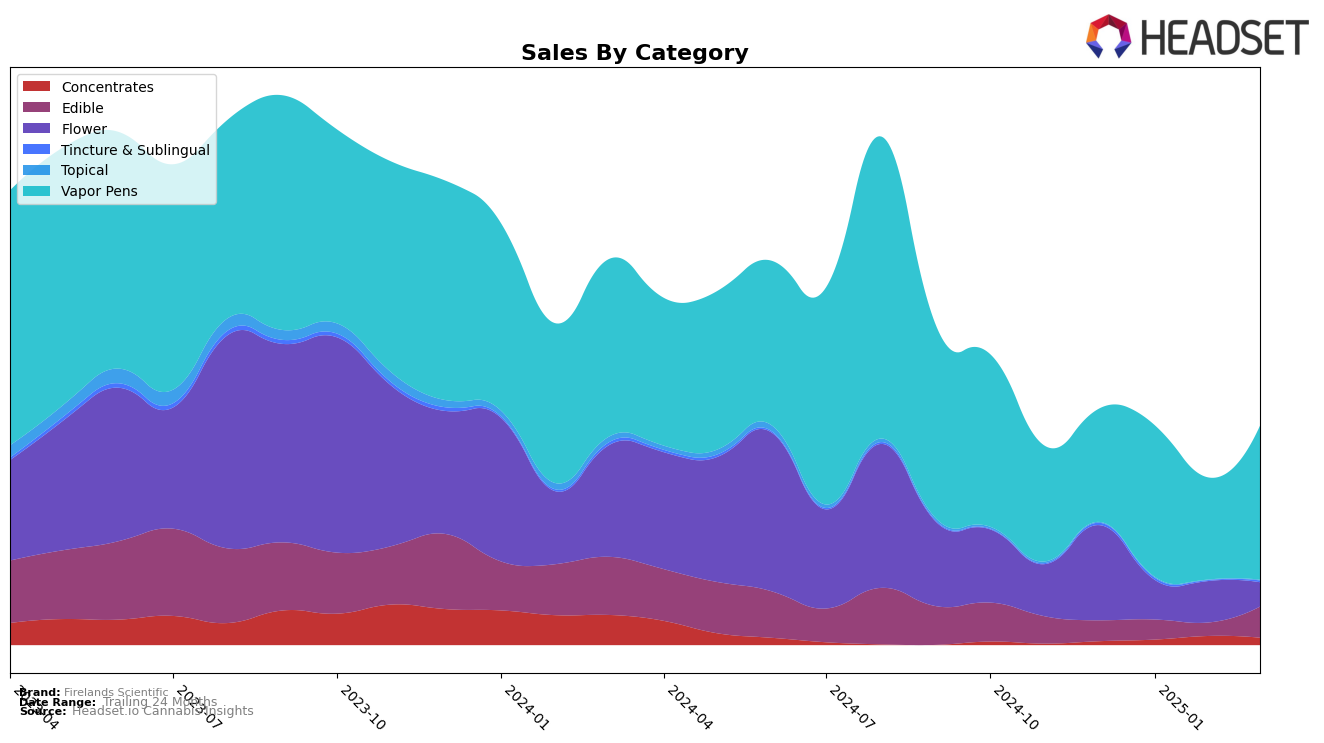

Firelands Scientific has shown varying performance across different product categories in Ohio. In the Concentrates category, the brand witnessed a positive trend, moving up from not being in the top 30 in December 2024 to securing the 22nd position by February 2025, before slightly dropping to 23rd in March. This indicates a growing presence in the Concentrates market, although the slight dip in March suggests there might be challenges to address. In the Edible category, Firelands Scientific fluctuated, starting at 35th in December, briefly improving to 29th in January, then returning to 35th in February, and finally climbing to 24th in March. This upward movement by March is a positive indicator of increased consumer interest or strategic improvements in their edible offerings.

In the Flower category, Firelands Scientific's performance has been less consistent. The brand fell from 30th in December 2024 to 40th in January 2025, improved slightly to 35th in February, but then slipped again to 39th in March. This suggests a competitive market environment or potential issues in maintaining steady growth in this category. However, the Vapor Pens category paints a different picture, with Firelands Scientific maintaining a strong presence. Starting at 19th in December, the brand improved to 16th in January, dipped to 24th in February, but regained the 16th spot by March. This resilience in the Vapor Pens market might be attributed to effective product strategies or consumer loyalty, reflecting a robust segment for the brand in Ohio.

Competitive Landscape

In the competitive landscape of vapor pens in Ohio, Firelands Scientific has experienced fluctuations in its market position, notably dropping out of the top 20 in February 2025 before rebounding to 16th place in March 2025. This volatility highlights the intense competition in the market, with brands like Vapen maintaining a steady rank at 14th place from January to March 2025, and (the) Essence showing a decline from 9th to 18th place over the same period. Despite these challenges, Firelands Scientific's sales in March 2025 surpassed those of Timeless and Pacific Gold Cannabis Co., indicating potential for growth and resilience in a competitive market. This dynamic environment suggests that while Firelands Scientific faces stiff competition, there are opportunities for strategic advancements to improve its market standing.

Notable Products

In March 2025, the top-performing product for Firelands Scientific was the Sativa Orange Grove Sunbites Gummies 10-Pack (100mg) in the Edible category, achieving the number one rank with sales of 967 units. The Indica Mixed Berry Sunbites Gummies 10-Pack (110mg) also saw a notable rise, climbing from the fifth position in February to second place in March, with sales increasing significantly to 841 units. The Dragon Cheese CO2 Cartridge (1g) secured the third spot, marking its debut in the rankings. House Fire CO2 Cartridge (1g) followed closely in fourth place. The Flower category's Salty Watermelon (2.83g) slipped to fifth place, a drop from its third-place position in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.